Corn market rally continues

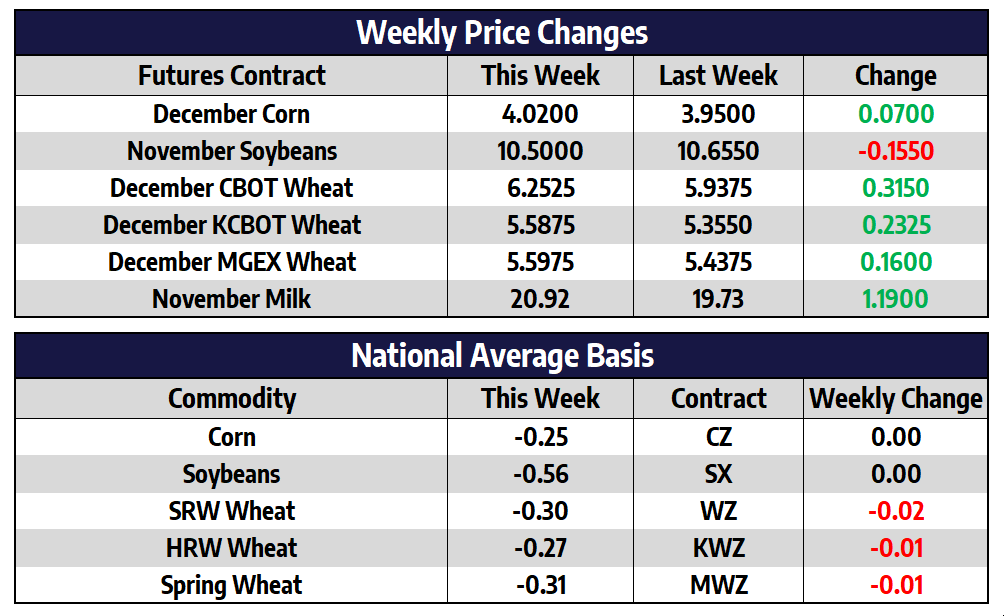

December corn futures added 7 cents this week to close at 402. July futures were 3/4 of a cent lower this week to close at 408-3/4. December corn futures remained in a steep uptrend this week as prices rallied to their highest levels since January 15. Typhoon damage to the corn crop in China has many traders feeling more corn purchases will be coming down the line from China. Chinese corn futures hit a new record-high this week, prices are up 14% since September even with harvest well underway. This price action contrasts with assurances from the Chinese government that domestic production was not impacted by the typhoons and that stockpiles remain adequate. Harvest here in the US continues to plug along ahead of the average pace. Harvest was seen as 41% completed this week, well above the 5-year average of 32%.

Corn export sales for the week ended October 8 totaled 25.8 million bushels. This was the lowest total export sales so far in the 2020/21 marketing year and below the 27.2 million bushels needed per week to meet the USDA’s export estimate of 2.325 billion bushels. Ethanol production released this week showed production at a multiweek high of 937,000 barrels. However, ethanol stocks pushed back above the 20-million-barrel mark as gasoline demand continues to stagnate across the country.

Soybeans retract this week

November soybean futures lost 15-1/2 cents this week to close at 1050. July soybeans lost 10 cents to close at 1035-1/4. NOPA crush numbers for September were released this week, a reported 161.5 million bushels of soybeans were crushed by NOPA members in September which was above estimates. This was a record volume of soybeans for the month of September but was also the lowest monthly total of the past year. Oil stocks to end September were at an 11-month low of 1.43 billion pounds. US crushing industry looks to be running close to capacity with harvest running at a fast pace. Harvest was seen as 61% complete this week as compared to the five-year average of 42%. With a relatively quiet weather week this week, harvest should be able to pass the 3/4 complete mark by early next week.

China imported 9.8 million metric tons of soybeans in September, this was a nearly 20% surge from a year ago. A majority of these soybeans were of Brazilian origin, but this will not be the case in the coming months. Brazil is on pace to be out of exportable supplies after October. China will need to turn its attention to the US for soybeans during the next four months. Weekly soybean sales were strong once again for the week ended October 8 coming in just below 100 million bushels. This far exceeded the 12.5 million bushels needed per week to meet the USDA’s newly updated export estimate of 2.2 billion bushels.

Wheat continues higher

December Chicago wheat added 31-1/2 cents this week to close at 625-1/4. December KC wheat added 23-1/4 cents to close at 558-3/4. December spring wheat added 16 cents to close at 559-3/4. December Chicago wheat traded to its highest level since October of 2018 this week as managed money traders continued to buy. Production uncertainties in the US, Russia, and Argentina remain front of mind for traders even with record world wheat ending stocks. Private weather forecasters are saying the last 60 days in Russia have been the driest in the last 40 years. Fears are that producers will need to plant lower-yielding spring wheat in the spring if moisture does not show up soon. Dryness also continues to persist in the US Plains as winter wheat attempts to germinate before freezing temperatures. The wheat market will need continued bullish news to push through resistant levels being currently overbought. First support should come in around this year’s previous highs near the six-dollar mark.

Futures Prices Continue to Rally

We are now entering a fourth consecutive week of aggressive movement in the spot cheese market as the block/barrel average moved another 11.125 cents to $2.4625/lb. We are seeing the majority of the heavy lifting still coming from barrels rising towards block prices. As cheese prices are getting closer to the upper bound of where prices topped out previously this year, the market could be getting closer to a pullback. Butter prices were the other big mover of the week gaining 9.75 cents to $1.51/lb after making new lows for the year last week. The strong reversal Esque price action is impressive but we have seen many butter rallies slammed lower quickly in the current environment. Whey and powder price movement was less exciting as whey finished slightly lower on the week and powder finished slightly higher.

Futures prices are continuing to see stronger momentum higher as the November contract gained over a dollar this week to finish at $20.92 vs. $19.73 last week. As October moves closer to settlement it continues to trickle higher as well finished the week at $21.38. Yesterday the 2021 Class III average made a slight new all-time high and we will have to see if the upside breakout can continue with prices so relatively high in the spot markets. With the amount of discount the market has priced in, prices may be resilient against a quick downside flush in cheese prices.