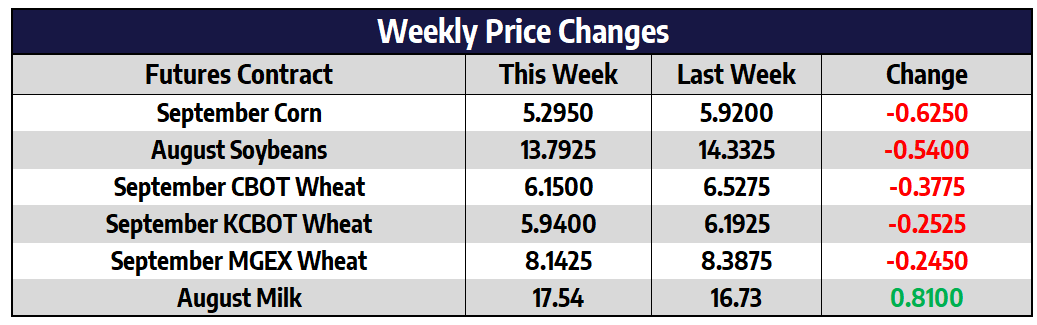

Corn prices drop below support levels ahead of Monday’s USDA report

September corn futures finished 7-1/4 cents lower today at 529-1/2. New crop December futures were down 6-3/4 cents today to close at 517. December corn futures slipped below 520 this morning and fell to as low as 507 midsession before clawing back 10 cents into the close. December futures closed below the 100-day moving average, which has been support on the contract since prices started moving higher last August. The 200-day comes in at 471. On technical charts, the move is on the oversold side and could be ready for a bounce on short covering. The week’s selloff was prompted by improved weather reports and today saw beneficial rains moving across areas of the Dakotas and Iowa. Midwest weather forecasts continue to call for rains across most of the area over the next week to 10 days. The market is also positioning ahead of Monday’s USDA supply and demand report. The average of trade estimates sees a higher US production estimate than on the June report. But only by 125 million bushels. Despite the USDA raising planted acres on last week’s report, the pre-report estimate is that the agency will lower yield from the current 179.5 bushels per acre. None of the analysts surveyed for Reuters survey expect the yield to be raised on this report. On one hand, the market could still be surprised with an unchanged or lower 2021-2022 ending stocks number if the USDA lowers yield below 178. On the other, they could lower demand for next season as late last week the agency’s Foreign Agricultural Service estimates China will increase their corn planting area and subsequently their demand for US corn.

Soybeans sharply lower to start the week but remain above support

August soybean futures were up 14 cents today to close at 1379-1/4. November futures finished 9-3/4 cents higher at 1329-1/4. Soybeans finished higher today despite lower than expected weekly export sales. Other oil grains like canola and palm oil traded higher overnight as did China soybean prices. Even though there have been no announcements of soybean sales to China this week, Mexico has been buying US soybeans and products the last two days. With the stocks-to-use on soybeans historically tight, any sales news is supportive. China already has more than 150 million bushels of new crop soybeans on the books. The average of trade estimates for Monday’s Supply and Demand report is for a slight decrease to US 2021/2022 production of about 10 million bushels to 4.394 billion bushels versus 4.405 in June and 4.135 in 2020/2021. The USDA left planted acres unchanged from their June report and the March intentions, but traders expect the agency to trim yield from the current estimate of 50.8 bushels per acre. November soybean futures are holding above the 100-day moving average (1310) but was tested again today.

Wheat prices mixed on harvest pressure and pre-report positioning

September CBOT wheat futures dropped 3 cents today to close at 615. September KC wheat futures were up 6 cents today to close at 594. September Minneapolis wheat futures were up 9-1/4 cents to close at 814-1/4 today. The average of trade estimates for Monday’s USDA Supply and Demand report sees a small decline in 2021/2022 US ending stocks from the June report estimate of 770 million bushels but the range of estimates is wide from 575 million to 809 million bushels. Estimates on the low end are likely factoring in much larger global feed use. US spring wheat condition ratings dropped another 4% from last week with just 16% considered good-to-excellent versus last year at 70%. However, some feel improved yields from the 2021/2022 winter wheat harvest will offset the losses. Weekly export sales at 10.7 million bushels were in line with pre-report estimates and close to being on pace with current USDA estimates. Chicago wheat futures dipped below trendline support on the continuous chart on harvest pressure and reports of good yields selling.

Milk prices erratic to end week

After yesterday’s strong trade action, Class III milk futures moved sharply higher this morning before turning negative and finishing with small losses. The August contract held an 85 cent range made up of a mid-morning move to 52 cents higher and a late morning reversal to 33 cents lower, closing down just a nickel. This was still 83 cents higher on the week for the August contract, 44 cents up for the Q3 average, and a dime higher for the Q4 average. That brings the Class III Q4 average to $18.22, 69 cents beneath our target to cover a second 1/3rd of Q4 milk. Class IV trade was marked with a fall beneath the $16.00 mark for the Q3 contracts, bringing the second month continuous chart to its lowest point in three months.

The strength in Class III prices this week, which occurred despite pressure from elements of the spot trade and outside markets, was earmarked by a strong push in cheese prices as the block/barrel average closed at $1.6525/lb, up 12.5 cents for the week. Whey, butter, and powder prices were all lower on the week, with whey prices down the hardest by falling more than 8% on the week to just above $0.50/lb. If whey prices can find some support in the coming weeks while cheese prices continue their trend higher, our upside target for adding to hedges may come in to play sooner rather than later.