The CME and Total Farm Marketing offices will be closed Monday, January 16, 2023, in observance of Martin Luther King Jr. Day.

Corn Futures Higher After Lower Production Estimate

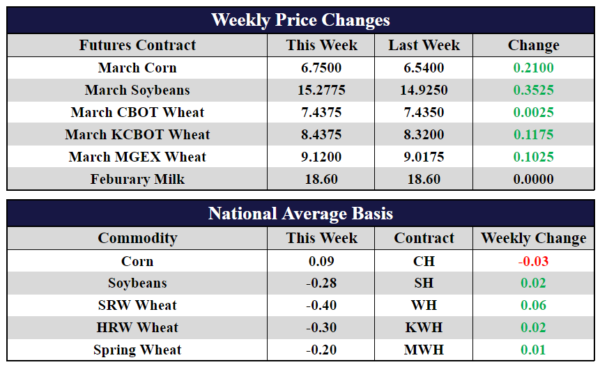

- March corn finished 4 cents higher today at 675, up 21 cents for the week.

- December of 2023 corn futures added 7-1/2 cents this week to close at 598-1/2.

- Corn prices rebounded after the USDA lowered US corn production by 200 million bushels on their final 2022/2023 crop estimate issued yesterday. Production of 13.73 billion bushels was below the lowest of prereport trade estimates (of analysts polled by Reuters)

- The reduced production was due to a huge, 1.6 million acre cut in harvested acres. This was more than a million acres below prereport estimates. The acres were slashed in areas hardest hit by summer drought. The US average yield was increased by 1 bushel per acre 173.3 bpa.

- Prices will continue to feel pressure from lagging US exports.

- Ukraine continues to move grain into the world markets. The USDA raised their estimate for Ukraine corn exports from 17.5 million tons to 20.5 million tons which is in line with some trade estimates.

Soybeans Higher After Bullish WASDE Report

- March CBOT soybean futures gained 35-1/4 cents this week to close at 1527-3/4.

- November of 2023 CBOT soybean futures shed 4-1/4 cents this week to close at 1393.

- Soybean yield was lowered to 49.5 and harvested acres were reduced by 300,000 for final production of 4.276 billion bushels. This was below the lowest of prereport trade estimates (of analysts polled by Reuters).

- Continuous soybean futures pegged their highest close since the end of August on the news. but did not break through the high on December 30th.

- To offset some of the lower supplies, the USDA lowered US exports by 55 million bushels. But this just puts the current sales pace farther ahead of the 5-year average pace and lowers the sales needed weekly to reach the estimate.

- World ending stocks were raised, however, by less than a million tons as lower production was offset lower demand from China. Argentina’s soy crop was lowered by 4 million tons while Brazil’s crop estimate was raised by 1 million.

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

Wheat Prices Recover from Lows

- March CBOT wheat futures finished 1/4 of a cent higher this week to close at 743-3/4.

- March KCBOT wheat futures gained 11-3/4 cents this week to close at 843-3/4.

- March MGEX spring wheat futures gained 10-1/4 cents this week to close at 912.

- US Wheat ending stocks were lowered 4 million bushels to 567 million bushels as higher production was offset by higher expected feed use.

- World ending stocks were raised 1 million tons to 268.39 million tons on higher production in Ukraine and the EU.

- The International Grains Council also raised their forecast for 2022/23 global wheat production. Ukraine production was raised to 25.2 million tons. The USDA estimates the crop at 21 million tons.

- The USDA raised Ukraine wheat exports by .5 million tons to 13.0 million tons. When winter wheat prices were making record highs last year it was feared that nothing would come out of Ukraine.

Second Month Futures Higher After Down Week

Second month Class III and IV futures were both higher this week following big losses from the week prior. Class III second month had a trading range of 23 cents and up 8 cents overall this week. Class III quarterly futures were as follow: Q2 down 2 cents, Q3 up nearly 22 cents, and Q4 down just over 2 cents. The Class IV second month contract had lost 74 cents last week but rebounded 27 cents higher this week to recoup some of those losses. Class IV quarterly futures were as follow: Q2 down 29 cents, Q3 down 26 cents, and Q4 down nearly 18 cents. Quarter one is historically the poorest performer for dairy and that is playing out currently in the markets. Fundamentals of growing cheese supplies, ample milk, and export strength waning, has put pressure on the markets.