Corn Continues Sideways as US Harvest Passes 50% Complete

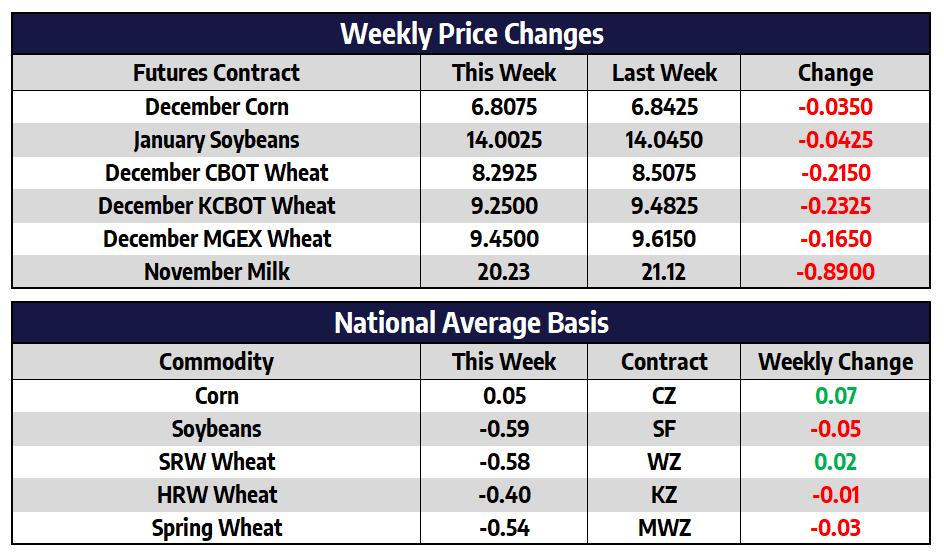

- December 2022 CBOT corn futures shed 3-1/2 cents this week to close at 680-3/4

- March of 2023 CBOT corn futures shed 3-3/4 cents this week to close at 686-3/4

- 63% of the Lower 48 United States was categorized to be in some level of drought this week, this is the highest amount since October 2012

- Corn export sales were awful for the week ending October 20, this was the lowest weekly volume since 2012; US corn remains the most expensive in the world while this slow start to export sales continues

- Corn market bulls have continued to defend the $6.75 level the entire month of October, sellers have also been stout at the $7 level as the sideways grind to the corn market continues

- The USDA will release its November Crop Production report on November 9, sideways price action will more than likely persist leading up to this report release

Soybeans Rebound After Weakness Monday

- January of 2023 CBOT soybean futures shed 4-1/4 cents this week to close at 1400-1/4

- July of 2023 CBOT soybean futures shed 3 cents this week to close at 1419-1/2

- Mississippi River water levels at St. Louis jumped up nicely this week after weekend and early week rains fell in much of the region; Levels downriver remain low, but rains are forecasted for the Gulf region over the coming days

- Soybean planting pace is well ahead of the average in Brazil’s northern state of Mato Grosso but behind the average in the southern state of Parana after recent rains have kept planters from rolling

- With more than 50% of world soybean production located in Brazil and Argentina, market attention will be focused on South American weather over the coming months now that US harvest is wrapping up

- Chinese officials this week stated they are willing to work with the US to find ways to get along to the benefit of both countries, this news, along with a sliding US dollar, helped soybean rebound from early week weakness

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

Wheat Prices Lower for the Week

- December CBOT wheat futures shed 21-1/2 cents this week to close at 829-1/4

- December KCBOT wheat futures shed 23-1/4 cents this week to close at 925

- December MGEX wheat futures shed 16-1/2 cents this week to close at 945

- As of October 25, 74% of US winter wheat acres were experiencing some sort of drought according to the USDA

- Many parts of Oklahoma have seen an inch or more of rainfall over the past two weeks, this is a welcome sign after winter wheat plantings

- The Rosario Grain Exchange cut its 2022-23 Argentine wheat crop estimate by 1.3 million metric tons to 13.7 million tons this week citing continued drought conditions

Deferred Contracts Weaken

The lack of fundamental news this week led to dairy prices following the path of least resistance lower. Class III prices took a major hit this week with second month November prices dropping from a high of $21.30 to close out Friday trade at $20.21. The $20 level on second month Class III has been both resistance and support multiple times over the last two years, more often than not this price had worked as resistance so a close below could set a trend of milk prices below $20. Class IV prices moved lower this week as well but fared much better than its Class III counterpart. Second month November fell from $23.88 to $23.65. The only major spot market to close higher this week was powder, gaining a single penny on the week to settle at $1.43/lb. The spot cheese market was a significant loser on the week, starting the week at $2.06/lb. and closing Friday’s spot session at $1.9425/lb. Butter lost 5 cents on the week to settle Friday’s trade at $3.14/lb., while whey continues to trend sideways to finish the week a penny lower at $0.43/lb.