Corn Lower this Week as Exports Continue to Struggle

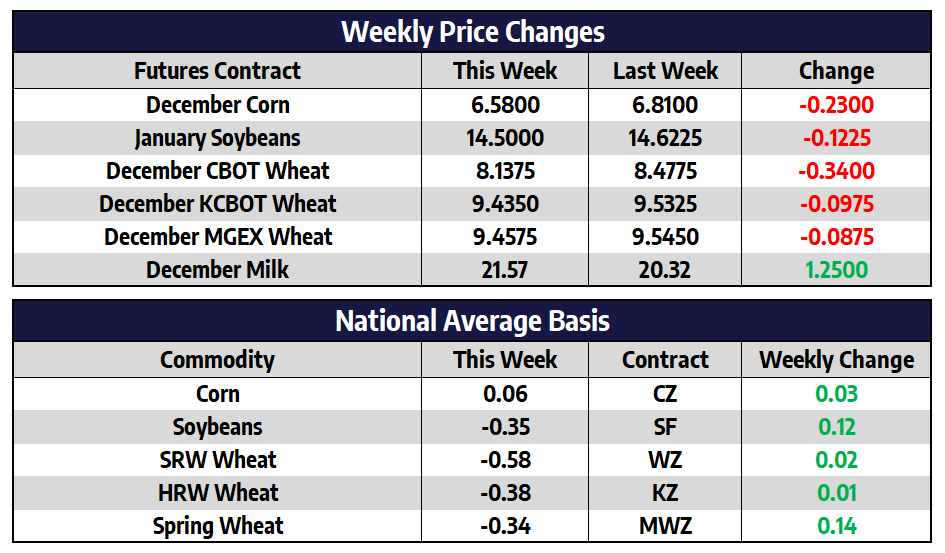

- December CBOT corn futures shed 23 cents this week to close at 658

- July CBOT corn futures shed 23-3/4 cents this week to close at 658-1/4

- Railroad labor unions have agreed to extend the cooling off period in their contract negotiations to December 4th, this eliminates the threat of strike at the pervious deadline of November 19th

- The USDA Foreign Ag Service is estimating Ukraine’s 2022/23 corn crop at 25.8 million tons, which is down from the current USDA forecast at 31.5 million. An estimated 10% of the crop may go unharvested due to a lack of funds for fuel and storage

- This was the worst performing week for front month corn futures since mid-July when prices closed below $6 per bushel

- Slow to start corn exports remain the biggest headwind for corn prices as we work towards the end of the year

Soybeans Strong Again this Week

- January CBOT soybean futures shed 12-1/4 cents this week to close at 1450

- July CBOT soybean futures shed 18-1/4 cents this week to close at 1460

- Brazilian producers are expected to plant about 850,000 more soybean acres than previously estimated. As a result, Conab raised its soybean crop estimate by 1.2 million tons to a record 153.5 million tons

- With US harvest virtually finished, market focus will remain on South American weather, which looks friendly over the next two weeks

- Through the first 10 months of the year, China imported 73.18 million tons of soybean from all exporters, this is down 7.4% from the same period last year

- China loosening its Covid-zero policy and a better-than-expected US CPI report this week supported the soybean market

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

Wheat Prices Lower for the Week

- December CBOT wheat futures shed 34 cents this week to close at 813-3/4

- December KCBOT wheat futures shed 9-3/4 cents this week to close at 943-1/2

- December MGEX spring wheat futures shed 8-3/4 cents this week to close at 945-3/4

- An artic air blast over the next 10-days may send wheat in the plains into dormancy in poor condition

- Wheat prices drifted lower once again this week, even as the US dollar backed off in dramatic fashion

- The market will remain focused on the Russia/Ukraine grain export deal ahead of the November 19th deadline

Strength in Class IV, Class III Mixed

Class IV futures rebounded from a sluggish start to finish the week, with two solid days of gains. Second month December contracts gained 16 cents on the week, while Q1 ’23 contracts were up 45 cents and Q2 contracts gained over 19 cents, settlements being $21.63, $20.88, and $20.79, respectively. Along with mixed settlements on Thursday and Friday, Class III futures were mixed overall on the week. December Class III contract gained $1.24 on the week, while Q1 and Q2 contracts were slight losers, settlements being $21.56, $20.57, and $20.31, respectively. The spot markets were finding active buyers with gains in cheese ($2.13125), powder ($1.43), and butter ($2.90); only whey ($0.44) was lower for the week. Next week will be a quiet week for fundamental reports; opportunities in supporting these recent gains will come from holiday demand and strong spot demand.