Corn crawls back from last week’s lows

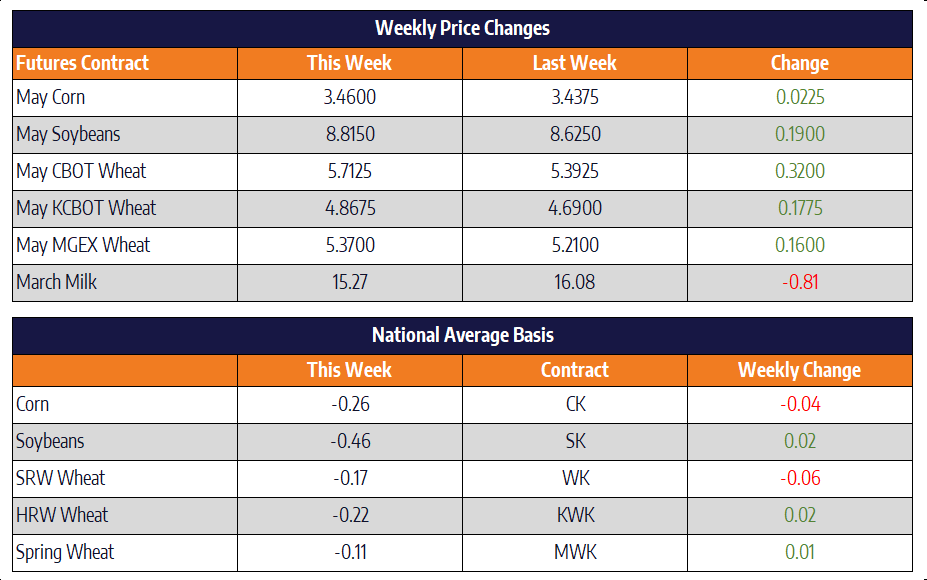

May corn was 2-1/4 cents higher this week closing at 346. December corn was a penny higher to close at 364-1/4. Decades low oil and gasoline prices have been very damaging to the ethanol industry. Crude oil has fallen from a high of over $65 dollars a barrel back in January to as low as $20 a barrel late last week. The other side of the equation hurting ethanol margins is the demand destruction for gasoline in the last two weeks. Stay at home orders in have been announced in 20 states and a number of cities across the country in the last few weeks. In Illinois alone this week gasoline demand was 73% lower than the week prior. This was relatively the same story for states across the country. Ethanol stockpiles are increasing by the week as gasoline demand is being destroyed.

With corn prices as low as they are and with a global pandemic at the helm, world importers bought large sums of US corn to sure up food security. China was the biggest corn buyer last week picking up 756,000 tons of corn. Looking ahead to USDA’s Prospective Plantings next Tuesday estimates are have come in rather heavy corn acres. The average of analyst estimates come in at 94.3 million acres. This would be larger than the 94 million acres projected at the USDA’s outlook forum last month and larger than the 89.7 million acres planted in 2019. Keep in mind the survey was taken in early March before corn took its deep dive below 3.50 futures. Price action in the last two weeks may have caused producers to rethink their acreage splits for the coming year.

Soybeans rally higher

May soybeans were 19 cents higher this week to close at 881-1/2. November soybeans were 16 cents higher this week closing at 876-3/4. The US dollar slid lower this week trading nearly 5 index points lower. The US Dollar vs the Brazilian Real spread looks like it may also be turning lower. This would be a welcome sign for US ag exports moving ahead. The largest buyer of US soybeans this week was unknown picking up 406,000 tons of soybeans. Analyst are estimating 84.9 million acres of soybeans here in the US for the planting season coming up. This would be close to 9 million acres more than last year’s soybean acreage of 76.1 million acres. Much of the increased acreage this year is anticipated acres coming back to production after record levels of prevent plant last year. During the time frame the USDA was collecting farmer surveys, soybean prices fell nearly 70 cents. Soybeans since have rallied back but front month prices are still below the $9 mark. The next chance for farmers to report their planted acres to the USDA is in early June and the results will be published on June 30.

Measures taken to curb the spread of the novel coronavirus in Argentina, which have hampered local logistics, may end up benefiting other soybean processors. Argentina placed transport restrictions much stricter than the rest of the world this week. Argentina is the world’s largest soybean meal exporter so others around the world may benefit from increased soy meal business in the coming weeks.

Wheat re-tests previous highs

May Chicago wheat moved 32 cents higher this week to close at 571-1/4. May KC wheat closed at 486-3/4 up 17-3/4 cents this week. May Minneapolis wheat was 16 cents higher this week to close at 537. Front month Chicago wheat charts ran up and challenged previous highs this week. The previous highs made back in January, just above the 580 mark look to be strong upside resistance for the wheat market. This week’s run higher then close just below previous highs is not great news for the wheat market and points to a possible move lower next week. Tuesday’s USDA stocks report will be important to the market, but hot domestic demand has been the major influence of price action these last two weeks. Most major moving averages have concentrated around the 540 front month mark. A retest of these averages would not be surprising in the coming weeks.

Dairy Complex Down Hard Friday

Class III and IV milk futures continue to run into strong selling pressure as the products in the spot market continue to press lower. The block/barrel average was hit hard today as blocks traded 15 cents lower and barrels traded 6.25 cents to take the block/barrel average down to $1.465/lb. Butter prices have been being crushed lower this week as they lost 26.75 cents this week, closing at $1.4875/lb. Powder prices dropped 6.75 cents on the week and finished below the psychological level of $1.00/lb at $0.92/lb. Whey prices were unchanged.

Prices across the board were down heavily in Class III and Class IV. The Class III 2020 average dropped to a new all-time low this year at $15.40. This drop has been one of the largest drops in an annual average we have seen in the past 10 years. The negativity behind the virus continues to be the largest driving factor in the markets.