Corn rallies despite higher yield estimate.

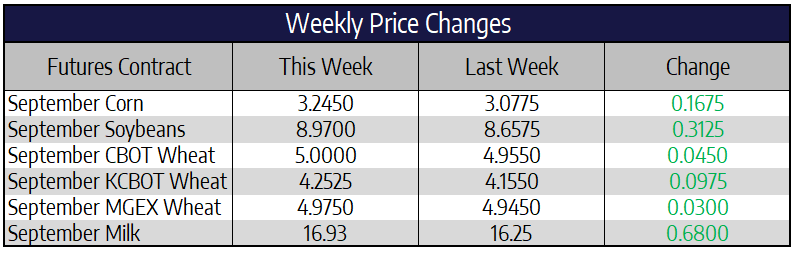

September corn futures added 16-3/4 cents this week to close at 324-1/2. December corn futures were 17-1/4 cents higher this week to close at 338. While on the surface Wednesday’s USDA US corn yield estimate of 181.8 bushels per acre looked bearish, market action following the report was just the opposite. Some are attributing market action this week to the Farm Service Agency’s updated corn and soybean planting figures which were both lowered. The FSA is claiming prevent plant acres at 5.37 million on corn, 1.22 million for soybeans and totaling close to 9 million acres across all crops. While these numbers are down from 2019’s horrendous planting season they are three times as much as the 2016-2018 average of 2.6 million acres total. Come harvest this means fewer harvested acres and in turn lower production forecasts from current levels. These numbers are being disputed by some given incomplete data sets amidst the struggle to collect data given COVID-19 restrictions.

Monday’s massive derecho damage which was initially estimated to have impacted 10 million acres was revised higher this morning by the USDA saying as much as 14 million acres have been impacted. This includes 5.64 million acres of soybeans and 8.18 million acres of corn. The USDA estimates 58,000 policy holders were affected with an initial liability estimate near $6 billion. The full extent of the damage is yet to be known and most likely will not be fully realized until combines get into the fields. Harvest and grain quality will be an issue in lodged, snapped and twisted corn. In certain areas finding storage this fall could also be an issue as millions of bushels of grain storage were damaged in the 80+ mph winds.

Soybeans rally as demand projections increase

September soybean futures rallied 31-1/4 cents this week to close at 897. November soybeans also added 31-1/4 cents this week to close at 898-3/4. For an 8th consecutive trading day China purchased US soybeans for delivery in 2020/21 this morning. Confirmed soybean purchases to China this week totaled over 1.3 million tons. Soybean demand projections were an attention grabber for the market following Wednesday’s WASDE report. The USDA increased China’s soybean import forecast for the 2019/20 marketing year by 1 million metric ton, to total 98 million tons. The USDA also added 3 million tons to Chinese soybean demand for the 2020/21 marketing year which begins in two weeks. Some feel these projections are rather lofty and will most likely be revised lower. The question remains where these soybeans will be sourced from, Brazil and the US will be the two dominant players but the split between the two countries remains unknown.

Central Iowa has had a rather dry last 90 days. According to IEM estimates from July 1st to August 13th central Iowa has been experiencing its fourth driest stretch for this period in the last 128 years. August weather is known to be a very important month in term of bean yields. Wednesday’s USDA guess at a record bean yield of 53.3 may need to be revised lower in the coming months if conditions continue to remain dry. It is still early but there has been more and more talk about a La Nina weather pattern forming into the fall. This could spell trouble for already dry South American regions as they begin to plant soybeans.

Wheat moves higher this week

September Chicago wheat futures added 4-1/2 cents this week to close at 500 even. September KC wheat futures added 9-3/4 cents this week to close at 425-1/4. September spring wheat futures rallied 3 cents this week to close at 497-1/2. While Wednesday’s USDA print of massive and record world wheat ending stocks forecast will limit upside potential, Kansas City wheat is currently oversold and looks poised to move higher. The drop in hard red winter wheat ending stocks to 390 million bushels from 521 million last year might be enough to sustain a bounce back to near the 450 mark. On front month KC wheat, the 100-day moving average comes in right near that 450 level. Continued weakness in the US dollar and strength in gold should also supply some underlying support to the wheat complex as a whole. Friday’s price action in wheat is somewhat worrisome closing well off their daily highs but managing to hang onto some of this week’s gains is a welcome sign none the less.

Block Prices Jump 12 Cents

This week, we had every product category finishing green other than butter in the spot trade at the CME. The biggest story remains to be cheese as it started the week trading lower, but was able to make a bullish reversal to finish out the week up 4.875 cents at $1.66/lb. The advance we led by blocks with them gaining 12 cents on Friday alone to finish that week at $1.82/lb. Butter prices continue to struggle despite their counterparty in the fact complex of cheese finding a recovery this week. Whey and powder were both higher but only slightly. Whey added 0.5 cents while powder added 1 cent. The biggest obstacle for powder remains the psychological level of $1.00/lb.

The July to December average gained 57 cents this week as it went from $18.21 last week to $18.78 this week. This is particularly impressive given that July is no longer active on the board after settling at $24.54 last week. From a seasonal standpoint, we usually expect a pullback August and can see a recovery from September to October. Given that the breakdown in prices came a little bit earlier this year we may be able to see the recovery happen a bit earlier as well.