February 26, 2021

January Milk Production at 1.6%

Trade this week was positive in the Class III markets as the 2021 calendar year average tested levels just below $17.00 before reversing higher to finish the week at $17.37. We received a lot of fundamental information for the milk market this week as milk production and the cold storage report came out on Tuesday. Milk production for the month of January came in at 19.17 billion pounds vs. 18.877 billion pounds in January of last year. This is an increase of 1.6% YoY, which is near trendline growth but well off of recent growth numbers in November and December coming in over 3% higher YoY. Cold Storage for cheese was up 3% YoY and was virtually stagnate from December to January. The rapid growth of over 6% YoY in December looked concerning, but the slow change in January looks to alleviate the issue. The spot trade this week was a bit of a mixed back. The block/barrel average and non-fat powder gained 4 cents. Butter lost traction after a 15 cent up week last week to finish down 8 cents at $1.47/lb. Whey finished the week at the highest levels of 2021 at $0.5575/lb.

Milk Highlights:

United States spot butter erases half of last weeks gains losing 8 cents

Milk Production growth rates slowed down to 1.6% in January

Cheese in cold storage also showed signs of slowing growth up 3% YoY in Jan vs. 6% YoY in Dec

The second half of 2021 traded to the highest prices the contracts have ever traded this week

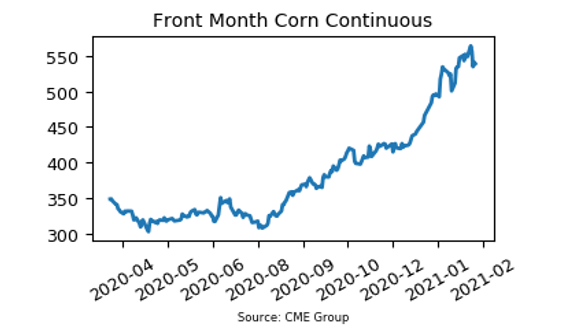

Corn Adds 6.25c This Week

Corn futures remained choppy this week as the first three days started out trading higher and the last two day of the week ended up trading lower. March futures were still able to add 6.25 cents by the end of the week to close at $5.49. Weekly export sales for the week came in at a marketing-year low for corn at 453,300 metric tons. We may begin to see lower export sales numbers through the upcoming weeks as South America continues to work on harvest and getting second crop corn into the ground. Currently, Argentinian corn is estimated to be 20-30 cents cheaper than U.S. prices.

Corn Highlights:

Corn futures look choppy but ready to move higher or lower on the first sign of new information

The USDA expects 2021/22 corn acres at 92 million versus 91 million last year

Weekly Export Sales put in a marketing-year low of 453,000 metric tons

Argentinian corn prices are currently more competitive than domestic prices for exports.

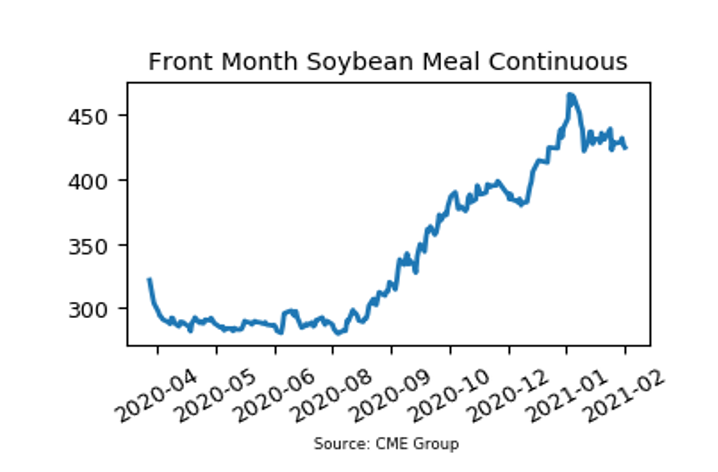

Soybean Meal Falls 4th Week In A Row

The soybean meal market continues to struggle to gain any substantial traction as it finished its fourth week in a row lower. The losses were minimal only losing $1.20 a ton to finish the week at $422.4. The monthly candlestick for February is now finished and the net losses on the month sit at $8.60 a ton. From a technical standpoint, we are starting to see some of the longer-term technical indicators turn negative. Weekly export sales for beans came in at 167,900 metric tons. This is down 67% from last week and 72% from the previous 4-week average.

Soybean Meal Highlights:

Soybean meal futures continue to consolidate between about $420 and $440 per ton

US soybean yield is expected at 50.80 bushels per acre for the 2021/22 crop

The weekly export sales number dropped 67% vs. last week and 72% from the previous 4 weeks

Better weather in South America is expected to help advance harvest over the next week

Market Quotes