Corn Battles Back After Tough Start to the Week

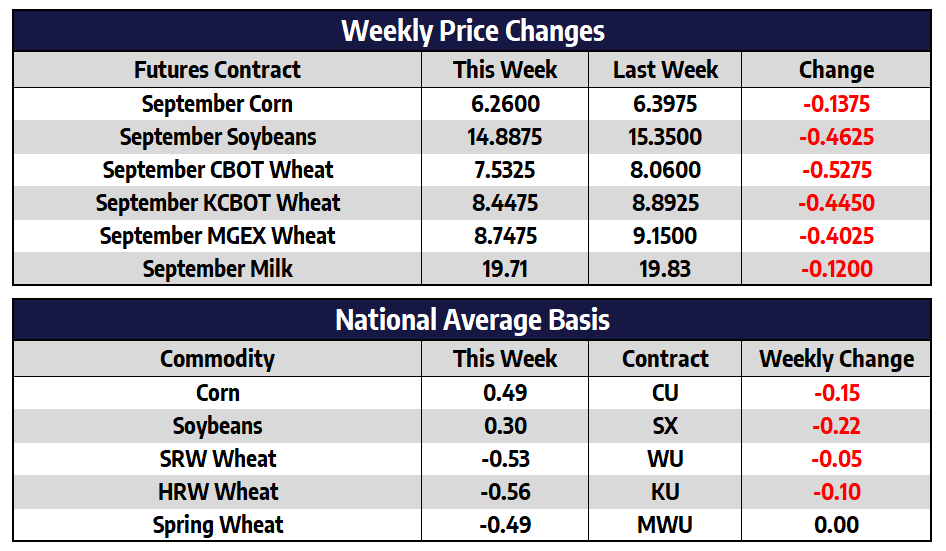

- September CBOT corn futures shed 13-3/4 cents this week to close at 626.

- December CBOT corn futures shed 19 cents this week to close at 623-1/4

- Corn shipments along the Mississippi, Illinois, Ohio and Arkansas rivers in the week ending August 13th declined 49% versus the previous week. Year to date shipments for corn are down 31% compared to 2021

- Natural gas futures closed at their highest point since July of 2008 this week, supply issues facing Europe continue to provide support

- The share of France’s corn crop that is in good or very good condition dropped to 50% as of Aug. 15. This is the lowest rating for this time of year in at least a decade and compares with 53% a week earlier and 91% a year earlier

- Corn held up nicely this week in the face of weakness in wheat. Seasonally December corn futures face weakness from mid-August through the month of September

- The market will be watching the Pro Farmer crop tour next week for a better indication of yield potential

Soybeans Lower on the Week

- September CBOT soybean futures shed 46-1/4 cents this week to close at 1488-3/4

- November CBOT soybean futures shed 50-1/4 cents this week to close at 1404

- The footprint of drought slightly expanded this week in soybean producing areas, some form of drought is now plaguing 24% of the US soybean area compared to just 9% being affected two months ago

- A low-pressure system is expected to produce weekend rains for the eastern Corn Belt, locally heavy rainfall could come to those in eastern Iowa, northern Illinois and Ohio

- December soybean meal held critical support this week and the market experienced follow-through buying to push the market to a three-day high. The increase in open interest for meal to its highest level since February is a positive development and suggests that speculative buying is active

- November Soybeans have so far been able to hold critical support at 1365, a close below this level would open up the door for a test of the July lows at 1288-1/2

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

All Wheats Lower on the Week

- September CBOT wheat futures shed 52-3/4 cents this week to close at 753-1/4

- September KCBOT wheat futures shed 44-1/2 cents this week to close at 844-3/4

- September MGEX wheat futures shed 40-1/4 cents this week to close at 874-3/4

- Ukraine’s 2022 wheat harvest is estimated to be 91% complete as of this week according to the UGA, the expectation for Ukraine’s entire wheat crop is now 19.1 million tons, this would be down from a record crop of 32.2 million tons last year

- The USDA raised its total forecasted spring wheat yields for Russia this week noting very favorable conditions in most of the western producing regions of Russia, harvest is expected to begin in late August

- The US dollar index closed at a new high for its recent move higher to end the week finishing over 108 index points

Dairy Markets Stay Range Bound

Class III second month futures finished the week at $19.75, faltering after trading above $21.00 on Tuesday and lower than where it closed last Friday at $19.80. Class IV second month futures traded slightly higher on the week. After finishing last week on 8/12 at $23.18, the September contract settled at $23.50 today and is still trending higher after hitting a recent low of $22.60 on August 8th. Spot butter has not traded under $2.90/lb since June 1st; the market closed the week out at $2.94/lb with a weekly high of $2.99/lb. The block/barrel average started the week near $1.92/lb. and finished lower today at $1.8575/lb. The dairy markets have settled into these ranges recently with $20.00 for Class III and $23.00 for Class IV showing signs of technical support. Given there have not been any drastic changes fundamentally within the dairy market, this consolidation of prices will likely stick around under current market conditions.