March 4, 2022

Milk Higher On Week

Class III prices pushed to new highs to begin March, led by a $1.20 gain in the April contract with a close at $23.68. That contract held a daily high on Friday of $24.00, eclipsing the July 2020 peak on the second month chart and sitting just beneath the November 2020 high of $24.09. Spot cheese was a winner this week with its first push over $2.00/lb in a year and a half, gaining 13.75 cents in total, with a close at $2.06/lb. The block/barrel spread, after spending seven weeks within a nickel of even, has pushed to 18 cents as blocks have led the way higher. On the negative side, spot whey was lower for the fourth straight week with a 2.25 cent drop to $0.7575/lb.

Class IV futures were higher this week as well, with the second month April contract closing at $25.19, a gain of 63 cents this week. A new all-time high on that chart was hit at $25.30 as this market continues to plug along with very little in the way for resistance. Spot butter is still hanging at some solid levels and gained 9.75 cents on the week, finishing Friday at $2.6850/lb, while spot powder was up 1.25 cents. Next week Tuesday will give the market an update on January export numbers, something that was very supportive for the dairy markets through most of 2021, as well as the March Supply & Demand report on Wednesday, which could add fuel to the wildly explosive grain markets.

Corn Highest Since 2012

May futures pushed to a daily high of $7.8275 during Friday’s trade, the highest the front month has traded since September 2012. That contract did settle off its high at $7.5425 but was still 98.50 cents higher on the week. Of course this strength is tied to the Russia/Ukraine conflict and the fact that Ukraine is responsible for roughly 17% of the world’s corn exports, with a large percentage of last year’s crop still waiting to be exported and the planting season around the corner. At some point corn will price itself out of demand in terms of exports and US producers have certainly seen basis widen dramatically in many areas, but the initial volatile push higher has been something not seen in many years. In a shift from the bullish news out of South America, some late season rains have apparently helped Argentina during a trying production season with the Buenos Aires Grains Exchange pegging their corn crop at 51 million metric tons.

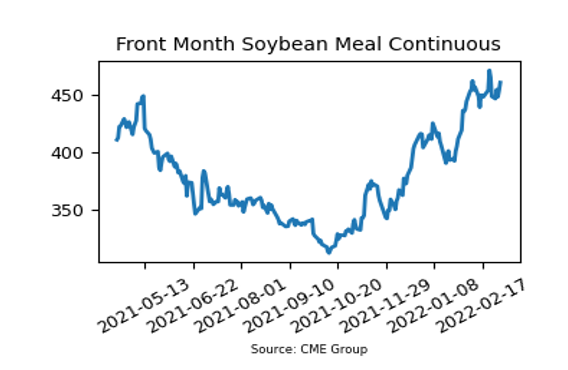

Soybean Meal Off Highs Again

In three of the last four weeks, soybean meal futures have closed at solid, historically-high prices but have left a decent tail on the charts by closing off their highs. The high on the front month at $487.00 from last week is an eight-year high and impressive but there has been a failure to hold above $460.00 on a week basis, with this week’s close just breaching that point by $0.40/ton. Soybean oil, which out of the soybean complex holds the closest ties with the Black Sea region, did see a nasty reversal this week and put pressure on the rest of the complex. The unknown going forward in regards to all commodity markets remains immense with a lot to get ironed out. For soybean meal, South America is nearing peak supply as harvest progresses but China remains heavy buyers.

Friday’s Market Quotes