Corn slightly lower this week.

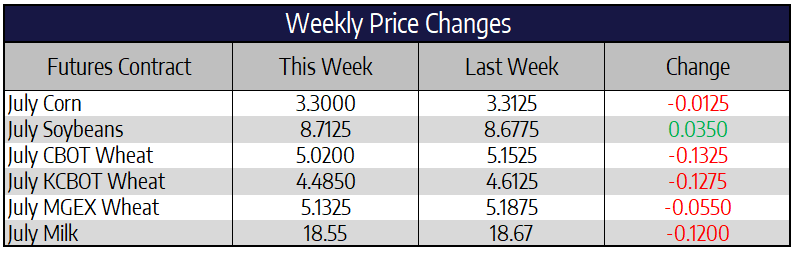

For the week, July corn futures were down 1-1/4 cents to close at 330. December futures were down 2-1/4 cents, finishing at 343 this week. After the remnants of tropical storm Cristobal passed through some of the corn belt earlier this week, blue skies and sunshine took hold. Lots of sun and below normal rainfall look to be the predominate weather story for the next ten days across the Plains and Midwest. For those who missed beneficial rains this week, an extended stretch of hot and dry weather has them nervous. This week’s drought monitor showed an expansion of abnormally dry areas. According to the monitor, as of June 9, 2020 over 38% of the US is experiencing dry conditions. This compares with just 10% of the country experiencing the same conditions a year ago.

Thursday’s monthly USDA Supply and Demand report brought little to no changes to the corn balance sheets. Old crop ending stocks came in at 2.103 billion bushels vs expectations for 2.150 billion, as compared with 2.098 billion in the May update. New crop ending stocks came in at 3.323 billion bushels, slightly below expectations at 3.36 billion bushels and compared with the May estimate of 3.318 billion. Short term for the corn market the funds hefty short position may be the most positive factor. If news supporting the corn market begins to appear short covering will help to fuel a rally.

Soybeans close above 100-day moving average this week.

For the week, July soybeans were 3-1/2 cents higher to close at 871-1/4. November soybeans closed at 879-3/4, up 1/4 of a penny this week. Soybean futures closed above the 100-day moving average on Friday; this was the first close above this level since January. Just like last week, more USDA soybean flash sale announcements percolated this week. Large daily sales to both China and to unknown (most likely China) were announced throughout the week. Assuming our unknown buyer is China, over the last two weeks China has bought over 2.5 million tons of US soybeans. That equals just over 90 million bushels. Over 75% of the beans will not set sail to China until after September 1. This two-week run has been the largest sum of US soybeans China has purchased since the trade war began two years ago.

Thursday’s Supply & Demand report was considered bullish for soybeans. US soybean ending stocks for the 2020/2021 season came in at 395 million bushels as compared with trade expectations for 426 million bushels and compared with the May estimate of 405 million bushels. The USDA still sees exports for the new crop season up 24.2% from this year. In addition, crush was revised higher by 15 million bushels to 2.145 billion, a record high. The 395 million bushel ending stocks estimate is down from 585 million bushels last year and 909 million bushels two years ago.

Wheat moves lower this week.

July Chicago wheat futures were 13-1/4 cents lower this week to close at 502. July KC wheat futures were 12-3/4 cents lower this week to close at 448-1/2. July spring wheat futures were 5-1/2 cents lower this week to close at 513-1/4. On Thursday the USDA pegged all wheat production at 1.877 billion bushels, which was above expectations for 1.85 billion bushels and compared with the May USDA estimate at 1.866 billion bushels. The European Union again reduced their wheat crop estimates this week. Officials estimate that their 28-state total wheat crop will come in at 130.9 million metric tons. This is a 16.2 million metric ton loss from last year’s crop. While this may seem like a sizable reduction, this loss should be more than offset by a return to normal production in Australia after last year’s awful drought conditions. Argentina is also expected to have a record crop.

Spot Cheese and Futures Waver

The price action in the spot and futures market started to waver this week, as the market ran out of momentum to the topside. The spot cheese market finished 3 cents down on the week but still near all time highs at $2.4263/lb. There is a lot of potential for further downside in the cheese market given how far we have risen. Whey prices continue to consolidate near $0.30/lb, as the market can’t seem to get out of the recent rut. Butter prices were down, as they seemed to follow the cheese market lower. The only market to finish higher on the week was the powder market trading to $1.005/lb. Finishing above the $1.00/lb is a good psychological development.

The July to December average finished at $17.16 last week and to no surprise fell lower to $16.84 to end the week. Futures continue to price in a massive decline in the cheese market. The last time spot cheese prices were this high we saw $24.00 milk futures. So the pessimism of the market is pretty clear. Even if the cheese market is due a pullback if the market has overpriced in the negative price action we may see futures rise as a result.