Corn Slightly Lower this Week

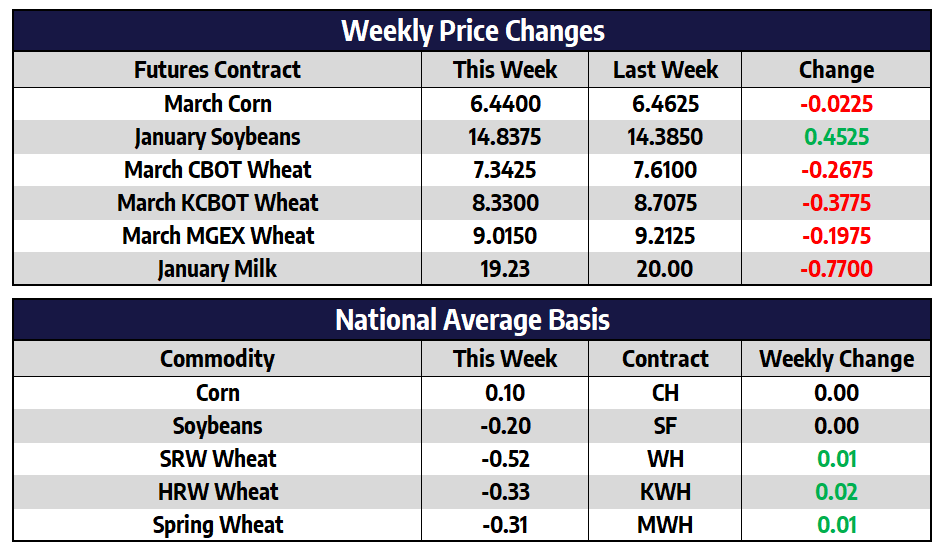

- March 2023 CBOT corn futures shed 2-1/4 cents this week to close at 644

- July 2023 CBOT corn futures shed 3-3/4 cents this week to close at 640-3/4

- In today’s WASDE report, US corn ending stocks increased from last month’s estimate by 75 million bushels due entirely to a cut of the export estimate, this was well anticipated by the trade

- World corn ending stocks came in smaller than expected in today’s report, as Ukraine’s crop was cut by 4.5 million tons; South America’s crop estimate was left unchanged from last month

- Mexico has offered this week to extend the deadline to ban GMO corn until 2025, a year later than previously planned; US and Mexican officials could meet next week to discuss the new proposals

- Corn futures remain in a downtrend but given late-week price action may have found a short-term bottom to work off of just below the 640 area

Soybeans Push Towards Multi-Month Highs

- January 2023 CBOT soybean futures added 45-1/4 cents this week to close at 1483-3/4

- July 2023 CBOT soybean futures added 37-3/4 cents this week to close at 1496-1/4

- January soybean futures rallied to their highest level since mid-September this week, as Chinese demand and US soybean meal futures remained strong

- China imported 7.35 million tons of soybean in November, up 77.5% from October but 14.2% behind November 2021; Year to date Chinese soy imports are down 8.1% from 2021

- As expected, the USDA made no changes to their 2022/2023 US soybean balance sheet today, the December WASDE is historically a “sleeper” of a report

- Front month soybean futures probed towards the $15 per bushel level this week; With weather looking non-threatening over the coming weeks in Brazil, soybeans may struggle the breech the psychological $15 level before Christmas

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

Wheat Prices Lower for the Week Again

- March CBOT wheat futures shed 26-3/4 cents this week to close at 739

- March KCBOT wheat futures shed 37-3/4 cents this week to close at 833

- March MGEX wheat futures shed 19-3/4 cents this week to close at 901-1/2

- Confidence is “high” that La Nina will weaken and lose much of its influence on world weather by February according to World Weather Inc; This weakening is historically good news for the drought-stricken Plains states

- Wheat futures sunk to their lowest levels since October 2021 to start December, as slow demand for US wheat and a strong US dollar plagued the market

- An increase to the Australian wheat crop and a cut to the Argentinian wheat crop left world wheat ending stocks, according to the USDA, near unchanged in today’s WASDE report

Dairy Under Pressure All Week

For nearly all of the dairy market, this week concluded in losses. Both Class III and Class IV futures lost value in the first half of 2023, with January contracts in both classes down for the fourth straight week. The spot markets were all lower besides cheese, which gained just over 2 cents per pound, while powder, butter, and whey were all in the red. Butter was extremely volatile this week with a 20-cent drop in the spot market Thursday and a 12.75 cent recovery in Friday’s trade. Volume in both cheese and butter spot markets was good this week with 21 and 18 loads traded, respectively. Regional butter reports have shown production and demand as steady, while inventories continue to be well short of recent history and regional cheese reports show similar sentiment for production and demand but large inventories continue for cheese. Opportunity maintains for US dairy products shown in this week’s reporting of October Dairy Exports and Global Dairy Trade event. It will be a quiet week for fundamentals coming up with no reports on the release docket.