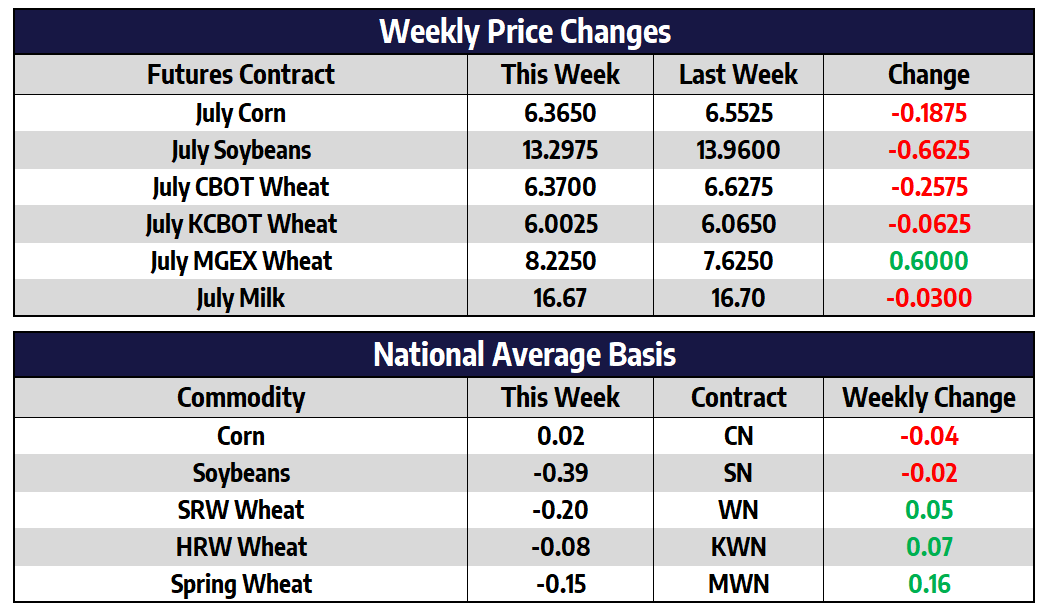

July corn futures shed 18-3/4 cents this week to close at 636-1/2. New crop December futures shed 47 cents this week to close at 519-1/4. Technical action this week was poor, as the market remains in a downtrend. New crop prices bounced off of the pivotal 100-day moving average on Thursday, but struggled to find buying interest during Friday’s trade. Much of Iowa picked up highly beneficial rains this week, as multiple rounds of storms moved through the state, southern Iowa saw the highest totals, with localized areas picking up close to 6 inches. The seven-day precipitation map is calling for a band of heavy 3+ inch rain across central Illinois and northern Indiana with lesser amounts in Iowa and Wisconsin. The driest parts of the Corn Belt, South Dakota and Minnesota, look to receive little to no relief over the next week.

The US Supreme Court on Friday bolstered a bid by small oil refineries to seek exemptions from a federal law requiring increasing levels of ethanol and other renewable fuels to be blended into their products, a major setback for biofuel producers. This further opens the door for the Biden administration to side with refiners after announcing last week the administration was considering reevaluating the Renewable fuel standard biofuel blending mandates.

Beans Fall Sharply as Meal Prices Collapse

July soybean futures shed 66-1/4 cents this week to close at 1329-3/4. New crop November futures shed 43-1/4 cents this week to close at 1269. New crop soybean futures closed this week below the 100-day moving average, typically a line of longer-term support. After falling more than 1.25 last week new crop prices struggled to rebound this week and are now over 2 dollars off of their contract highs. Soybean meal prices have been lower seven of the last eight weeks while soybean oil prices have been sharply lower two of the last three weeks.

While rains appear to be on deck across much of the Midwest over the next week drought concerns seem to have been put to ease for now. Historically the critical month for determining soybean yields is August weather but potential can be gained or lost early on in the season. Analysists expect soybean acres to rise 1.4 million acres from their March estimate in next weeks June acreage report. This June report is the third most volatile report of the year historically for the soybean market.

Winter Wheat is Quiet to Lower, Spring Wheat Ratings Plummet

July CBOT wheat futures shed 25-3/4 cents to close at 637. July KC futures shed 6-1/4 cents this week to close at 600-1/4. July Spring wheat futures added 60 cents this week to close at 822-1/2. With 50% of North Dakotas crop rated poor to very poor and Minnesota’s spring wheat rating also falling this week spring wheat futures rallied sharply with front month prices seeing the largest gains. September futures look poised to make a run at the previous contract high near 8.45. Winter wheat harvest continues to lag behind average with just 17% harvested as of Sunday compared with the 5-year average of 26%. Winter wheat futures remain in a downtrend but have traded sideways in the last few weeks. A break of previous lows could open the door to more long liquidation.

Milk price movement on Friday was fairly negligible, as the Class IV market was completely unchanged on the day, while the Class III market finished a few cents higher across the board, excluding the June contract. As we get into the final week of June pricing, it looks like that price will settle out near $17.15, the third-highest settlement of the year for the Class III market. If the June Class IV contract is able to settle at $16.40, it would be the highest Class IV settlement of the year. The July-December average for the Class III market is approaching its 2021 low as an area of potential support for the market. With cheese prices near the lows of the year as well, we may be in store for a bounce as we approach the typical time of year we can see price improvements in the market.

The spot markets were all negative on the week, excluding the non-fat powder market, which finished unchanged. The biggest loser of the week was the butter market, as it traded 6.75 cents lower to $1.7175/lb. Butter has been in a choppy downtrend since hitting the highs back in March. Butter, powder, and whey all are displaying a similar price pattern of what could be a bull flag. Cheese is the market deviating from this pattern as it sits near its lowest levels of the year and what has been long-term support for the last 2 years. We still look for a return of the premium to blocks over barrels to point to more stability for the market.