Corn finishes the week lower, no surprises from the USDA

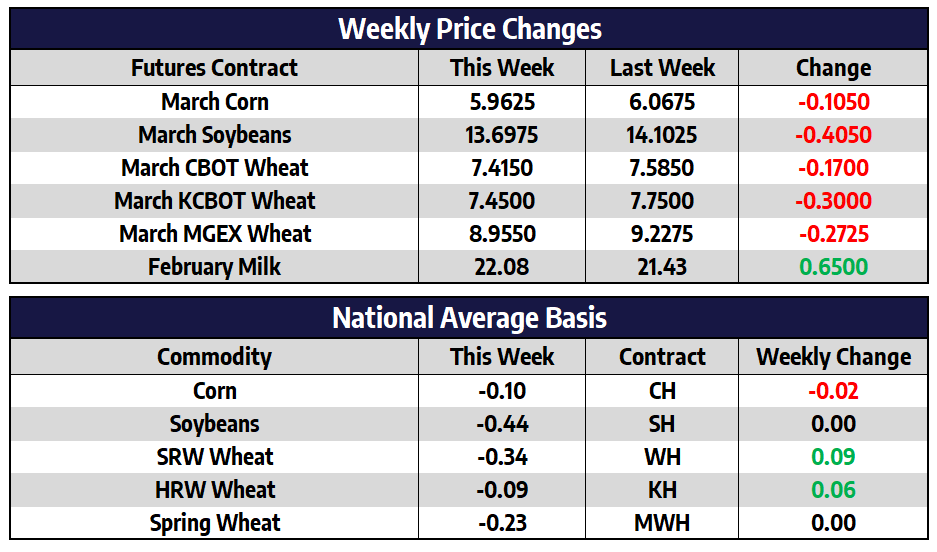

There will be no reports on Monday January 17 as the grain markets and our offices are closed in observance of Martin Luther King, Jr.’s birthday. March corn futures lost 10-1/2 cents this week to close at 596-1/4. December of 2022 corn futures gained a half of a cent this week to close at 558-1/4. The USDA lowered global corn supplies on their January WASDE report, but weakness in wheat futures weighed on prices. The report was mostly supportive, but much of the information was within trade estimates and already factored into prices. The USDA raised ending stocks by 45 million bushels to 1.54 billion bushels. This raised the stocks-to-use ratio for the US 2021/2022 crop year to 10.4% versus 10.1% last month and 8.3% for the 2020/2021 crop year. Corn finished the week lower, never retesting last week’s high.

Now that the January reports are behind us, the market will return focus to weather in South America and US demand. The Rosario exchange lowered Argentina’s corn crop to 48 million metric tons (mmt). The USDA’s latest estimate is 54.0 mmt. Brazil’s CONAB lowered Brazil’s corn production 112.9 mmt. The USDA’s latest estimate is 115 mmt. If the end results were to be closer to The Rosario Exchange and CONAB estimates, it could push more export demand the US but overall, global stocks-to-use would remain adequate. Support next week comes in at 585 March and resistance at last week’s high of 617-3/4.

Soybeans fail to hold above $14 despite cut to Brazil crop

March soybean futures fell 40-1/2 cents this week to close at 1369-3/4. New crop November 2022 soybean futures were down 28-3/4 cents this week to close at 1293. The USDA cut their Brazil soybean crop estimate by 5 mmt to 139 mmt. This was below most prereport analysts’ estimates. The agency also cut Argentina’s production by 6% to 46.5 mmt. The International Grains Council echoed the decline in South American production and lowered their world production estimate to 368 million metric tons, just 2 mmt higher than last season. However friendly the fundamentals appear, much of this was priced in last week as the March contract traded above $14 for the first time since June. Now the trade will look to get yield confirmation as Brazil harvest ramps up. Brazil is expected to see net drying which will be beneficial to harvest and late maturing crops in those areas should have good subsoil moisture to continue development.US soybean export sales more than doubled from the previous week but still lag last year’s commitments to date by 23%. This will continue to put pressure on prices. The 5- and 10-day moving averages on the March contract have crossed over negative and could bring on additional selling next week. The next level of support comes in at 1360.

Wheat prices continue lower on larger supply estimates

March CBOT wheat futures traded 17 cents lower this week to finish at 741-1/2. March KC wheat futures were down 30 cents this week and closed at 745. March Minneapolis spring wheat futures closed at 895-1/2, down 27-1/4 for the week. European wheat prices have been under pressure, and this weighed on the US markets. The Paris Milling Wheat futures contract closed below support at the 100day moving average ahead of Wednesday’s USDA report. FranceAgriMer cut its forecast for French wheat exports and increased its wheat stocks projection to a 17-year high. The USDA later echoed the larger global ending stocks, raising supplies by 1.75 mmt. The International Grains Council says it expects 2022 production to be another record, but that consumption will also increase keeping ending stocks little changed year-over-year.

Milk Continues Higher

Class III milk capped off another volatile week with the February contract closing at $22.08, up 65 cents on the week. Futures traded within a nickel of the $23.00 mark on Thursday before turning lower. After finally breaking out of its long-term range last week, the block/barrel average traded within a few cents of $2.00/lb earlier this week before closing at $1.94/lb, up just a penny from last Friday. Whey prices pushed to a new all-time high of $0.77/lb and has posted just one lower weekly close out of the last 19 weeks. Class III milk is in a bit of a no-mans land after pushing above the $20.00 mark and, while producers should remain mindful of the downside potential from these levels, a move near the 2014 and 2020 highs is still possible.

Class IV milk kept right on moving higher as the February contract tacked on $1.36 this week to close at $23.49. This puts the second month contract just 36 cents beneath its all time high from January of 2014 and is now almost $8.00 (51.6%) above where it closed out the month of July before the rally started. Spot butter traded to a new long-term high at $2.8425/lb this week, but closed a little softer at $2.7250/lb after dropping more than a dime in Thursday and Friday’s trade. Historically, that market has made quick and severe tops on the charts in which the break lower often comes at a quicker pace than the rally. Spot powder again pushed to new highs by trading over $1.80/lb for the first time since June 2014. Class IV milk may run into some resistance near previous highs and will be susceptible to a sell-off if the recent run-up for spot butter fades as quickly as it has happened. but for now the momentum continues higher.