March 19, 2021

Dairy Slides Lower This Week

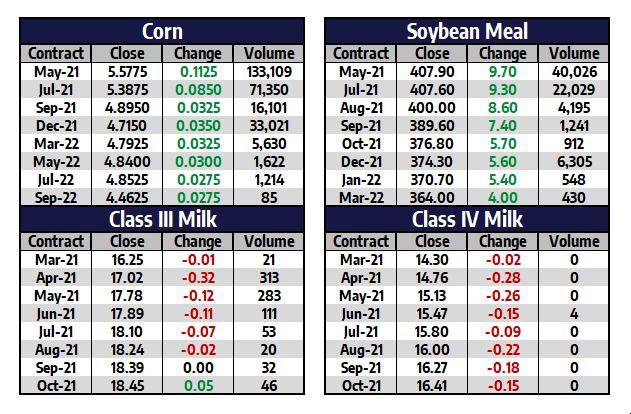

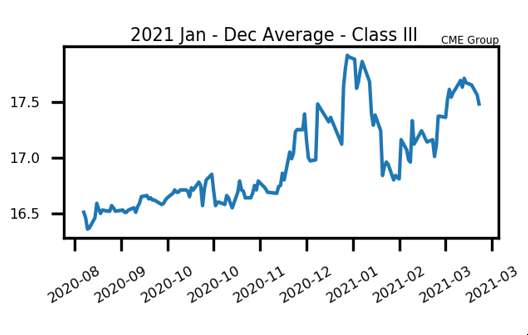

Throughout this last week the dairy markets have been slowly trading lower as Friday marks the 6th consecutive down day in the market for Class III milk. Most of the recent slippage in the market is coming from disappointing trade in the CME spot market. Every product in the spot market other than the whey market finished lower on the week. The fat complex was the worst performer as butter and cheese both finished 5 cents lower on the week. Short-term support for butter looks to be near the $1.60/lb area and short-term support for cheese looks to be closer to $1.55/lb. While prices still look to be in a positive trend for both of these products, a break of short-term support would break that view. The non-fat powder market continues to be rangebound between $1.15 and $1.20/lb. Look for a breakout at either level for additional momentum higher or lower. Whey continues to be the standout product as it finished 2 cents higher on the week at the all-time high for the spot market of $0.6125/lb.

Milk Highlights:

The February U.S. Milk Production Report showed production growth at 2% compared to last year

The spot whey market is at all-time highs for the electronic spot trade

The market continues to wait for updates from the new Ag Secretary Tom Vilsack to see if there will be additional government product purchasing

The second half of 2021 remains near the all-time highs for their respective contracts

Class IV milk is still at depressed levels, but are starting to push higher

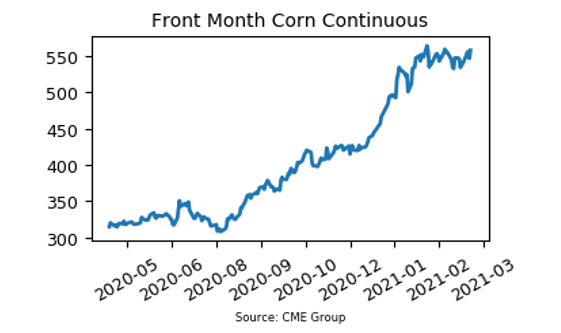

Corn Rebounds Friday

Front month corn futures finished higher in four out of the five sessions this week, tacking on 18.75c in total. This brings the May 2021 contract up to $5.5775 at week’s end. That May contract struggled on Thursday, dropping 11.50c, but then recovering Friday with an 11.25c up session. Global demand questions were answered this week when China came out and bought several large purchases of corn from the U.S. The purchase announced on Friday totaled 800,000 metric tons for the 2020/2021 marketing year. Meanwhile, Brazil is getting closer to finishing up its 2nd corn planting, but is still very far behind the normal pace. In Argentina, there was a notable reduction in rainfall across the southern half for next week.

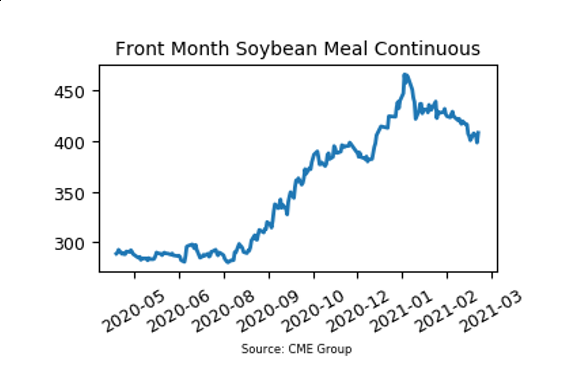

Soybean Meal Holds $400/ton

After hovering around the $400 per ton threshold all week and even pushing below it a few times, soybean meal held over that level once again by week’s end. The front month May 2021 contract gained $9.70 on Friday, finishing up at $407.90. This put the market up $7.20 for the week and snapped a streak of five down weeks in a row. Brazil is starting to trend drier next week while Argentina continues to lower its soybean crop ratings. This is helping to put some premium back into the market. China’s soybean imports are forecast to reach a record 100 million metric tons in 2021/2022. Friday’s trade in the U.S. saw the May 2021 soybean contract jumping 24c, which helped support meal.

Market Quotes