February 12, 2021

Milk Futures Remain Volatile

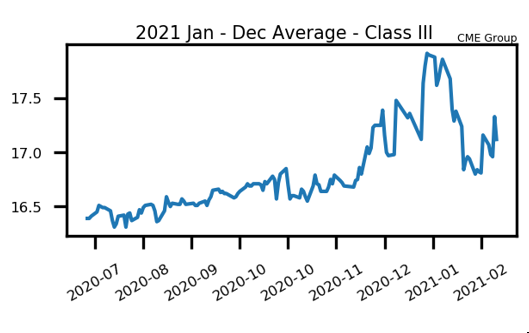

The class III milk market didn’t see much follow through this week after last week Friday’s random limit up day in several contracts. However, there was yet another limit up move again this week on Thursday. Milk futures remain extremely volatile as the fundamental picture is still mixed. Pressure comes from a production glut here in the United States with production up 3.10% in December from a year ago with cow numbers up over 100,000 head. Meanwhile, support is coming from strong exports, a weak US dollar, and high feed costs. Butter futures are starting to work higher too, with the second month contract up 15.45c last week and another 2.925c this week.

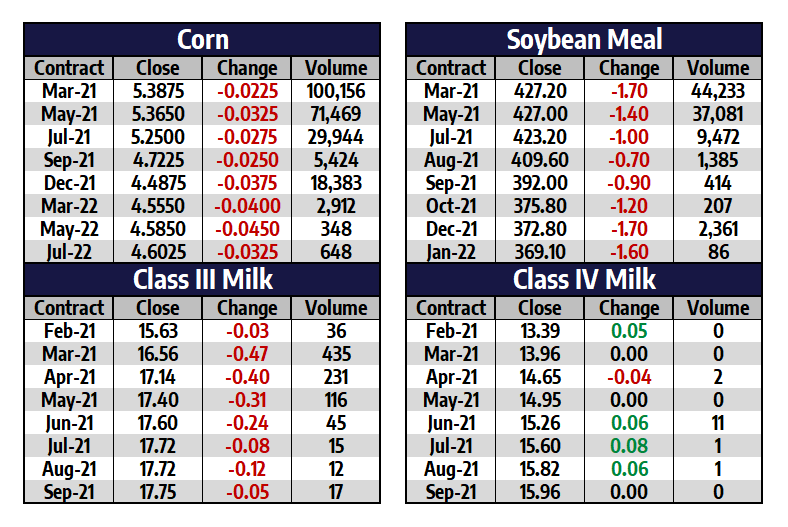

Milk Highlights:

United States cheese prices remain at a pretty steep discount to global dairy trade levels

Class III milk futures in 2021 are priced between $15.63 and $17.77 currently. Class IV is between $13.39 and $16.21

United States butter exports were 115% from a year ago in December and were up 137% from last month

Milk production in November was up 3.40% and it also grew 3.10% in December. Cow numbers added 100,000 head from a year ago

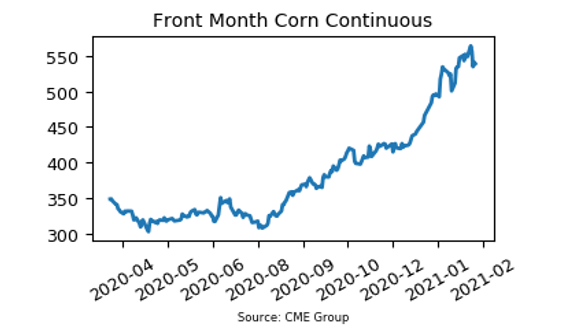

Corn Finishes The Week Well Off Its High

The corn market put together yet another volatile week of trade and did not post the strongest finish. It will be interesting to see if the red weekly candle entices some additional selling pressure into next week as market conditions do remain well overbought. By week’s close, the front month March 2021 contract was down 9.75c to $5.3875 per bushel. This was 35.50c off of its intraweek high of $5.7425 per bushel. Market price action this week had contracts bullish leading into the report, then mostly bearish after the report. March corn added 15.25c on Monday, fell 7.50c Tuesday, and lost 21.75c on Wednesday. In Tuesday’s report, the USDA estimated US corn carryout near 1,502 million bushels versus 1,392 expected and 1,552 last month. Although the cut in carryout was favorable, it was well below market expectations.

Corn Highlights:

Corn futures posted a bearish looking weekly candle which could entice some follow through selling next week

US corn carryout came in at 1,502 million bushels versus market expectations of 1,392 million bushels

The USDA estimated world corn carryout near 286.50 million metric tons versus 279.80 mmt expected

The corn market is consolidating a bit up at these recent highs

Soybean Meal Trades Choppy

Soybean meal futures finished just slightly lower for the second week in a row. The March 2021 contract lost $3.30 per ton and finished at $427.20. The recent high for the move on that contract in early January was $463.20 per ton. Some pressure on the market comes from the fact that CONAB raised Brazil’s soybean expectations to 133.80 million metric tons – this us up slightly from the USDA’s 133 million metric ton estimate. On the positive side, rains continue to delay harvest in Brazil, which is only at 4% done versus 18% this time last year. Total United States soybean exports are at 97.10% of USDA predictions with 81% of those shipped.

Soybean Meal Highlights:

Soybean meal futures have not hit a new high for the move since January 13th

The market is working through some consolidation up at prices around $430 per ton

Brazil’s harvest is delayed due to wet conditions. They are 4% harvested versus 18% last year

Despite planting and harvest delays, Brazil is still expected to have a record crop

Market Quotes