Corn Finishes the Week Slightly Higher

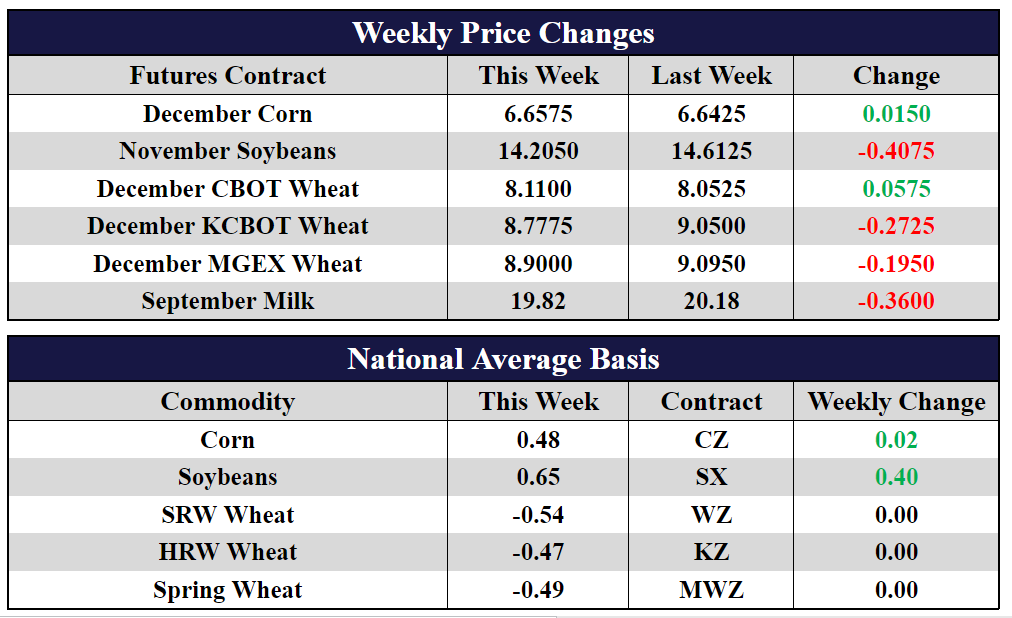

- December corn futures added 1-1/2 cents this week to close at 665-3/4.

- March corn futures added 1-1/2 cents this week to close at 671-1/4.

- The USDA has cancelled weekly export sales reports until mid-month as they work to fix a new program for reporting data.

- Corn finished the week on a higher note, able to recoup mid-week losses, after putting in a new two-month high (683-3/4) on Monday.

- Corn planting has begun in parts of Brazil amid persistent La Nina conditions.

- Brazil exported 7.554 million tons – 297.4 million bushels – in August. This is up 76% from August 2021.

- StoneX lowered their US corn yield estimate to 173.2 versus 176 last month. This is above the resent ProFarmer tour estimate but below the last USDA figure from August. The next USDA production report is on September 12.

Soybeans Give Back Last Week’s Gains

- November soybean futures traded 40-3/4 cents lower this week to finish at 1420-1/2.

- January soybean futures gave back 40-1/4 cents this week to close at 1425-1/4.

- More covid lockdowns in China drove commodity prices sharply lower on Thursday but soybeans were able to recover the some of the week’s losses on Friday ahead of the long holiday weekend.

- The USDA soybean crush report released after the close yesterday showed the US processed 181.3 million bushels of soybeans into oil in July. This was above the average estimate of 180.5 million bushels and up from June’s 174.1 million bushels crushed. This is the second highest July crush ever reported.

- Argentina and Brazil have had sufficient rainfall during the winter so that spring fieldwork could begin with good conditions. However, a persistent La Niña could limit rainfall during the growing season.

- Forecasts for a record large soybean crop continues to pressure the market. Another private firm, Stone X, raised their soybean yield estimates to 51.8 bushels per acre from 51.3 last month and production over 4.5 billion. The USDA estimated soybean yields at 51.9 in the August production report.

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

Wheat Lower This Week

- December CBOT wheat futures fell 31-1/2 cents this week to close at 784-3/4.

- December KCBOT wheat futures fell 38-1/2 cents this week to close at 883-1/4.

- December MGEX wheat futures fell 19-3/4 cents this week to close at 894-1/2.

- Wheat futures erased most, if not all, of last week’s gains on a surge to new highs in the US Dollar Index.

- A stronger US dollar particularly hurts US wheat exports as it becomes less competitive to other countries’ supplies.

- The Chair of the Ukrainian Agri Council estimated as little as 50% of the grain could be planted this year as the war hinders farmers ability to get cash, supplies and equipment. If production is 50 million tons, however it is enough to still export half of the crop.

- There are reports that nearly a quarter of Argentina’s wheat crop is under stress from poor weather and is expected to have below trend yields.

Milk Adding Muscle to End Week

After a strong selloff in the Class III market to begin the week that had September and October futures flirt with $19.50, Friday’s bounce saw 21-cent gains in September and 53- cent gains in October. The record high inventories in cheese have not limited that market as the spot block/barrel price saw gains on the week overall to settle at $1.81 per pound. Butter continues its bull run as low inventories have driven spot prices to $3.10 per pound. Although not linear, the spot butter price has risen from 2.94 on 8/19 to today’s level. Consolidation is king as Class III and IV prices have been generally range bound since early July as the markets await a fundamental change that can shift the markets up or down.