Corn trades back near top of recent range

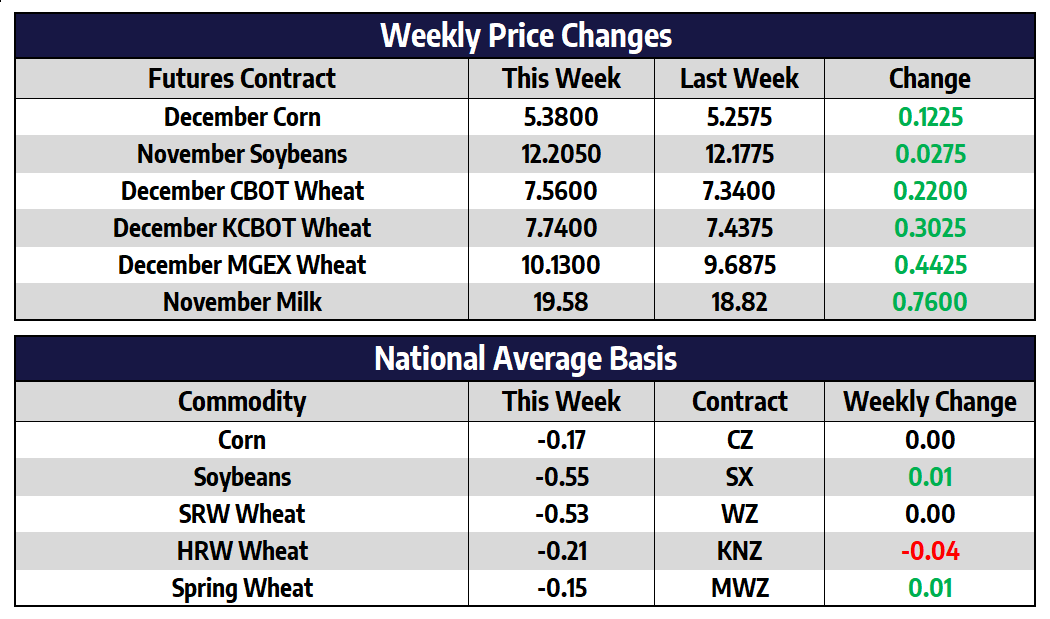

December corn futures added 12-1/2 cents this week to close at 538. July corn futures added 11-1/2 cents this week to close at 551. Managed money is continuing to hold a hefty net long position. Spillover weakness is expected from soybean futures, and farmer selling is expected to put pressure on corn futures into the end of the year. The market has been in a sideways to lower grind since early August, with any sort of rallies met with selling pressure. Wheat prices hanging near or at contract highs continue to provide support for the corn market, but weakness in the soybean complex has been and will more than likely continue to be too much headwind to overcome.

Brazilian farmers are estimated to have booked about 40% of their fertilizer needs for the second crop corn that will be planted in early 2022. The recent surge in fertilizer prices has caught many producers by surprise, and farmers who have not purchased their needed fertilizers may be forced to pay even higher prices with non-delivery as a possibility due to supply shortfalls. Brazil imports approximately 80% of their fertilizer needs, which puts the country at the mercy of foreign suppliers. For the farmers who have not purchased any fertilizers for their safrinha corn, they will probably apply less fertilizers as a way to hold down production costs.

Soybeans fractionally higher this week

November soybean futures added 2-3/4 cents this week to close at 1220-1/2. July soybean futures added 4 cents this week to close at 1254-1/2. The US sold 105 million bushels of soybeans last week; this was the biggest weekly volume in over a year. Total sales through October 14 cover 51% of the USDA’s 2021/22 forecast. Last year in this same week, 76% of the USDA’s marketing year forecast had been met, given the extremely strong start to the export season. Soybean sales to destinations other than China continue to hang slightly below average; beans are expensive this year compared to others. The US soybean export window will likely close quickly as the calendar flips to 2022 with Brazil off to a blistering soybean planting pace.

Brazil’s soybean planting pace is off to the second fastest start on record behind only the 2018/19 growing season. While the risks of drier-than-normal conditions persist for South America this year, soil moisture conditions are starting at a much better level than last year. Recent rains have helped subsoil moisture levels encouraging a quicker than normal planting pace this year. Earlier soybean planting should result in an earlier than normal harvest which should set up Brazil’s second crop corn for success compared to the delays faced last year.

Spring wheat closes above $10 this week for first time in 10 years

December CBOT wheat futures added 22 cents this week to close at 756. December KC wheat futures added 30-1/4 cents this week to close at 774. December spring wheat futures added 44-1/4 cents this week to close at 1013. China’s winter wheat planting has reached 26% complete as of last week; this is well below the average for the date of 53% complete. Constant rains in recent weeks have slowed field work and caused quality concerns for unharvested corn. The US dollar while still relatively high, has traded lower in the last two weeks adding support to wheat futures. Export sales for the week ending October 14 totaled 13.3 million bushels, which was expected. Cumulative sales have reached 51.8% of the USDA forecast for the 2021/2022 marketing year versus a 5-year average of 54.7%.

Milk Prices Higher Again This Week

The November Class III contract finished the week 31 cents higher, pushing to a new contract high close of $19.91 on Thursday before giving 30 cents back to end the week. The block/barrel average finally pushed above its April high, closing 2.625 cents higher today at $1.83625. This is up more than a nickel on the week and could open up the topside from a technical standpoint. Spot whey also pushed to a 4 1/2 month high today, closing at $0.6175/lb and within 10 cents of its April peak. Class IV futures were no slouch this week as the November contract finished at $18.29. Every 2022 contract now has an $18.00 handle in front of it as the market has seen good follow-through after its recent move to seven-year highs.

Fundamentally, this was a busy week with a Global Dairy Trade auction, the September production report, and Cold Storage. The GDT auction was higher for the seventh time in a row with butter and cheese prices still holding a strong premium to US spot prices. The production report was also supportive with September milk production just 0.2% higher than September of 2020 along with a revision lower for August. Cow numbers have corrected dramatically from their May peak, although they are still running above the 5-year average. The Cold Storage support was seen as negative for cheese, but positive for butter. While there are reasons to be optimistic for price direction in the near future, many elements are testing resistance and the market is providing a valuable area to cut downside risk.