Corn Slightly Higher this Week on Early Holiday Trade.

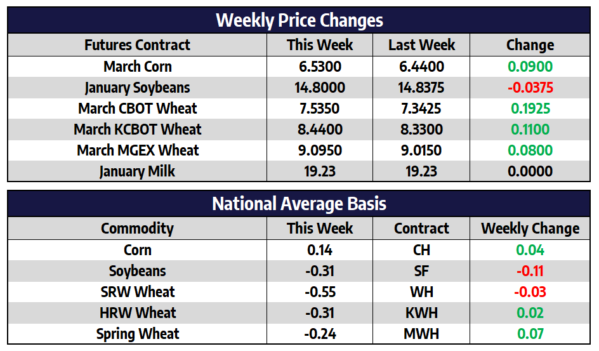

- March CBOT corn futures added 9 cents this week to close at 653.

- New crop December of 2023 CBOT corn futures added 4-1/2 cents this week to close at 597-1/2.

- Corn futures look to have entered the “holiday’ trade this week with light volumes and limited price moves blessing the market.

- Corn export sales were strong in the week ending December 8 but have still reached just 38% of the USDA forecast versus a five-year average of 51.3%.

- Corn appears to have put in a short-term bottom last week with follow through price action this week, a move above this week high would open the door to return to the fall trading range between $6.65 and $7.00.

- Corn will need help from outside correlated commodities such as wheat and crude oil to retest recent short-term highs, such as the $7 level in the months to come.

Soybeans Quietly Lower this Week, Eyes Still on South America.

- January CBOT soybean futures shed 3-3/4 cents this week to close at 1480.

- New crop November of 2023 CBOT soybean futures shed 9-1/4 cents this week to close at 1389-1/4.

- Brazil’s forecast continues to look favorable for the coming week with average temperatures and precipitation for most.

- Far southern Brazilian weather tends to track closely with Argentina’s weather and will be continually monitored by the trade given the drier than normal start to the growing season for those areas.

- Chinses buyers were active last week booking 10 US soybean cargoes and 12 Brazilian soybean cargoes for delivery in the coming months. It is now estimated China has close to 75% of its expected first-quarter 2023 soybean needs booked.

- Bunge announced an investment of $550 million to build a soy protein facility in Morristown, Indiana this week. The plant is expected to process 4.5 million bushels of soybeans and be up and running by mid-2025.

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

Wheat Prices Higher Breaking 5-week Losing Streak

- March CBOT wheat futures added 19-1/4 cents this week to close at 753-1/2.

- March KCBOT wheat futures added 11 cents this week to close at 844.

- March MGEX spring wheat futures added 8 cents this week to close at 909-1/2.

- 71% of the US winter wheat crop was experiencing drought as of December 13 according to the USDA, this is down four percent from November but 18 percent greater than this time last year.

- Wheat futures broke a five-week losing streak this week moving slightly higher, wheat is well oversold and due for a retest of longer-term moving averages and trendlines.

Class III Milk Red Fifth Week in a Row

Since peaking in November at $21.04, the January 2023 class III milk futures contract has fallen $1.80 over the past few weeks. Over that stretch, the market has closed red five weeks in a row. Pressure for dairy stems from a shaky spot cheese trade, consistently lower powder prices, and a softening corn trade. 2023 class III contracts still remain at elevated levels, in a range between $19.10 and $20.59, but that range has fallen $1 to $2 in the past couple months. The market will see a busy week of new data next week and the oversold nature of the market could create a turnaround on positive news. There is a US milk production report on Monday, a Global Dairy Trade auction on Tuesday, and a US cold storage report on Thursday. The milk production report from October had US production up 1.40% year-over-year and cow numbers up 42,000 head from a year ago. The market will watch to see how cow numbers look, because since May cow numbers have been mostly flat. The Global Dairy Trade will be watched closely with the GDT in the midst of a two-event upswing. The market will watch to see if buyers will continue to support higher global dairy prices.