January 6, 2023

Class III Off Weekly Lows

The nearby Class III contracts managed to close with small gains on the shortened week after heavy losses to kick off the new year. February took over as the second month contract and finished a penny higher on the week at $18.59, but that represents a 64 cent move off of Wednesday’s intra-day low. However, that is the lowest weekly close for the second month Class III contract since the week of 11/22/2021. Class IV futures kept their downtrend intact into January as the 2023 average has hit a 5-month low. Despite Thursday’s release of some solid November export numbers, the declining Global Dairy Trade momentum and weaker domestic demand has weighed on the spot markets and keeps the bear camp in control for now.

- November dairy exports totaled 236,177 metric tons, up 9% YoY and down 1% from October

- US butter exports in November were a full 102% more than the same month in 2021 at 9,387 metric tons

- November showed that US butter production is on the rise, up 8.9% from November 2021

- March soybean meal futures continue to rally off of news of lower crop potential for Argentina

Corn Gives Back 24.50c This Week

- The corn trade has been choppy the last few weeks. After adding 25.50c over the last two weeks, corn fell 24.50c this week to close at $6.54 per bushel

- The Buenos Aires Grain Exchange rated 13% of Argentina’s corn crop good to excellent

- All eyes are on next week Thursday’s Supply and Demand report. There are concerns that the USDA could show a reduced corn demand estimate in the report

- Ukraine corn prices are lower than the US and that is offering resistance

- Chinese March corn prices posted their 8th consecutive gain and are equivalent to about $10.62 per bushel

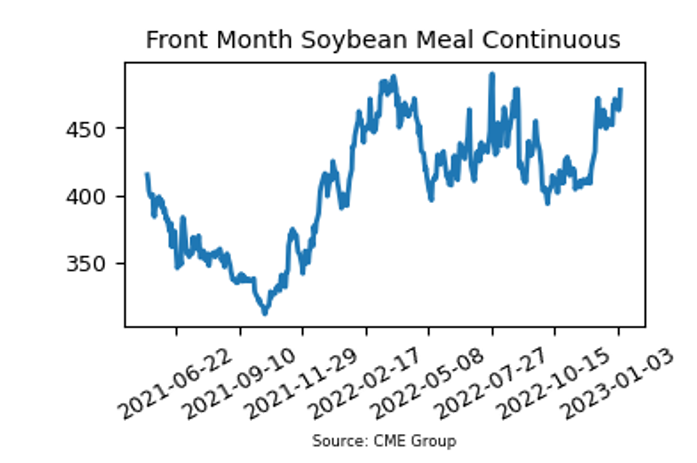

January Soybean Meal Hits $500/Ton

- Front month bean meal futures have closed higher in six out of the last eight weeks. The March contract tacked on $6.60 this week to close at $477.60

- The Buenos Aires Grain Exchange rated just 8% of Argentina’s soybean crop good to excellent

- Brazil conditions still look mostly favorable in the central and northern areas, but there is dryness in the south

- Chinese bean demand is still a concern, especially with their rising Covid cases

- Brazil’s soybean crop could be record large at 5.58 bb

Friday’s Market Quotes