January 15, 2021

Government Demand Props Up Milk

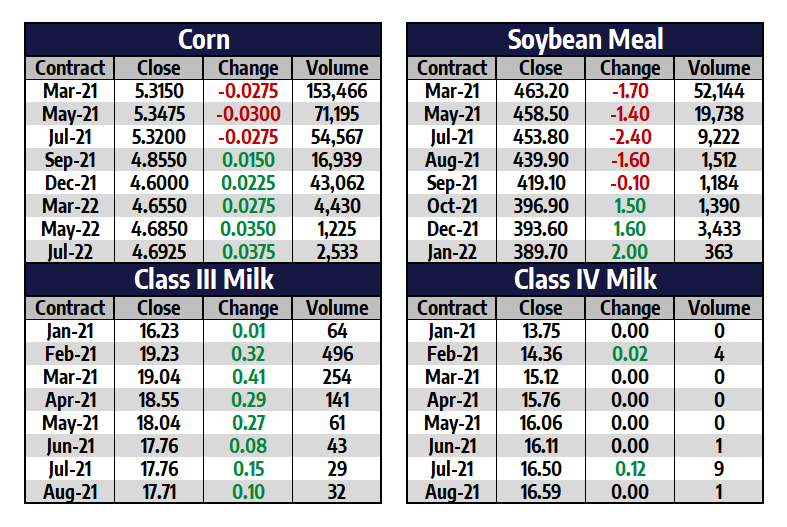

The government continues to announce programs and funds set aside to purchase dairy products on the open market and prices are rising because of it. Recent announcements include $400 million to buy milk on the open market as part of the COVID relief stimulus bill. There was also a fifth round of product purchasing announced as part of the Farmers to Families Food Box program. Now this week it was announced that $40 million of butter would be purchased and $40 million of cheese would be purchased as part of the government’s food nutrition assistance programs. Milk futures continue to work higher as a result. February 2021 class III milk finished the week up at $19.23 with March at $19.04. Most 2021 contracts hold over at least $17.50. Additional support comes from a weaker Dollar, strong exports, and high feed costs.

Milk Highlights:

The government continues to announce programs to purchase dairy products off the market for donations

2021 class III milk prices continue to rise as the market nears $20 again

United States whey prices are strengthening, with the spot market up 3c this week to $0.53/lb

United States dairy exports in November were down 2% from a year ago

Corn Adds 35.25c This Week

The front month March 2021 corn futures contract gained another 35.25c this week and posted a close up at $5.3150 per bushel. This is the sixth up week in a row for a market that is trading in extremely overbought conditions. The high prices this week may have triggered a bit of farmer selling, with the best levels farmers have seen in 7 years. There were some rains that hit Argentina this week, but conditions look dry after that. Argentina’s crop conditions are rated 19% good to excellent versus 55% last year. A bullish USDA Supply and Demand report this week Tuesday took U.S. corn futures limit up and the market mostly consolidated up at those elevated levels the rest of the week. The trend remains up.

Corn Highlights:

Corn futures had a strong week of trade. The market finished limit up on Tuesday after the WASDE report

Argentina corn crop conditions are only rated 19% good to excellent

Rain is expected in parts of South America over the weekend. How much rain and where it hit will be watched closely

The front month corn contract pushed over $5.00 per bushel with ease this week

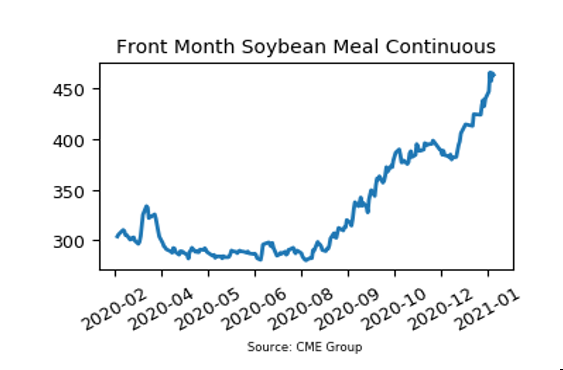

Soybean Meal Gains Over $20 This Week

For the fifth week in a row, soybean meal futures were aggressively bid higher. The market closed green in three out of the five sessions this week, with March 2021 adding $23.60 overall and settling up at $463.20 per ton. Palm oil futures and soybean oil prices are starting to reverse lower, which did add some spill-over selling in the grain complex on Friday. However, the soybean market performed so well at the start of the week that it was another strong week overall. The market had a bullish reaction to Tuesday’s Supply and Demand report. South American weather is still being watched very closely. Weather has been better in parts of Brazil with some much needed rain hitting the area. China raised their soybean imports to a record large 100.30 million metric tons – up 13% from a year ago. The funds remain long about 225,000 contracts of soybeans.

Soybean Meal Highlights:

Soybean meal futures have put together a five-week up streak with the market now pushing over $450/ton

Weather has been better in parts of South America with rains coming in, but it still remains dry

Palm oil futures are starting to pull back, causing the soybean complex to sell off later in the week

China is still expected to be a large buyer of United States soybeans over the coming months

Market Quotes

**Quotes show Friday’s close