Corn Rallies on Crop Tour Data

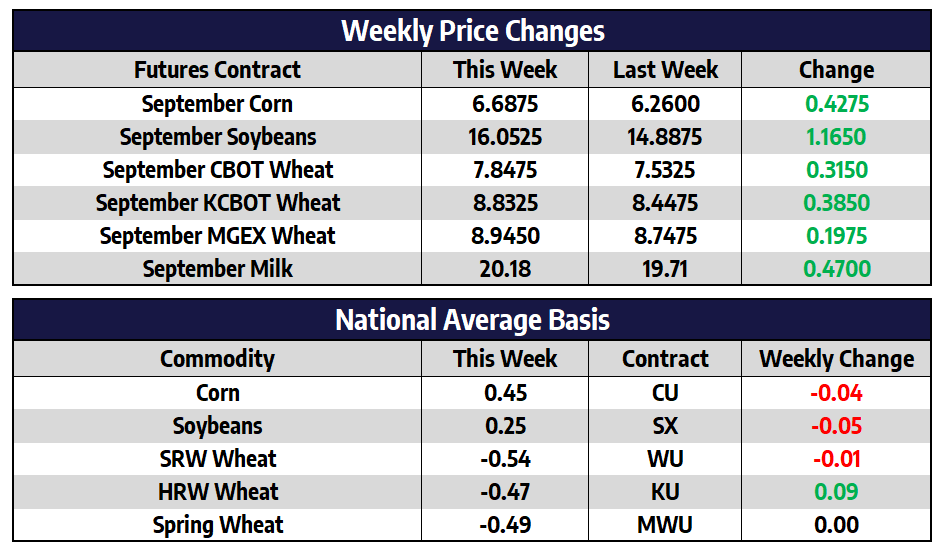

- September corn futures added 42-3/4 cents this week to close at 668-3/4

- December corn futures added 41 cents this week to close at 664-1/4

- Pro Farmer estimated the US national corn yield at 168.1 bushels per acre following their Midwest tour this week; The USDA estimated the national yield at 175.4 bushels per acre earlier this month

- Pro Farmer toured some of the worst parts of South Dakota and Nebraska, according to the latest drought monitor; Pro Farmer feels the good yields of the eastern Corn Belt will not be enough to offset the poor areas of the western Corn Belt

- December corn futures closed above the 200-day moving average this week; This level has been upside resistance over the last six weeks

- Germany’s Ag Ministry estimates the 2022 corn crop will fall by 21.5% versus last year’s crop; Conditions in France are also poor with good to excellent conditions at 47% this week, the lowest rating sing 2011

Soybeans Rally Back Near Late July Highs

- September soybean futures added 116-1/2 cents this week to close at 1605-1/4

- New crop November soybean futures added 57-1/4 cents this week to close at 1461-1/4

- Pro Farmer estimated the US national soybean yield at 51.7 bushels per acre following their Midwest tour this week; The USDA estimated the national yield at 51.9 bushels per acre earlier this month

- Pro Farmer takes pod counts for soybeans in a three-foot by three-foot square; Soybean pod counts were down from last year, but Pro Farmer noted a favorable September should allow for a strong finish to the soybean crop

- The USDA reported a sale of 146,000 tons of soybeans for delivery to “unknown destinations” today, earlier this week the USDA reported two soybean sales totaling 627,000 tons to China

- Rains are expected over the weekend in much of Iowa; Over the next seven days the rest of the Corn Belt is expected to receive at least some precipitation

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

Wheat Rallies with Corn this Week

- September CBOT wheat futures added 31-1/2 cents this week to close at 784-3/4

- September KCBOT wheat futures added 38-1/2 cents this week to close at 883-1/4

- September MGEX wheat futures added 19-3/4 cents this week to close at 894-1/2

- French wheat showed slightly weaker protein values than initial samples; For protein, 27% of soft wheat analyzed so far came in below 11% content compared with 24% in initial results published last week; Last year just 5% of the soft wheat crop showed protein below 11%

- Initial harvest reports for US spring wheat have been encouraging given much better moisture conditions this year compared to last.

- Piggybacking on strength in the row crops this week, wheat futures managed to build off of recent lows closing above the 20-day moving average

Dairy Markets Reverse Higher This Week

Buyers have returned to the dairy markets and are pushing contracts higher off of recent lows. Several further out Class III contracts have closed over the 50-day moving averages, while some of the late 2023 contracts finished the week at new all-time buys. There seems to be a strong influx of capital working its way back into commodities at this time, with grains, dairy, and fuel all rallying higher. This week’s trade saw December Class III add $1.15 to a $21.75 close, while December Class IV added $1.77 to $23.10. A bullish factor driving prices higher is the fact that spot butter hit new multi-year highs on Friday, closing at $3.0825/lb. Butter demand is high, while inventories stay about 20% below a year ago. A slightly bullish milk production report on Monday fueled buying support throughout the week.