Corn market slides lower

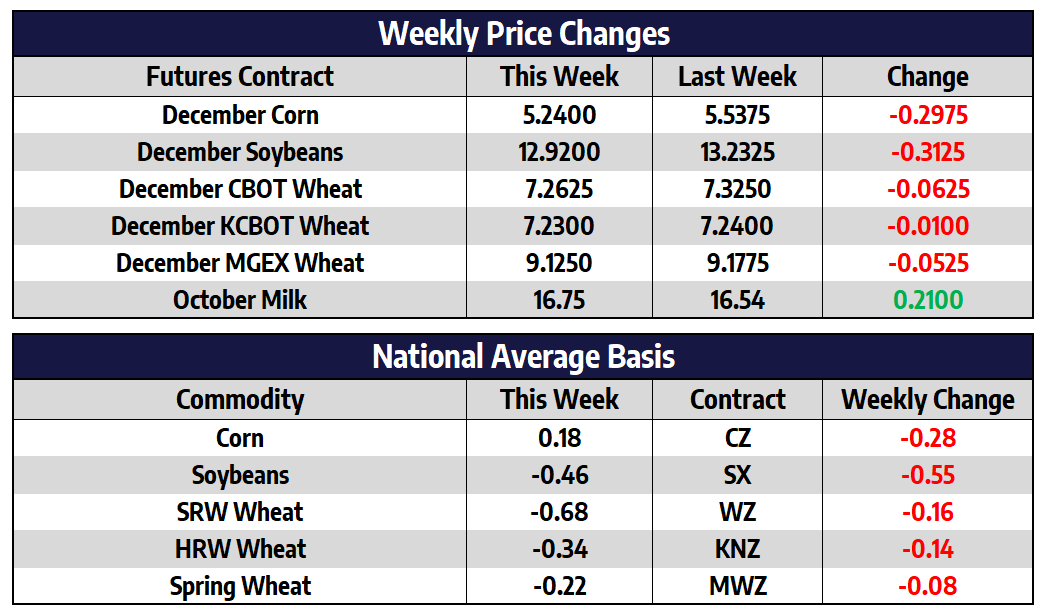

December corn futures shed 29-3/4 cents this week to close at 524. July futures dropped 23 cents this week to close at 538-1/2. StoneX released their updated estimates for US corn yield and production estimates this week. Their survey estimated US national corn yield at 177.5 bushels per acre compared with 174.6 bushels per acre estimated last month. This new yield number brings their total production estimate to just shy of 15 billion bushels. The USDA will release their September corn yield estimate as well as supply and demand adjustments next week Friday, September 10th. This will be the first USDA yield estimate of the year to include objective yield samples. The USDA will also review acreage numbers based on FSA data in this report, typically the October report is when this takes place, but data has been deemed sufficient by NASS to complete the review here in September.

Concerns of Chinese feed demand slowing continued to grow on Friday as China reportedly canceled 5-7 cargoes of feed barley from Ukraine. Many fear Chinese demand may not live up to expectations in the coming year after such strong demand in the 2020/2021 marketing year. China’s hope for an upcoming strong corn harvest was cited as a factor in the cancelation of the feed barley. China accounted for 32% of all 2020/2021 marketing year US corn sales.

Soybeans lower this week

November soybean futures shed 31-1/4 cents this week to close at 1292. July futures shed 16-3/4 cents this week to close at 1317-1/4. Weakness in the US dollar helped spur some buying interest late this week but it was not enough to regain the losses to start the week. This is just the third weekly close below the $13 mark for November soybeans dating back to mid-April. StoneX pegged the US soybean production at 4.409 billion bushels with a yield of 50.8 bushels per acre this week. This compares with the August 1 forecast of 4.339 billion bushels with a yield of 50 bushels per acre.

The start of September marks the start of a new crop marketing year. As of August 26th, 652 million bushels of US soybeans had been sold for export in the new 2021/2022 marketing year. This is above average for the date but below last year’s all-time high by over 200 million bushels. The current sales on the books account for 32% of the USDA’s full marketing year estimate. The USDA confirmed a few smaller daily export sales to China this week. This trend of smaller daily sales began in mid-August but has done little to help soybean prices which have shed nearly a dollar from their August highs.

All three wheats slightly lower this week

CBOT December wheat futures shed 6-1/4 cents this week to close at 726-1/4. December KC wheat futures shed 1 cent this week to close at 723. December spring wheat futures shed 5-1/4 cents this week to close at 912-1/2. The US dollar continued its slide lower this week after putting in new highs for the year in mid-August. In the last two weeks, the dollar has lost nearly 1.5% of its value and broke trendline higher that dated back to May. A continued setback in the dollar should help support all three wheats. Like corn, wheat may be looking to establish a new range. CBOT wheat prices have remained between $6 on the bottom side and 7.50 on the top side for nearly all of 2021. With higher input prices, lower world-ending stocks, and continued inflationary concerns this higher range may be the new normal for wheat prices.

Class IV Leads the Way

Class III futures were once again mixed but mostly flat to end the week. The second month October contract did manage to finish the week up 24 cents, unfortunately not putting a huge dent in the losses it took amassed in the two weeks prior, but an attempt at putting in a bottom nonetheless. Spot cheese was higher today but lower on the week, and the 34.25 cent premium of blocks over barrels still remains troublesome. Whey prices are also dead in the water, for the time being, falling back beneath the $0.50/lb mark. For now, continue to watch chart action for signs of a turnaround.

Class IV prices were higher once again today with the second month October contract pushing 20 cents higher to $16.60, totaling 29 cents higher on the week. Spot butter was up just a quarter-cent today but gained 9 cents on the week to push back to just under the $1.80/lb mark. Spot butter has not traded in the $1.80’s since the last week in May. Powder prices were up 1.5 cents today to $1.34, the highest weekly close since October of 2014! It will take continued strength to get Class IV futures to sustain a move above the pesky $17.00 level, but the market is due for some upside strength after years of rangebound trade.