Corn Market Recovers some of Last Week’s Losses

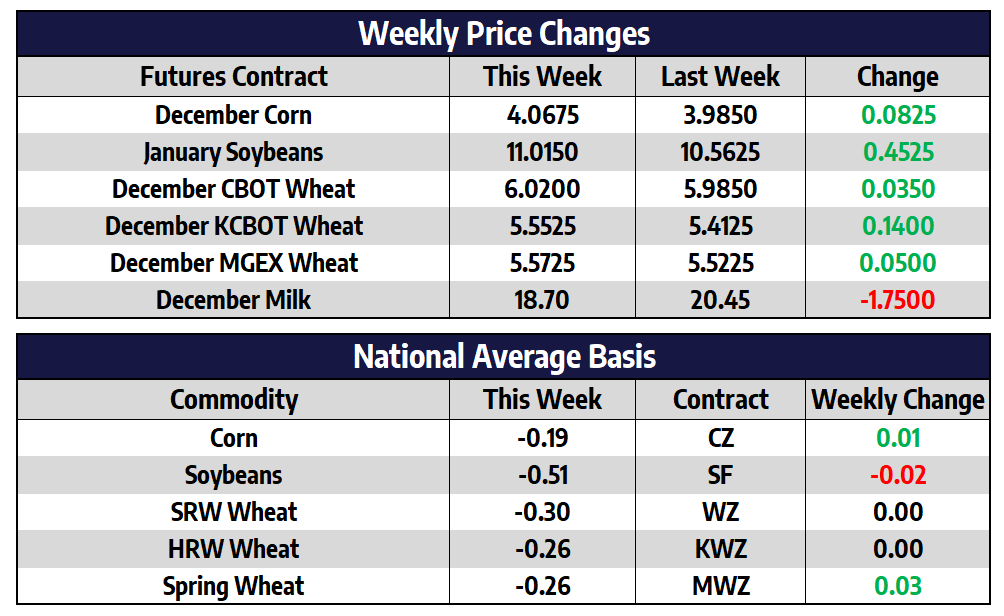

December corn futures were 8-1/4 cents higher this week to close at 406. July futures added 13 cents this week to close at 420-1/4. The USDA’s Beijing attache increased its 2020/21 outlook of Chinese corn imports this week to 22 million tons. The current Chinese corn import estimate by the USDA stands at 7 million tons. The USDA’s Beijing attache cited depleted stocks and high domestic prices for the reasoning behind the increase. China’s State Grain Administration announced this week that China will eliminate more than 95% of its open-air grain storage by 2020. This is in an attempt to clamp down on waste and modernize its agriculture sector. It is believed that as much as 100 million tons of outdoor stored grain may have spoiled last year threatening the nations food security.

While trade attention is focused on weather in South America as their growing season gets underway the upcoming 2021 US growing season must also be kept on the radar. Currently 26% of corn production area here in the US is experiencing drought conditions. While most of this dryness showed up late in the 2020 growing season it has yet to leave eastern Nebraska and western Iowa as we work into November. Ample winter precipitation will be needed to replenish sub and topsoil moisture. According to the drought monitor map, similar conditions to this year persisted into late 2011 for much of Iowa. 2011 into 2012 also featured La Nina conditions like we are experiencing this year. While not identical parallels can be drawn between these two timeframes.

Soybeans Push to New Contract Highs

November soybeans added 42 cents this week to close at 1098-1/2. July beans added 51-1/2 cents to close at 1094-3/4 a new contract high. Soybeans rallied into new contract highs on Thursday as concerns over global weather and the potential loss of production continued. Sizable losses in the US dollar also helped add fuel to the rally across commodities this week. China was a buyer of 29.8 million bushels of US soybeans in the week ending October 29th, this included 21.3 million bushels of soybeans which were switched to China after being previously reported as sales to “unknown destinations.” The USDA confirmed sales of 33,000 tons of soybean oil to India on Thursday. India is a top consumer of soybean oil but has been inactive in the US market since 2012. India has looked mostly to Argentina to supply their soybean oil in the last few years.

This week’s sale of US soybean oil to India highlights the logistical and currency issues in Argentina. Rampant inflation has led to hording of soybeans by Argentinian farmers in hopes for government policy changes down the line. With limited available supplies Argentina soybean crushers are struggling to meet rising global demand for soybean meal and oil. Chinese soybean buyers have cooled off their buying pace of US soybeans in the last month. After such aggressive buying in September traders are left wondering if China is now taking a breather from US soybeans, or if buyers have met their intended soybean volumes and now await Brazilian soybean supplies in early 2021. The latter seems more likely given the now higher export prices and the sheer volume of soybeans China has bought over the last few months from both the US and Brazil.

Wheat Holds onto Small Gains This Week

December Chicago wheat prices closed the week 3 cents higher at 602. December KC wheat was 14 cents higher to close at 555-1/4. MPLS spring wheat was 5 cents higher this week to close at 557-1/4. Wheat futures found favor in aggressive fund buying early in the week paired with a continued weaker US dollar. While the aggressive buying drove prices higher on Tuesday the wheat market stumbled late in the week as front month Chicago wheat closed nearly 25 cents off of its weekly highs. This weak close below some pivotal support levels and lower trending stochastics should accelerate any sort of liquidation that would arise. Wheat sales for the week ending October 29th totaled 597,088 tons. Cumulative wheat sales have reached 63% of the USDA forecast for the 2020/21 marketing year versus the 5-year average of 58.2%. Sales need to average 224,000 tons per week to reach the USDA forecast.

Dairy Volatility Continues As Cheese Drops

Last week, the block/barrel average had the highest weekly close in the history of the spot cheese market. This week, the cheese market has taken a strong downswing, losing 32.625 cents off of the block/barrel average. The cheese market is a volatile market in a normal year and in 2020, this has been even further exaggerated. Despite the recent drop, cheese prices are still relatively lofty at $2.33/lb. The futures market has been pricing in a large decline for quite some time. Last week, the first quarter contracts of 2021 were pricing in close to an 80 cent decline in the market. So, even after this week’s 32 cent drop, the market has still given itself a lot of room for the market to correct. In the meantime, the December futures contract remains the contract the most at risk to larger moves as it sits in the second month.

Markets outside of the cheese market this week were more uneventful. However, the whey market was quietly able to trade to new 2020 highs and finish the week at $0.4225/lb. Butter and powder trade worked against each other this week as butter traded 4 cents higher to $1.43/lb and powder prices traded 4.25 cents lower to $1.065/lb. These two factors counterbalancing each other are leaving the Class IV markets stagnant in the $13.50 area.