Corn sideways this week

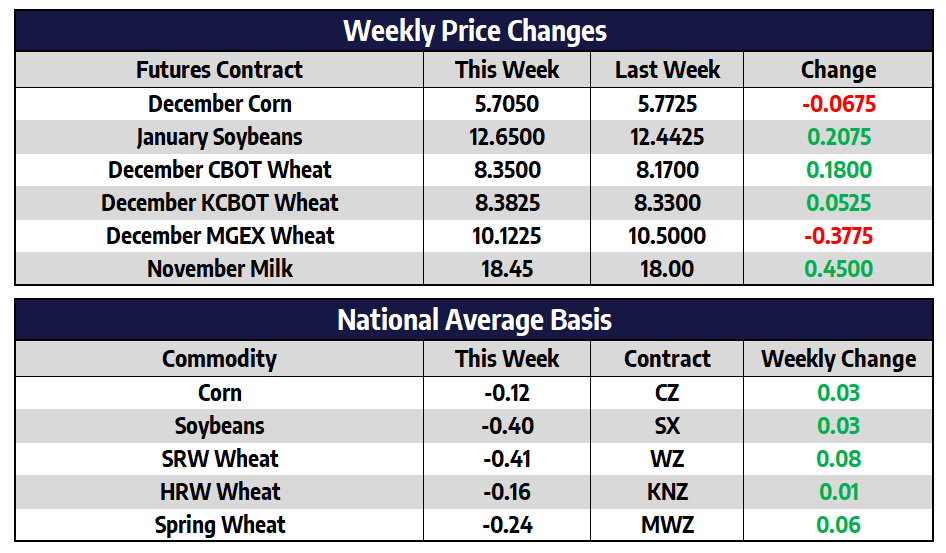

December of 2021 corn futures shed 6-3/4 cents this week to close at 570-1/2. December of 2022 corn futures added 4-1/2 cents this week to close at 553. Continuous corn futures moved mostly sideways to lower this week as prices struggled to find traction above the 200-day moving average. As expected export sales totals and little to no fresh news to the market supported the sideways grind. Crude oil futures shed over $5/barrel this week posting its worse week since August. Weakness in energy futures should warrant caution to corn bulls.

China purchased a record 13,751 metric tons of U.S. beef the week ended Nov. 11. Total beef export commitments to China reached 176,522 metric tons, up from only 56,000 metric tons last year at this time. Since September 4th, China has suspended all Brazilian beef shipments after two cases of mad cow were reported in Brazil. With both export and domestic demand for US beef running hot the price outlook for the cattle market is positive moving into 2022. This should help to keep corn for feed demand strong in the coming months.

Soybeans build slightly on last weeks gains

January soybean futures added 20-3/4 cents this week to close at 1265. November of 2022 futures added 9 cents this week to close at 1249-1/4. Soybean meal led the charge higher in the soybean complex this week. Lysine supply concerns were noted for the fuel of the rally. Lysine is an amino acid used heavily in the hog industry as a supplement to soybean meal. Without enough lysine in the diet, other amino acids cannot combine correctly to form muscle protein. This means with less lysine more soybean meal must be added to the hogs feed ratio.

With much of Brazil’s soybean planting complete, market attention will be focused on weather into the end of the calendar year. Metrologists from the Brazilian National Weather Service (Inmet) indicate that La Nina is in place, but the current La Nina is not as intense as last year but it is still expected to impact the weather in southern Brazil from the end of November through January. Over the next week much of central Brazil is forecasted to receive over two inches of rainfall with ample rainfall also forecasted for Mato Grosso, Mato Grosso do Sul, Minas Gerais as well as northeastern Brazil. This is near perfect weather for the currently growing soybean crop.

Winter wheats move higher yet again

December CBOT wheat futures added 18 cents this week to close at 835. December KC wheat futures added 5-1/4 cents this week to close at 838-1/4. These were contract high closes for both of these winter wheat contacts. December spring wheat futures shed 39-3/4 cents this week to close at 1010-1/4. The winter wheat markets remain extremely overbought when looking at traditional market indicators. Both Chicago and KC futures posted bearish key reversals with Thursday’s price action this week after trading to new contract highs and closing lower on the session. The continued move higher in the US dollar should also be viewed as a bearish influence on the market.

Huge Move Higher to End Week

Class III futures exploded to the topside on Friday’s trade led by a $1.09 rally in the December contract. That contract closed 83 cents higher on the week, which adds to what has been a wild two months of back-and-forth trade. December futures moved from a close of $17.18 on September 23rd to a close of $19.64 on October 21st before shifting lower again, closing just two days ago at $17.15. All twelve 2022 contracts traded to new highs as well, with the yearly average closing the week at $18.97. The main catalyst was another bullish production report on Thursday, with October production down 0.50% from October 2020 and yet another drop in cow numbers, along with solid spot market trade with cheese appearing to find a short-term bottom. The block/barrel average was 6.5 cents higher on the week at $1.68875/lb, with spot whey up 3 cents to $0.70/lb.

The Class IV market was no slouch this week either, mainly thanks to Friday’s action. The second month December contract tacked on 34 cents today for a 36 cent gain on the week to push to a new high on the continuous chart at $19.47. All six contracts for the first half of 2022 closed at $19.50 today, with the overall average for the calendar year closing at $19.3875. Spot butter was finally able to break above $2.00/lb this week, closing at $2.0475/lb and up 9.75 cents on the week to push to a two-year high. Spot powder is sitting 1.5 cents off its seven-year high of $1.57/lb, closing up a half cent on the week at $1.5550/lb. Class IV milk should hold onto some momentum until something gives in the underlying spot markets, both of which are sitting at multi-year highs.