January 28, 2022

Milk Recovers Late Week

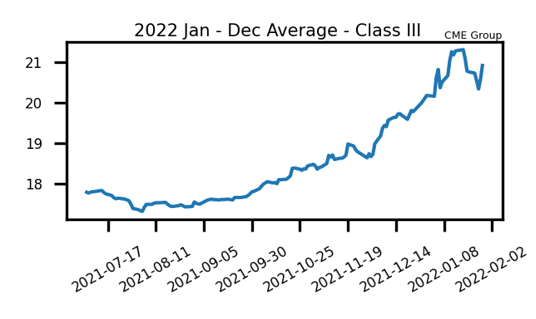

After the recent sharp move lower for the nearby Class III milk futures, Thursday and Friday’s trade was friendly with double-digit gains in most contracts. The February contract finished the week at $20.19, down 35 cents overall but up 69 cents from the weekly low, while the soon-to-be second month March price rallied back over $21.00. The block/barrel average was down more than 4 cents on the week but posted a nice 6.25 cent grain on Friday, while spot whey keeps chugging along with a new all-time high of $0.84/lb, up 4 cents this week. Earlier this month, Class III milk finally broke through the $20.00 barrier while the block/barrel average pushed to 14-month highs with its break above $1.84/lb, and both returned to their old ranges this week after a severe reversal. Spot cheese will likely have to trade back above $1.90/lb to get milk futures to retest the recent highs.

Class IV milk futures also had a strong end to a negative week. February futures were down 88 cents heading into Friday’s trade and managed to halve that with a 41 cent gain today. The second month chart is just 58 cents off its all-time high posted on Monday, representing a much smaller retracement than its Class III counterpart made this week. Spot butter traded a nickel higher to $2.54/lb on Friday, but was still down 39.50 cents on the week. That market had gone up too much in too short of time and was due for a correction, but the volatile swings have been something that market has not seen in years. Spot powder continues to hang on at near 8-year highs, closing down just a penny this week at $1.8050/lb. The bullish fundamentals for Class IV and it underlying spot markets remain in place, but it is tough to know if there is enough ammo to sustain a move near $24.00 for an extended period of time

Corn Keeps Pushing Higher

Corn futures continued their rally with the front-month March contract closing up 19.75 cents on the week at $6.36. It has become repetitive but a dry forecast for southern Brazil and Argentina next week had buyers active, and the continued uncertainty with the Russia-Ukraine conflict and its effect on crude and wheat prices only added to the risk-on mentality. From a technical standpoint, the continuous chart has now closed the gap from last summer when the July 2021 contract came off the board. While the front-month 2021 contracts traded over $7.00 last May, the March 2022 contract peaked at $6.4050 at that time, just 3.25 cents above today’s high. While the rallying dollar and overbought conditions warrant some concern, prices remain strong for now.

Soybean Meal Rebounds

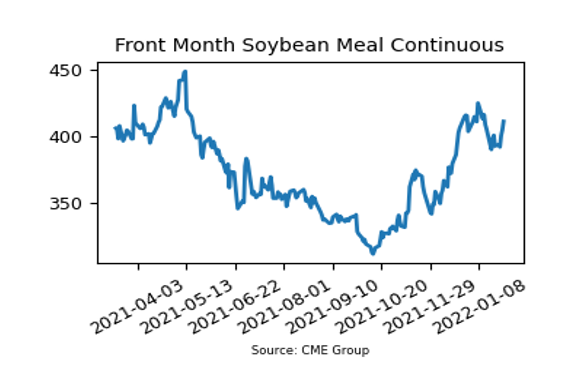

March soybean meal closed the week $18.50/ton higher at $411.20, an impressive move after falling $32.30/ton in the preceding two weeks. The soybean complex pushes higher thanks to beliefs of tighter world supplies and a rallying palm oil market. Palm oil hit a record high due to sanctions put in by the Indonesian government restricting exports, which caused soybean oil futures to rally for their second week in a row. But the main focus remains on weather in southern Brazil and Argentina, which are expected to be dry again next week amid falling production estimates. Soybean meal futures topped out earlier this month along a trendline on the continuous chart, and if that is to be retested again would come in place in the high $420.00’s.

Friday’s Market Quotes