Corn continues march higher

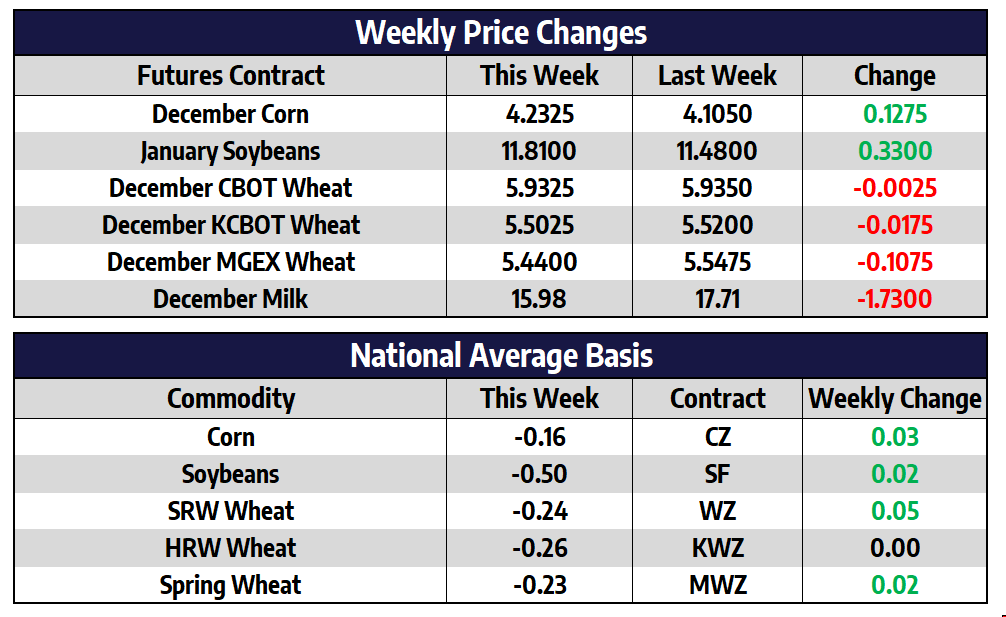

December of 2020 corn futures were 3-3/4 cents higher this week to close at 423-1/4. July corn futures were 4-1/2 cents higher this week to close at 430-3/4. On Friday morning, the USDA confirmed the following sales of US corn for delivery in 2020/21. 158,270 tons to Mexico and 131,000 tons to unknown, that’s 11.4 million bushels in total and the third daily sale announcement this week. Estimated corn use for ethanol production for the first 74 days of the marketing year totals 1.02 billion bushels, down 60 million or 5.6% from 2019/20’s pace, and down 20 million bushels from the seasonal pace needed to hit the USDA’s corn for ethanol usage target. With COVID-19 cases continuing to increase around the country and more restriction being enacted, this lower than last year trend for ethanol does not look to be improving anytime soon.

Issues continue to pop up with Chinese imports. It is not uncommon to see China “find” quality issues with grain and soybean imports and want to renegotiate contracted prices. We are now starting to see China use COVID-19 contamination as a price negotiation tool. China claims it has found the virus on the packaging of products from 20 countries including German pork, Brazilian beef and Indian fish, but foreign officials say the lack of evidence produced by Chinese authorities means it is damaging trade and hurting the reputation of imported food without reason. It is quite likely China is simply using this excuse to protect their domestic market from cheaper imports.

Soybeans continue their run higher

January soybeans were 33 cents higher this week to close at 1181. July of 2021 soybeans were 31-3/4 cents higher this week to close at 1173-3/4. Significant rains are forecast for Argentina over the next six days. Those same rains are expected to move into Brazil late next week. Areas most in need of heavy rainfall are far southern Brazil and eastern Argentina. US soybeans are not the only oil seed in the globe pushing to new highs recently. Canadian canola, European rapeseed, and palm oil are all pushing into new highs together with US soybeans. This is supportive to US grain prices to be seeing global prices rallying in addition to US prices. US soybean oil is about the cheapest edible oil in the world currently. It is unusual to see soybean oil trading at a discount to palm oil. In other years edible oil end users may switch from using soybean oil to a cheaper alternative. That looks to not be a possibility here in 2020.

As of November 12, US soybean export commitments have accounted for 86% of USDA’s projection of 2.2 billion bushels. This is a new record; the previous record was 80% set in 2013. This new record pace suggests that the USDA’s projection is 150 million bushels too low. With a currently projected carryout of 190 million bushels any adjustment to exports higher, without an upward adjustment to production, would significantly tighten ending stocks. One must keep in mind these are export sale commitments, largely to China and unknown, that could be cancelled at any time.

Wheat falls lower this week

December Chicago wheat was 1/4 of a cent lower this week to close at 593-1/4. December KC wheat was 1-3/4 cents lower this week to close at 550-1/4. December MGEX spring wheat was 10-3/4 cents lower this week to close at 544. The wheat market remains in a short term choppy to lower trend. Technical indicators remain at slightly oversold levels but not at an extreme. The market does not seem to have new fresh bullish news to push into new highs. Australia may have 4 million tons of more exports than the USDA is currently projecting if yields in Australia remain favorable. Weekly export sales came in at 192,389 tons this week which was below expectations. Sales need to average 223,000 tons per week to reach the USDA export sales forecast.

Cheese Slide Continues

The spot cheese block/barrel average has now gone 14 consecutive sessions without posting a single up day. The price is down $1.1575/lb over that stretch and is back to its lowest level since late August. This extremely high volatility isn’t new to dairy this year, and there could be several factors causing it. First, there may have been a seasonal holiday rally throughout much of October that has now fizzled out. Additionally, with the government purchasing products on the open market through December 31, we may be in the middle of a pause in purchasing at this time. Buying could ramp up again at any time, but for now the market is still searching for a bottom. The August low came in at $1.49/lb, which is just 0.875c away. Perhaps that will attract some buyers.

With spot cheese dropping lower, nearby milk is struggling. The December 2020 class III milk contract gave back another 42c today and is trading down to $15.59. It seems safe to assume that as soon as cheese can find support, December milk should stop sliding. Until that happens, the contract remains under pressure. The class IV market is more of the same. Spot butter is near a monthly low, closing today down a half cent to $1.37/lb. Powder is also struggling this month, finishing today at $1.08/lb. Additional market pressure on Thursday may have stemmed from a large rise in milk production and cow numbers on yesterday’s October report.