The CME and Total Farm Marketing offices will be closed Monday, February 20th, 2023, in observance of President’s Day.

February 17, 2023

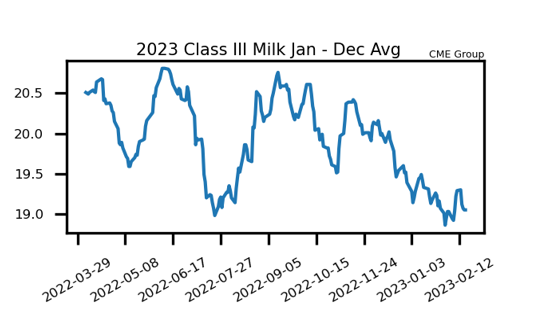

2023 Dairy Prices Succumb to Selling Pressure

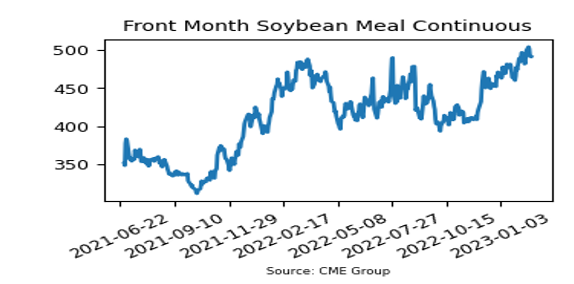

Despite the rebound in prices last week, all eight quarters for Class III and Class IV milk sustained losses this week. These losses come despite US dairy futures being vastly oversold. Likely scenarios for the downward movement of prices would be export demand for US dairy products waning, moderate growth in milk production, and increasing cheese and butter inventories. Next week will provide multiple fundamental reports in both Milk Production and Cold Storage. he spot market for cheese was extremely active this week with a whopping 51 loads trading, despite this activity the spot price of cheese was nearly unchanged on the week. Feed markets traded mainly sideways this week as corn continues to coil tighter and bean meal failed in staying over $500 per ton on the front month contract and carries a substantial premiums over future months.

- Quarterly Class III prices for the week: Q1 down 16 cents, Q2 down 47 cents, Q3 down 26 cents, and Q4 down 17 cents

- Quarterly Class IV prices for the week: Q1 down 12 cents, Q2 down 30 cents, Q3 down 30 cents, and Q4 down 25 cents

- Many discussions around the new Farm Bill include DRP and DMC levels, we will be monitoring these changes closely

- Cheese blocks have continued to hold at least a 20 cent per pound premium over barrels for 2023, ending this week at a 33 cent premium

- Class IV premiums over Class III have grown since early January when Class III briefly gained more value

Corn Continues Consolidation

- Corn contracts continue range bound trading, the March contract finished slightly higher at $6.7775 per bushel

- The US has objected to the Mexico block on GMO corn imports; Mexico maintains that the ban is solely for food purposes and that the country is self sufficient with their own white corn production

- Negotiations will start up again next week in regards to extending the Black Sea grain program, the current deal is set to expire March 18th

- The International Grains Council cut its forecast for global corn in 2022-23, slashing production 8 million metric tons, due mainly to Argentina and US production reductions

- Safrinha corn planting delays are being reported in Brazil due to multiple different factors affecting progress

Soybean Meal Fails at $500

- After breaking above $500 per ton, touching as high as $508 this week, meal prices failed to follow through and closed the week with the lowest value in the last three weeks at $491.10

- Some forecast South American soybean production to be a record 201.7 mmt, up over 18mmt from last year, which would be a nearly 10% increase in production

- Soymeal exports from India have grown dramatically, the first four months of this year have nearly matched the entire exports reported from all of 2022

- NOPA reported a crush of 179 million bushels of beans in January, a disappointing number in their eyes, as that number is down 3.2 million bushels from January of 2022

Friday’s Market Quotes