Corn lower this week

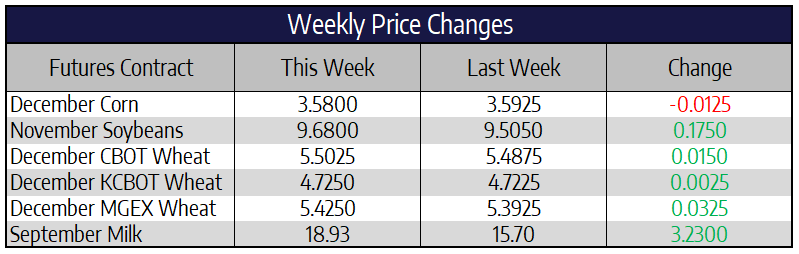

December corn futures were 1-1/4 cents lower this week to close at 357-1/4. March futures were ¾ of a cent lower to close at 368-1/2. While national crop conditions have declined in recent weeks, a large chunk of the ratings have been drug down by deteriorating conditions in select regions. In some areas around the dryness of Iowa the general consensus is rains and cooler temps have most likely added to an already big crop. Most in southern Minnesota feel this may be one of the best crops in years. As harvest just gets under way in the far southern Corn Belt, it appears, at least to start, yields are not as poor as originally thought. Informa’s estimate for the 2020 US crop was predicted at 178.1 bushels per acre this week, down from their previous estimate of 179. This latest estimate would be 3.7 bushels lower than the USDA’s August yield estimate and put carryout near the 2.5-billion-bushel mark.

The USDA’s ethanol demand projections continue to be in question by the market. During July US corn used for ethanol grind totaled just over 424 million bushels. While this was up slightly from June, this total is down nearly 6% from July of 2019. The USDA is currently projecting a more than 7% increase in corn demand for ethanol in their 2020/21 balance sheet. This would put total new crop corn consumption at 5.2 billion bushels, which seems like a stretch with US ethanol’s recent pace.

Soybeans move higher again this week

November soybean futures were 17-1/2 cents higher this week to close at 969. January soybean futures gained 17-1/4 cents this week to close at 973-1/2. Front month soybeans traded to a high of 969 ½ early in the day on Friday. This was the highest level traded for front month soybeans since mid-June of 2018 when the US and China were in the early stages of the trade war. Late week soybean flash sales of over 26 million bushels mustered little market reaction. Many feel the muted reaction to these latest sales has to do with the lofty export projections the USDA already has baked into their balance sheets. Until we get closer to these huge soybean export figures the market may be hesitant to work higher.

Farmers in Mato Grosso, Brazil are getting ready to plant their 2020/21 soybeans in less than two weeks, and they are looking at some very good domestic soybean prices. The available soybean supplies in Brazil are tight and crushers have been bidding up prices in the spot market. The average spot price for soybeans in Mato Grosso was around 124.83 Real per sack or approximately $10.70 per bushel. Soybean prices for March delivery trail spot bids however with the price of March export at $8.60 per bushel. There have been rumors in the past few weeks that Brazil may need to import US soybeans before March to meet domestic needs given their tight supplies of old crop.

Wheat holds onto small gains this week

December Chicago wheat held on to a penny and a half gain this week to close at 550-1/4. December KC wheat held on to a quarter cent gain this week to close at 472-1/2. December spring wheat rallied 3-1/4 cents this week to close at 542-1/2. After a four-week run of higher prices the wheat market looks vulnerable to increased selling in the near term. Outside market forces have turned bearish, world stock levels remain rather large and dry areas of Argentina wheat production received good moisture this week. A 3-day bounce in the US dollar plus a US stock sell-off this week helped add pressure to this overbought wheat market. Weekly export sales for the week ending August 27th showed wheat sales at 585,400 tons. Cumulative sales have reached 46.2% of the USDA forecast for the current marketing year versus a 5-year average of 44.3%. With Chicago wheat closing 18 cents off of its high this week, weakness to start the holiday shortened trading week on Tuesday will be no surprise.

Cheese Market Mounts Recovery

This week’s spot trade was positive for all of the dairy products other than whey. Losses were minimal in the whey market, as it dropped 0.75 cents on the week, chopping in between $0.33/lb and $0.35/lb. The big news this week was the aggressive rebound in the cheese market as it rallied over 28 cents this week. Futures have been pricing in a strong recovery and are being cautious to follow the market on the aggressive move higher. Recent volatility in the milk markets will keep futures lagging the spot markets in either direction. Butter was up 4.5 cents on the week to finish at $1.49/lb. The butter market has struggled to maintain above $1.50/lb, as sellers continue to enter the market on any breaks above. The spot powder market is continuing its slow and steady trek higher up 1 cent on the week to finish at $1.03 /lb.

The quarter four average has rebounded off the lows recently but remains hesitant to move too far too quickly. The spread between blocks and barrels remains at a dangerous level of 42 cents and threatens to deflate the market if block prices fall down to barrels. There is always the possibility the barrels could close the spread by moving up to block prices, but historically that is the less likely outcome.