January 22, 2021

Spot Cheese Falls 8 Days In A Row

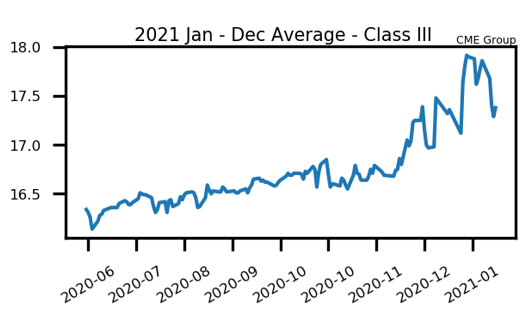

After the initial pop in cheese prices following the USDA’s announcement of the fifth round of purchasing for the Farmers to Families Food Box program, cheese has struggled to follow through. After that announcement, spot cheese jumped higher for five sessions in a row. Since that time, the market is now down eight sessions in a row and demand is weak. Because of the selloff in cheese, class III milk futures are struggling again as premium gets taken out of the nearby contracts. February 2021 class III milk lost a whopping $2.78 this week and closed at $16.45 per hundredweight. This contract had tested $20 just a week ago. Until cheese finds some buyers here and sees support, nearby milk could continue to weaken. Next week’s milk production report will be watched closely to see where cow numbers are at and what production did during a mild December.

Milk Highlights:

The spot cheese market has fallen 8 days in a row, as demand has dried up in recent sessions

Volatility in the dairy market continues to be extremely high – especially in the nearby contracts

This week’s Global Dairy Trade auction saw the GDT Price Index add 4.80% with GDT butter moving to 12-month highs

All eyes will be on Monday’s Milk Production report for December in the U.S. November production added 3% from a year ago

Corn Falls Sharply To End The Week

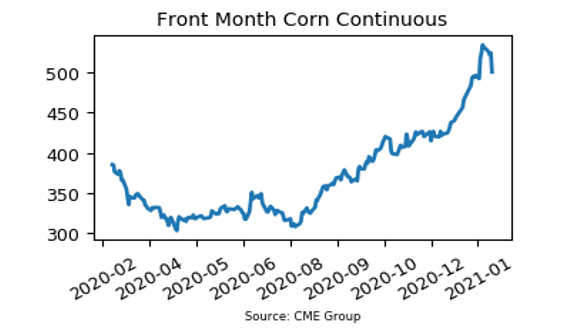

Corn futures struggled this week with the market dropping 31c in total. This brings the March 2021 contract down to $5.0075 per bushel. There wasn’t much bearish news this week that would induce selling pressure like this other than the fact that the market conditions had been very overbought leading into the week. There have been some timely rains in parts of South America that may have triggered some selling, though. Also, Argentine farmers have ramped up selling of corn ahead of a possible export tax increase. Weather in Argentina has improved, with 28% of the crop rated good to excellent versus 19% last week. Demand here in the United States is still steady. Weekly corn export sales were 1.437 million metric tons – about even with last week. Export sales notices continue to roll in as well.

Corn Highlights:

Corn futures struggled this week as the market corrected after holding overbought technical conditions

Argentina corn crop conditions are rated 28% good to excellent, versus 19% last week

Demand for U.S. corn holds steady with export sales notices continuing almost daily

The front month corn contract settled right over the $5.00 per bushel level on Friday, a psychological area that could act as support

Soybean Meal Pulls Back Off Highs

Soybean meal futures struggled this week and finished below last week’s low. The March 2021 contract lost a total of $41.60 per ton and settled at $421.60. This puts the market about $50 per ton off of last week’s high. Daily export sales announcements continue to roll in, with another 136,000 metric tons of soybeans purchased by China today. Weekly export sales for beans were 1.817 million metric tons this week – up about 50% from last week. Rains have improved the Brazilian soybean crop to 21% good to excellent versus 10% good to excellent last week. The funds have liquidated some of their long positions here, but still hold a hefty long position in beans.

Soybean Meal Highlights:

Soybean meal futures snapped a five-week up streak this week by dropping over $40 per ton

South America experienced some timely rains and their crop conditions are improving

The funds liquidated some of their long positions this week, but still hold hefty long positions in grains

China is still expected to be a large buyer of United States soybeans over the coming months

Market Quotes