Corn tumbles on raised yield estimates

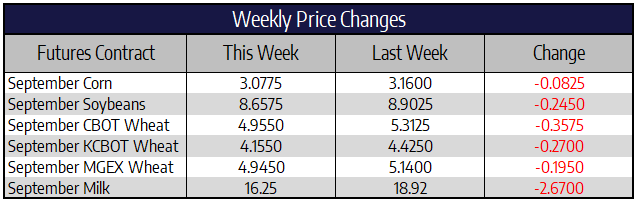

September corn futures were down 8-1/4 cents this week to close at 307-3/4. December futures were down 6-1/4 cents this week to close at 320-3/4. US Drought Monitor this week showed extreme drought in 9 counties in west-central Iowa. Across the entire state of Iowa, some form of dryness was reported in 80% of the state. Given market reaction this week the dryness may have been too little too late to have a major effect on corn yields in the country’s largest corn-producing state. Analysts see US corn yield at 180.4 bushels per acre on next Wednesday’s USDA report. This would be up 1.9 bushels per acre from the USDA’s July estimate and the highest ever August USDA yield for corn.

China, once again, sold all the corn offered in its weekly auction from state reserves. This week the average price per bushel came in around $7.33, down slightly from last week. Cash prices in China indicate a shortfall in available supplies which improves US corn export probabilities. The 150 million bushels of US corn on the books to China for the 2020-21 marketing year look like they will be much needed to drive down domestic prices in China. US corn exports to China in June alone exceeded all corn shipments to China during the 2018-19 marketing year. Given a great start to sales for the upcoming marketing year, we could easily break all-time records of shipments to China if they continue to buy into 2021. Big exports will be needed to make up for lost ethanol demand, given COVID-19 continuing to inhibit travel around the country.

Soybeans lower this week

September soybean futures were down 24-1/2 cents this week to close at 865-3/4. November futures were down 25 cents to close at 867-1/2. It was yet another big week for US soybean export sales, up 72 percent from last week but down 22 percent from the prior 4-week average. Germany was the top buyer of old-crop soybeans, picking up 183,000 tons of old crop beans. China was active once again buying new crop soybeans this week with four daily USDA sale announcement. In total, China picked up just over 1,000,000 tons of US soybeans for the marketing year beginning in September. In July alone, China bought over 9 million tons of US soybeans which was by far a record for July going back over the last 15 years.

Price action this week points to traders positioning ahead of Wednesday’s Supply and Demand report. Managed Money funds as of last Tuesday continued to hold a net long position in the soybean market. Profit-taking ahead of the upcoming report is likely what accelerated downward price action this week. Bearish yield projections for Wednesday’s report added momentum to the sell-off. Analysts estimate US soybean yield at 51.3 bushels per acre on Wednesday’s report, 1.5 bushels larger than the July estimate from the USDA. Continued buying from China will be key to meet the USDA’s lofty export projection for the upcoming marketing year.

Wheat lower this week

Chicago September wheat futures were 35-3/4 cents lower this week to close at 495-1/2. September KC wheat futures were 27 cents lower this week to close at 415-1/2. September MPLS spring wheat futures were down 19-1/2 cents this week to close at 494-1/2 their lowest front month close since November of last year. France’s farm ministry lowered its estimate of the 2020 soft wheat harvest to 29.71 million tons, down 1.6 million tons from its initial forecast last month and now 25% below last year’s crop, due to the continued effects of adverse weather. The reduced forecast was 16% lower than the average of the past five years and included the smallest harvested area since 1994, the ministry said in a crop report on Wednesday. Talks of bigger than expected crops in both Russia and Canada plus improving spring wheat conditions contributed to selling pressure this week.

Cheese Price Slide Continues

Cheese prices have started their massive downward swing after the massive upward swing in typical cheese market fashion. The block/barrel average lost a whopping 63.25 cents this week alone to finish at $1.61/lb. Sellers continue to press the market lower in abundance. Fears of additional returning shutdowns may be concerning the market. The rest of the spot trade was negative this week with all products finishing lower. Butter was the worst affected being the other portion of the fat complex. Butter prices dropped 7.75 cents on the week. Whey and powder both dragged slightly lower losing 2.25 cents on the week.

The July to December average lost just over a dollar this week finishing at $18.21 vs. $19.30 last week. The July Class II futures contract officially settled at $24.54 while Class IV settled at $13.76. The driving mover in futures is all related to spot cheese price action. Futures have been expecting a drop for some time and are seeing that realized. Seasonally we typically see milk pulling back in August before there is a recovery as you get into Sept/Oct.