Corn trades higher with help from soybeans

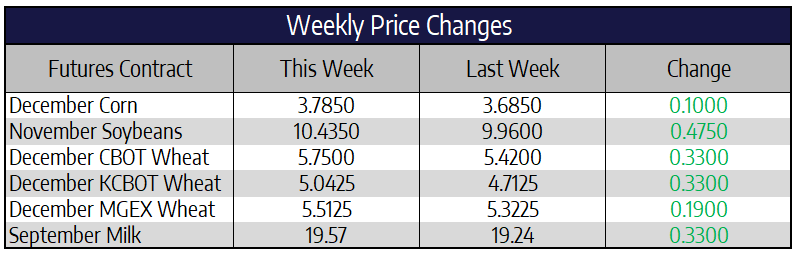

December corn futures traded 3-1/4 cents higher today at 378-1/2, up 10 cents for the week. December 2021 futures closed at 393-1/4, the high of the day. The President announced another round of CFAP payments at a rally in Wisconsin yesterday with sign up beginning next week. Payments will be based on 2020 planted acres of the crop, excluding prevented planting. The supply and demand balance sheet is tightening for corn but not to the extent of soybeans, thus the sluggishness in this rally. While final yields and acres are yet to be determined, it is generally felt that both items on the last USDA Supply and Demand report remain a bit too high. Another 100 million drop to production keeps ending stocks above last year. It is the demand figure that is probably too low. The US export sales pace is ahead of the 5-year average and China’s imports are expected to increase with more than 350 million bushels already on the books. However, another 200 million increase to US demand keeps ending stocks steady, lowers the stocks-to-use ratio, but it remains at sufficient levels and would suggest price targets within last year’s range.

Soybeans rally above $10 on demand outlook

November soybean futures finished 15 cents higher today at 1043-3/4, up 47-1/2 cents for the week. The November 2021 contract was up 4-3/4 cents today at 976-1/4. Front month soybean futures traded to their highest level since before the trade war with China escalated in May 2018. Soybeans are rallying on increasing demand and uncertainty over the size of US production. The dry weather in August has cast doubts on current yield estimates. Export sales to date which includes soybeans shipped during the first 10 days of the marketing year, and outstanding sales as of September 10, are at 32.3 million metric tons (MMT), or about 1.187 billion bushels. This is 55.9% of the USDA’s current forecast for the 2020/2021 marketing year. This is well ahead of the 5-year average pace of 34.2% at this time in the marketing year. Another 624,500 MT (22.9 million bushels) was reported today for China and unknown destinations. The USDA’s most recent estimate of 2.125 billion bushels of soybean exports is up 445 million from last year but unchanged from last month. The USDA will need to increase their estimate on future Supply and Demand reports. Without adjustments to production, a 200 million increase to exports would lower the stocks-to-use to around 5.6%, the lowest since 2014/2015. The USDA is estimating that China will import (from all countries) a total of 99 million metric tons and there are private estimates that it should be 100 MMT. There is also support coming from forecasts for continued below normal rainfall in the main growing areas of Brazil and Argentina.

Wheat rallies on dry weather in Ukraine

December Chicago wheat was 18-3/4 cents higher today to close at 575, up 33 cents for the week. December KC wheat was 16-3/4 cents higher today at 504-1/4 and December Spring wheat was 9-3/4 higher today at 551-1/4. Continued dryness in the Black Sea region and a little help from the soybean rally pushed prices higher. There is no precipitation forecast for the Black Sea region anytime soon. The Ukraine drought continues with farmers planting in the dust. Managed money increased their net long in wheat. These funds combined with grain and oilseed net long position is nearing the highest levels from 2015 and 2018. These levels were only exceeded by the run in 2010 through 2012. Six dollars appears to be the next target for CBOT wheat.

Block Prices Blasting Off Again

This week’s spot trade was positive for every product other than the whey market. The star of this week’s trade was the price of cheddar blocks gaining 46.25 cents on the week. This is quite astounding given that the price of cheddar barrels barely moved at all, leaving the spread between the two products at a record-shattering $1.00/lb. With blocks at $2.6275/lb and barrels at $1.635/lb, one of the two is bound to trade towards the other. The Class IV products of butter and powder both are showing better strength to end the week. Butter prices jumped 11.75 cents on the week to $1.5975/lb. Butter prices haven’t broken above $1.60/lb in months and trade above this level may indicate upside to the $1.80/lb area. Powder prices finished the week at $1.07/lb the highest since March of this year. Powder has been on a slow but steady grind higher after breaking above the psychological resistance of $1.00/lb.

The July to December average finished the week at $19.40 vs. $19.07 last week. Futures remain hesitant to follow the market higher but the recent aggressive move of the block market is forcing futures hands to trade higher. The market remains hesitant as the spread between blocks and barrels leaves the threat of continued volatility in the market. Class IV futures ended up trading limit up after the initial close on Friday on the recent strength in Class IV spot market products. The spread between Class III and Class IV on a second-month basis is still near $5.00/cwt.