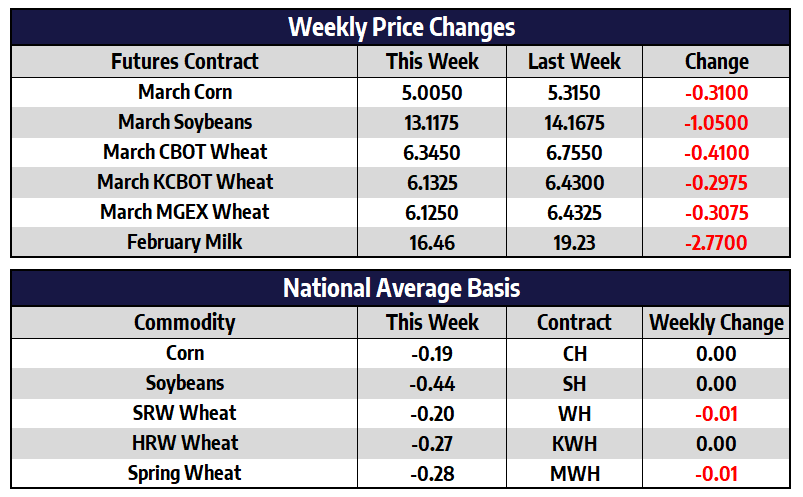

March corn futures lost 31 cents this week to close at 500-1/2. December futures lost 29-3/4 cents this week to close at 430-1/4. Traders took profits out of the long side of the corn market this week as prices tumbled. Buyers were found around the $5 area, supporting the market at that pivotal level. US export sales were better than expected this week coming in at 1.44 million tons for corn. Mexico, Japan and Colombia led the corn sales this week. Cumulative sales have reached 70.1% of the USDA forecast for 2020/21 versus the five-year average of 51.4%. Technical corrections like we saw this week are healthy for a market that is still in an uptrend for the time being.China imported a record 11.3 million tons of corn in 2020 up 136% from the previous year. Sorghum arrivals in china were a whopping 470% sure from 2019’s total coming in at 4.81 million tons. Earlier this month China approved two GMO corn varieties for import. Tight domestic supplies and rising feed costs have prompted the country to loosen export restrictions. China’s Ag ministry also approved a corn variety resistant to armyworm for production in the country. Armyworms have wreaked havoc on both wheat and corn in China in the recent years.

March soybean futures lost 105 cents this week to close at 1311-3/4. November soybean lost 85-3/4 cents this week to close at 1112. Profit-taking selling pressure compounded late in the trading session on Friday, as beans fell over 60 cents lower to end the week. Daily export flash sales on both Thursday and Friday were not enough to limit the selling activity. A Chinese report of a new outbreak of ASF did not help soybeans this week either. Illegal transportation of pigs is the suspected cause; this was the same suspected cause of the last reported outbreak in October. Export demand has remained strong even as the market traded near $14 a bushel. As Brazilian soybeans become available for export, demand should shift away from the US toward the cheaper Brazilian beans.

There were good rains across much of Brazil both this week and last week. There is a drier pattern starting next week, but for the time being, the weather has been good enough to stabilize the soybean crop. The 2020-21 Brazilian soybean harvest is less than 1% complete as compared with 1.8% last year. This year’s soybean harvest will peak in late February or early March, about 2-3 weeks later than normal. Soybean estimates for Brazil have been inching upward in the recent weeks with some firms pegging the crop in the 131 to 133 million metric ton range. Many firms note the improved weather in the past month, which has eased earlier concerns of a shorter drought stressed crop.

All wheats lower this week

March Chicago wheat was down 41 cents this week to close at 634-1/2. March KC wheat was 29-3/4 cents lower this week to close at 613-1/4. March MPLS spring wheat was 30-3/4 cents lower this week to close at 612-1/2. Talk of rains in the US Plains in the coming weeks should help the winter wheat crop there. In the January USDA Supply/Demand Report, US wheat ending stocks were lowered to 836 million bushels from 862 in the December report. This was down from 1.028 billion in 2019/20 and was the lowest domestic stocks number since 2014/15. With corn and soybean prices as high as they are, they could steal acreage from spring wheat this year. This potentially could be supportive to spring wheat prices this summer.

Spot cheese continues lower.

Last week the spot cheese market began to show signs of weakness as it traded 8.375 cents lower on the week. This weakness was continued this week with the sell-off becoming more aggressive as the block/barrel average dropped 20 cents lower to $1.50125/lb. This pressured the nearby contracts of February and March specifically, as these contracts have been holding in a large premium over spot prices and the negative price action took things even further. But the more deferred contracts continue to hold strong value with most contracts holding the mid $17.00 area.

Outside of the cheese market, the spot trade wasn’t nearly as bad with butter and whey showing strong performance on the week. Butter prices traded 11.25 cents higher on the week to finish at $1.4025/lb. Butter prices may have been supported by a strong Global Dairy Trade close for butter this week. Whey prices also finished at another new high for the year at $0.54/lb. Powder prices have run into resistance at the $1.20/lb level and retraced lower to $1.1725/lb.