Corn Futures Add 11-1/2 cents in December

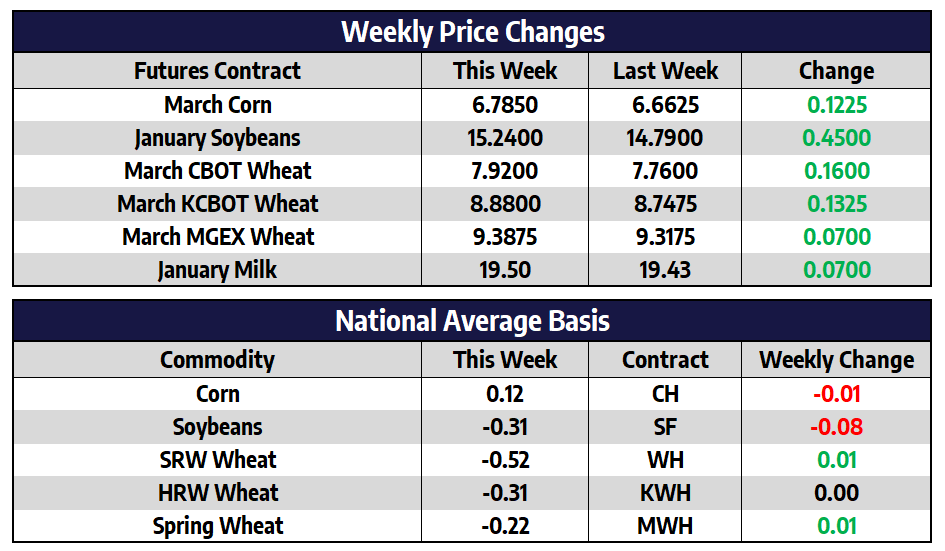

- March CBOT corn futures added 12-1/4 cents this week to close at 678-1/2.

- December 2023 CBOT corn futures added 9 cents this week to close at 610-3/4.

- US gasoline demand from Sunday to Thursday was down 28.6% from the week prior; Last year the week after Christmas was down 6.1% week over week for comparison

- Corn used in late week’s ethanol production is estimated at 96.76 million bushels, corn use needs to average 101.806 million bushels for the marketing year to meet the USDA’s 5.275-billion-bushel forecast

- The dryness issues of Argentina continue to support the corn and soybean market; Argentina is expected to account for less than five percent of world corn production in 2023

- December 2023 corn futures added 4-1/4 cents in the month of December to close at 610-3/4

Soybeans Add 54-1/2 cents in December

- March CBOT soybean futures added 45 cents this week to close at 1524

- New crop November CBOT soybean futures added 23-1/4 cents this week to close at 1416-3/4

- Over the last decade, Brazilian soybean acreage has jumped over 50%, 68 million acres of soybeans were harvested in 2013, and farmers are projected to harvest 106 million acres in 2023

- March soybean futures traded up to the highest level since June 17 overnight filling the gap on the chart left from when futures started their freefall lower

- Light rains are expected across Argentina over the weekend followed by a return to warm and dry conditions to start 2023

- Argentina accounts for about 13% of world soybean production; Argentina’s Buenos Aries Grain Exchange sees 1.2 million acres of planted soybean acres being abandoned if rains do not fall soon

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

Wheat Prices Higher Again This Week

- March CBOT wheat futures added 16 cents this week to close at 792

- March KCBOT wheat futures added 13-1/4 cents this week to close at 888

- March MGEX spring wheat futures added 7 cents this week to close at 938-3/4

- Wheat futures rallied sharply to end the week after weakness on Thursday; This was the third consecutive week of higher prices for the winter wheats

- Russian wheat was sold to Egypt this week, more competition out of the Black Sea region to come could pressure US wheat

Dairy Markets Mixed for the Week

The markets were mixed this week with front month futures for Class III slightly higher while Class IV was lower, and both milks were lower on their 2023 averages. The Class III average for 2023 was down over 15 cents to settle at $19.38, while the Class IV average settled at $19.98, down a nickel for the week. Dairy products moved in opposite directions this week as spot cheese gained 3 cents to $1.99/lb, butter was down a penny to $2.38/lb, powder barely made gains up a half penny to $1.335/lb, and whey broke back above support with a 3 cent gain to $0.415/lb. There was very little fundamental news this week, but next week we get GDT on Tuesday, Exports Thursday, and Dairy Products on Friday.