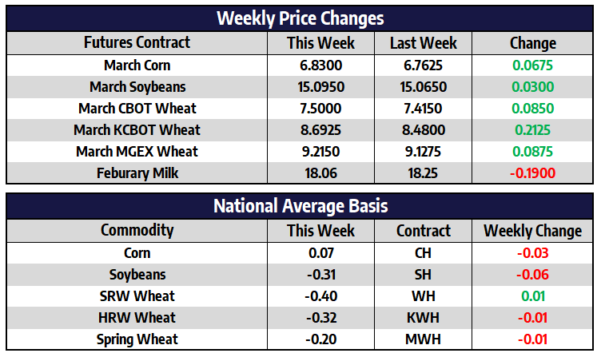

Corn futures mixed this week

- CBOT March corn futures added 6-3/4 cents this week to close at 683.

- CBOT December of 2023 corn futures shed 8-1/2 cents this week to close at 587-1/4.

- Strength in energy markets this week helped support front month corn as it traded back near recent highs.

- New crop corn futures slumped lower this week along with front month urea futures that traded below the $400 per ton level for the first time since June of 2021.

- Brazilian corn will represent a “substantial amount” of imports for China this year after the first vessel of corn from Brazil arrived earlier in January, according to the USDA Foreign Agriculture Service.

- Export sales have picked up from the poor level of the past month but cumulative sales for the marketing year continue to lag significantly to last years pace.

Soybeans hang onto marginal gains

- CBOT March soybean futures added three cents this week to close at 1509-1/2.

- CBOT November of 2023 soybean futures shed ¾ of a cent this week to close at 1351-1/4.

- Early yield indications from Northern Brazil have continued to impress with many reports of better-than-expected yields.

- Improvement this week was seen in Argentina’s soybean crop, the Buenos Aires Grain Exchange said that more rains seen over the next week will continue to help. Still 54% of the soybean crop is in poor condition versus 60% last week and 22% last year.

- Brazil’s soybean crop will be harvested in the next six weeks and is expected to have a large impact on US soybean exports.

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

Wheat prices show signs of life

- March CBOT wheat futures added 8-1/2 cents this week to close at 750.

- March KCBOT wheat futures added 21-1/4 cents this week to close at 869-1/4.

- March MGEX spring wheat futures added 8-3/4 cents this week to close at 921-1/2.

- After trading to its lowest levels since late 2021 front month Chicago wheat futures showed promise this week rallying above trendline resistance off of the late fall highs.

- Front month KC wheat closed above the 50-day moving average to end the week, this is the first close for KC wheat above the 50-day since mid-November.

- At a grains conference in Paris this week a top USDA official said the agency sees Russia’s official wheat crop estimate for this last year as “not feasible”. This is based on analysis of this year’s weather and previous crop data.

Milk chops around but lower overall

Second month futures in Class III came within a few pennies of $19 on Tuesday but otherwise trended lower throughout the week. Monday’s gains of 43 cents on the February contract were wiped away by selling pressure and ended up down overall on the week by 17 cents to settle at $18.07. Class IV second month futures were less volatile during the week, trading in a narrower range and settling at $18.92 at Friday’s close, up 17 cents on the week overall. Quarterly changes to Class III are as follows: Q2 down 8 cents, Q3 down 7 cents, and Q4 down 14 cents. Changes on Class IV quarterly contracts are as follows: Q2 down 2 cents, Q3 down 9 cents, and Q4 down 13 cents. These prices moving south are a similar pattern that plays out in the dairy markets to begin most years.