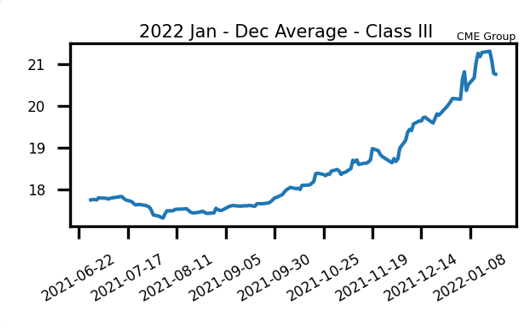

February Class III Down 6 Days In a Row

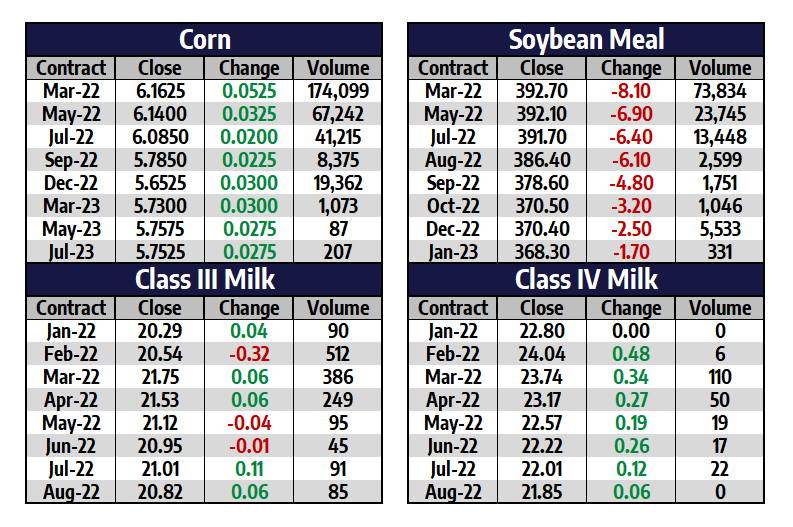

Nearby class III milk futures are going through a correction as the market takes out premium from the months closer to the spot cheese price. This week, February milk fell five days in a row by a total of $1.50/cwt. The fact that cheese wasn’t able to push over $2.00/lb and has since reversed back to $1.81/lb is keeping pressure on futures. The block/barrel average cheese price fell 13c total this week on steady selling pressure. The class III market is still receiving an overwhelming amount of support from multi-year high butter prices, multi-year high class IV prices, high feed costs, and tighter milk production, but a lower US cheese price will make it hard for the market to hold these levels. The front month January contract and the second month February contract are now more in line and are just 25c apart after Friday’s close. The class III trade had a pretty neutral session on Friday.

Class IV milk futures closed the week into new multi-year highs as the butter bidding hasn’t slowed. Spot butter jumped another 3.50c on Friday on a whopping 18 loads traded. This takes spot butter to $2.9350/lb as the market looks set to test the $3.00/lb level. Global demand for butter and strong US exports are driving the move. Rounding out the spot trade, spot powder added a half cent to $1.8150/lb while whey was steady at $0.80/lb. Possible volatility could come next week in the form of the USDA US Milk Production Report. The report will be released on Monday at 3pm. There is also a US Cold Storage Report on Monday as well.

Corn Hits New Highs For The Move

The corn market had a strong week of trade, with the March 2022 contract adding 20c total this week. The market was also able to push up into its highest price since early June 2021. On Friday, the market got news that 247,800 metric tons of US corn will be exported to unknown destinations during the 2021/22 marketing year. China’s corn prices have been strengthening as well, as its Dalian May corn contract hit its highest level since June (close to the equivalent of $11 per bushel). Commodity prices found support this week from talk that more and more hedge funds are adding to grains and soybean longs as a hedge against inflation. Weather in South America is still being watched closely.

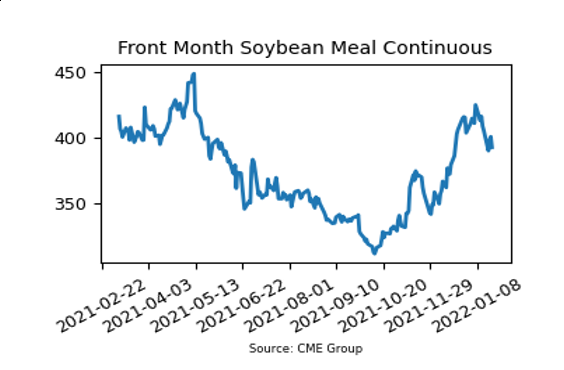

Soybean Meal Pushes Back Below $400/ton

March soybean meal futures finished the week $12.90 per ton lower to $392.70 this week. The contract hit a high of $405.30 and a low of $389.40 for the week. Support for the bean complex on Friday came from the fact that China purchased 132,000 metric tons of soybeans from the US for delivery during the 2021/2022 marketing year. Argentina continues to get rain but parts of Paraguay and southern Brazil remain hot and dry. The Buenos Aires Grain Exchange lowered Argentina’s soybean crop condition to 30% good to excellent. This was down 1% from last week. One private estimate yesterday put the Brazilian soybean crop as low as 127 mmt. Palm oil prices are making new highs, adding some support to beans.

Friday’s Market Quotes