Corn Slightly Lower on the Week

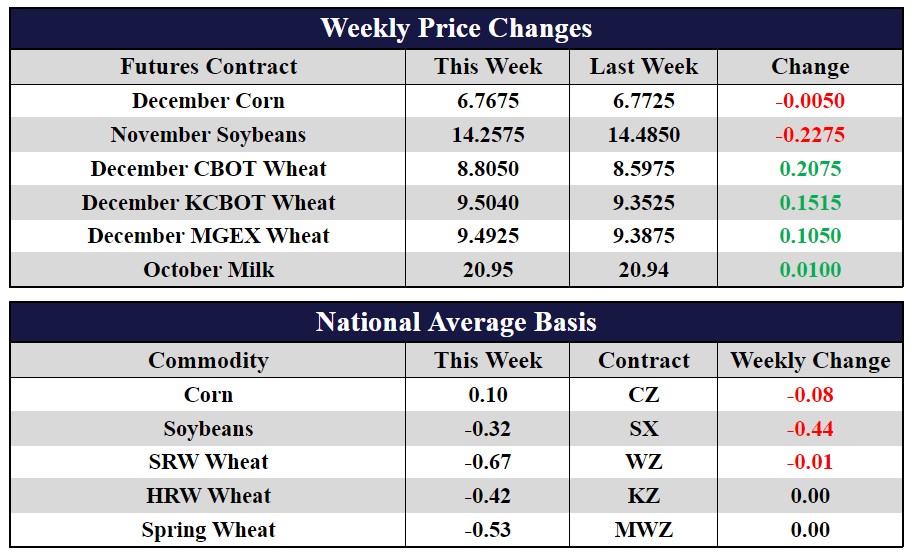

- December CBOT corn futures traded 11-1/2 cents lower today and shed a half cent for the week to close at 676-3/4.

- July 2023 CBOT corn futures shed 1-3/4 cents this week to close at 675-3/4.

- Corn had an inside trading week – unable to regain last week’s highs while staying above last week’s lows – as support from lower supply was outweighed by global economic concerns and the impact to demand.

- Corn started the week higher after the USDA downgraded the crop condition good-to-excellent rating by 1% to 52%.

- The stronger US dollar is weighing on commodities. The greenback gained against other world currencies after the Federal Reserve raised interest rates another 75 basis points this week and then surged to its highest level since May 2002 after the British Pound fell below 1.10 for the first time since 1985. This makes US commodities more expensive on the global market.

- Last week’s corn-based ethanol production dropped 6.4% from the prior week and was the lowest since February 2021 as processors slowed production on concerns of a railroad strike and cheaper new crop supplies on the way.

- The International Grains Council (ICG) lowered their US production estimate by 413 million bushels to 13.9 billion bushels which agrees with the September USDA estimate. The decline in global production they estimate will more than be offset by a decline in global demand but that world ending stocks will still decline year-over-year.

Soybeans Give Back USDA Report Gains

- New crop November CBOT soybean futures traded 31-1/4 cents lower today to finish the week 22-3/4 cents at 1425-3/4.

- July of 2023 CBOT soybean futures fell 17-1/2 cents this week to close at 1436-3/4.

- The National Index spot basis for soybeans has dropped 30 cents in the last week as new crop supplies start to arrive.

- More Argentine soymeal hitting the market after a surge in farmer soybean sales. The government of Argentina recently raised the exchange rate for soybean sales. China has been a noted buyer of Argentina soybeans, to the disadvantage of US supplies.

- The ICG forecast world soybean production at record 387 million tons in 2022/2023 as the international organization’s increased estimates for South America outweighed the USDA’s reduction to US production.

- Sharply lower crude oil prices – the lowest since January – are pressuring soy oil prices.

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

Wheat Prices Higher for the Week on Ukraine War Concerns

- December CBOT wheat futures traded 30-1/4 cents lower today but finished the week 20-3/4 cents higher to close at 880-1/2.

- December KCBOT wheat futures added 15-1/4 cents this week to close at 950-1/2.

- December MGEX wheat futures added 10-1/2 cents this week to close at 949-1/4.

- Prices are underpinned by growing concern that Putin will not agree to extend the Black Sea Grain Initiative in November which, since August 1st, has allowed Ukraine to export agricultural and food cargos through the region.

- In a rare television address, Russian President Vladimir Putin ordered to mobilize more troops to bolster the military campaign in Ukraine. This has triggered protests in Russia.

- The International Grains Council (IGC) is projecting record-high global wheat production for the 2022/2023 season. The ICG increased their estimate to 792 million tons, up from the previous projection of 778 million and now above last year’s 782 million tons.

Markets Dump Milk, Slice Cheese

Class III milk markets made large moves lower today with October and November futures losing 56 and 57 cents, respectively, while December futures were limit down 75 cents. Due to limit down trading on the December contracts, there will be expanded limits in the dairy markets Monday. For the week, second month October futures lost 59 cents, erasing gains from Monday and Tuesday. A catalyst for the lower Class III prices was the spot cheese trade today where blocks were down 4 cents and barrels down a half cent. Spot cheese was down nominally on the week, but similar to Class III, gains from earlier in the week were lost by the end of trade today. Class IV futures were mixed but mostly down. October contracts gained 3 cents, while November, December, and January were net losers of 3 cents, 33 cents, and 35 cents, respectively. Even with the small gains today, second month Class IV October futures were 36 cents lower on the week. For the week, spot powder was up 2 cents, spot whey down a half cent, and spot butter up 2 cents.