Corn pushes higher for third week in a row

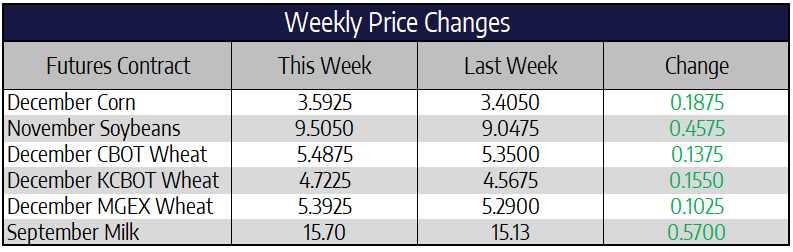

December corn futures rallied for a third week in a row closing 18-3/4 cents higher this week to close at 359-1/4. March futures rallied 16-1/4 cents to close at 369-1/4. Only 3.7% of Iowa is drought-free according to this week’s drought monitor. This is the smallest such area for Iowa since September of 2013. Just two weeks ago over 20% of the state was drought free. Taking a step back across the entire Midwest over 60% of the area is drought-free, the least since August of 2018, 13% is in a moderate drought or worse, most of that comes from Iowa. For many across the corn belt, especially in Eastern Iowa and Northern Illinois, dryness began to show up in the month of August. There is little clear historical indication of what can happen to corn yields in years with a dry August. Some comparable years have seen yields increase while others have seen yields decrease. With a record corn yield printed by the USDA in August, most feel favor lies on the side of a decreasing national corn yield moving forward.

China made its largest weekly US beef purchases on record last week. The USDA, in its weekly export sales report, said China bought a net 3,315 tons of US beef in the week ending August 20th, the largest weekly buy in records dating back to 1999. China also bought 11,216 tons of US pork last week, the most in a month. New crop corn sales last week were their third biggest thus far with China accounting for 56% of the 1.18 million metric ton total. Through August 20th, the US has sold 1.35 billion bushels of corn and soybeans for export in the 2020/21 marketing year that begins Tuesday. China accounts for 53% of this record booking total.

Soybeans move higher on continued dryness

November soybeans rallied 45-3/4 cents this week to close at 950-1/2. January soybean futures added 45 cents this week to close at 956-1/4. Continued strong exports to China, a deteriorating crop and a falling US dollar all helped rally front month soybeans to their highest weekly close since June of 2018. Weather has been the main topic for trade this week, especially for soybean yield potential. Dry spells in August have historically lowered soybean production by an average loss of more than a bushel and a half per acre. While soybean yields are almost certainly coming down from record estimates in early August even a small amount of precipitation soon could reverse this declining crop.

With soybean futures up over 80 cents from the August WASDE report the market has adequately factored in a large crop loss. Price action this week points to the funds adding to their already large net long position. It will be difficult to attract new longs without continued strong export buying. The US dollar continued its fall this week trading to its lowest levels since early 2018. Fed Chair Jerome Powell says the US central bank would allow inflation above its 2% target as part of an aggressive strategy to spur the economy from its recent set back. That is a signal the Fed will keep short term interest rates low for an extended period. The Fed’s new stance could reignite inflationary concerns which has historically been bullish for commodities as a whole.

Wheat moves higher this week

December Chicago wheat was 10 cents higher this week to close at 548-3/4. December KC wheat futures were 19-1/4 cents higher this week to close at 472-1/4. December Spring wheat futures rallied 11-1/2 cents this week to close at 539-1/4. Front month Chicago wheat futures traded to their highest level since April on Friday before backing off lower on the day. The challenge of previous highs with a close lower shows an unwillingness for wheat prices to move higher in the short term. After a three-week run of higher prices, stochastics reaching overbought territory and price action to end the week, a back test of the 100-day moving average near the 520 mark would make sense in the near term. Short covering and a falling US dollar are what traders are pointing to for this weeks run higher. Get current with recommendations if not already.

Cheese Finishes the Week Up 13 Cents

This week’s spot trade was positive for all of the dairy products other than butter. Butter took a decent hit losing 6.75 cents to finish the week at $1.4475/lb. In this week’s Cold Storage report, we did see butter numbers 13% higher than the same amount of butter in storage last year, which shows butter supplies are currently ample. Cheese prices had the largest up move this week, gaining 13.875 cents on the week. Part of this rally seems to have come from the extension in the farm to families program by an additional $1 billion dollars from the government. Powder was able to finish the week back above the psychological level of $1.00 at $1.02/lb this week. This could be supportive for new highs in the powder market. Whey price action was slow gaining 0.5 cents to finish the week out at $0.34/lb.

The Class III milk futures market took a hit following the rough week for cheese. Second month September Class III was down $1.75 per hundredweight. The Q4 2020 class III milk average gave back 67c and posted a close of $16.453. Most Class IV futures posted a red close for the week as well. Market fundamental updates from this week included a Global Dairy Trade auction on Tuesday and a Milk Production report on Wednesday. The GDT auction was mostly red across the board, with the GDT index falling 1.70%. GDT cheese led the way lower, falling 3.60%. July milk production across the U.S. increased 1.50% which was a bit of a bearish figure.