Corn moves higher again this week.

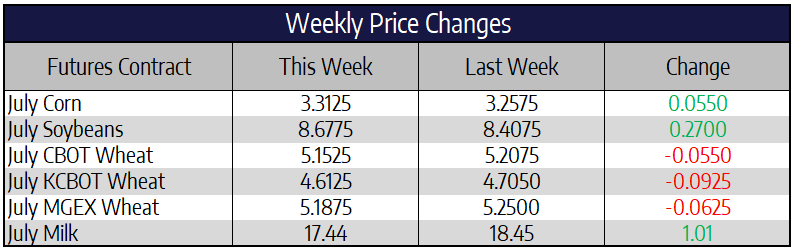

July corn futures were 5-1/2 cents higher this week to close at 331-1/4. December corn futures were 6-1/2 cents higher to close at 345-1/4 this week. Corn exports for the month of April totaled 5.06 million metric tons or nearly 200 million bushels. This was corns best export month since April of 2019. Weekly export sales were again strong this week totaling over 25 million bushels. Ethanol production again made a strong rebound this week but, production is still down 27% from a year ago. Overall ethanol stocks are back down to their lowest level since early January. Over in the livestock sector both hog and cattle slaughter numbers are back near “normal” levels. Corona virus outbreaks remain a threat to corn demand, but it seems most of the concern has been somewhat alleviated.

With fund traders holding a huge net short position, the second largest ever on record, the market is rather vulnerable to significant short covering. With December futures settling below $3.50 many feel a record crop and ideal weather are currently being “priced” into this market. July weather has always been seen as the deciding factor for US corn yields, during the critical crop developmental stages leading up to and throughout pollination. With the soybean market making a new two-month high and wheat prices showing resilience near the $5 mark the path of least resistance for the corn market going into summer looks to be higher.

Soybeans break higher this week.

July soybeans were 27 cents higher this week to close at 867-3/4. November soybeans were 27-3/4 cents higher today to close the week at 879-1/2. After shaking off some negative Chinese trade news on Monday the bean market posted four straight days higher or unchanged to finish the first week of June. Price action this week pushed front month soybeans above the 10, 20 and 100-day moving averages and blew through trend line resistance dating back to the first week of the year. The collapse of the US dollar to Brazilian Real spread and strong price action in the soybean complex as a whole gives a glimmer of hope to this soybean market that has spent the entirety of the last three months below $9.

There was a multitude of soybean export flash sales this week, almost all the sales were to unknown, but we can almost certainly assume that this unknown buyer was China. “Unknown” had made some smaller purchases earlier in the week and then made a rather large purchase on Friday morning. All in all, unknown bought about 42.5 million bushels of soybeans in the last week, some split between old and new crop. With the weakness in the US dollar this week and bean prices near 13 year lows our unknown buyer must be recognizing awfully good value to purchase US soybeans. Continued soybean export weeks like this will be a big help to the lagging export pace this year.

Wheat moves lower this week.

July Chicago wheat futures were 5-1/2 cents lower this week to close at 515-1/4. July KC wheat futures were 9-1/4 cents lower this week to finish at 461-1/4. July MPLS spring wheat futures were 6-1/4 cents lower this week to close at 518-3/4. Weakness in the US dollar helped push wheat prices to a three-week high this week. Sellers on Friday helped close the market lower this week right at support levels. There continues to be uncertainty about the size of the wheat crop both here in the US as well as in Europe and the Black Sea regions. 32% of US Winter Wheat producing area remain abnormally dry according to the latest USA drought monitor update, with 17% of areas in moderate drought. The UN Food and Agricultural Organization forecasts the tightest stocks-to-use ratio in eight years among the eight largest wheat exporters.

Spot Cheese Finishes the Week at All Time Highs

The fat complex of the dairy markets continues to be the leader as cheese and butter leap higher in the spot markets. The most impressive milestone of the week is that the block/barrel average hit a new all-time high and finished there on the week. The block barrel average finished at $2.45625/lb. to surpass the 2014 high in the market and rallying 33 cents on the week. Butter prices also surged with a 29 cents move higher on Thursday, but 9 cents were taken back to finish the week on Friday. Butter finished back below the psychological level of $2.00/lb. Non-fat powder was the only product to trade lower this week as it has been rejected back below the $1.00/lb level. Whey looks to be trying to shake off nearly 10 cents of losses over the last couple of weeks, finishing 4 cents higher this week at $0.345/lb.

We have switched from using the entire 2020 average to track the market to the July-Dec average now that we have moved almost halfway through the year. The July-Dec average is currently trading at $17.16 vs. its high of $18.16. The curve has become heavily inverted as the spot markets put all of the premium into the nearby milk contracts. June tested the $20.00 level this week and finished just below it. The last time spot cheese was at these levels we saw milk futures trade to $24.00.