March 25, 2022

Milk Lower Friday, Up on Week

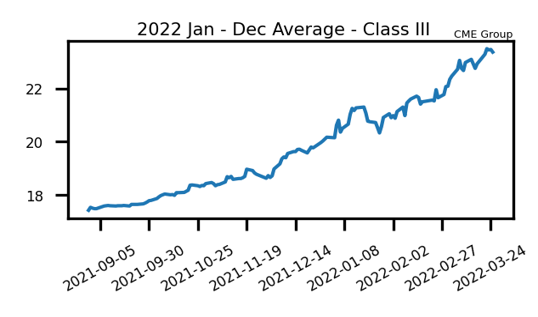

Class III milk futures saw prices trade down on Friday, with the April contract falling 20 cents to $24.30, but was still 87 cents higher for the week. The calendar year average hit a new high at $23.67 on Tuesday this week and settled at $23.34 by Friday’s close. Milk prices remain at historically great levels and this week’s February Milk Production report helped, showing a 1.00% drop year-over-year. Cow numbers did see their first month-over-month increase since May 2021, so that will be a trend to watch in coming months. Spot cheese was a big winner this week, closing at $2.2625/lb, which was up 18.25 cents overall and is sitting just beneath the 2019 high of $2.26875/lb. Demand remains strong, but prices have hit levels that are traditionally short-lived, so it is worthwhile being on the defensive.

After trading lower the two previous weeks, the Class IV market was positive, with a push to a new all-time high on the second month chart at $25.33. The calendar year average closed at $24.70, an impressive 31 cent gain since last Friday’s close. Spot butter continues to hold at strong levels, gaining 7 cents this week, with a close at $2.7950/lb. There isn’t much to get excited about unless that market can breach the January high at $2.9350/lb, but the fact both it and spot powder have gone sideways at multi-year highs is encouraging. For the upcoming week, there are no dairy-focused fundamental reports, but Thursday’s Planting Intention’s report and its effects on the grain/feed markets will be something to keep an eye on.

Corn Stays Sideways

To give you an idea how flat corn prices have been in recent weeks, May corn futures have traded at $7.50 at least once during each of the last 17 trading days. This week, the contract closed 12.25 cents higher at $7.54 and unless something happens in the meantime with Russia/Ukraine or in South America, the markets will likely continue to hang in a tight range until next Thursday’s Planting Intentions Report. That report is often a mover but it is tough to think of a time where this was this much outside market pressure affecting the markets, which could mute the reaction a bit. There still is so much to become known when it comes to Ukraine between exports and upcoming planting, and there also is no way to know what is “priced in” already, so the markets will stay volatile. The International Grains Council lowered their expectation for Ukrainian corn exports from 31.9 million metric tons to 21.0 mmt. On the bearish side, there are widening reports of avian flu spreading, with nearly 7 million birds culled nationwide since the outbreak in February, and Brazil’s corn crop is off to a great start.

Soybean Meal Hits New High

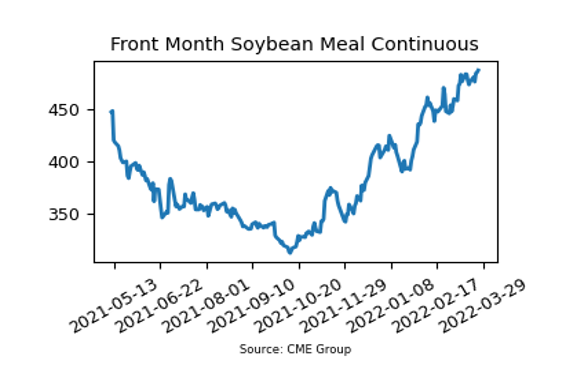

May soybean meal futures traded to a new high for the move this week by hitting $494.70 during Friday’s trade and also posted a new high weekly close by finishing out the week at $487.90. The market news is more of the same with high domestic soybean prices in China, declining conditions in Argentina, and an overall bullish trend in world food and feed prices. The Buenos Aires Grains Exchange pegged Argentina’s soybean crop at 32% good to excellent, down 2 points from their previous release. Harvest is Brazil is roughly 80% complete. Next week’s acreage report will likely set the tone with the average estimate at 88.9 million acres, up from 87.2 million last year.

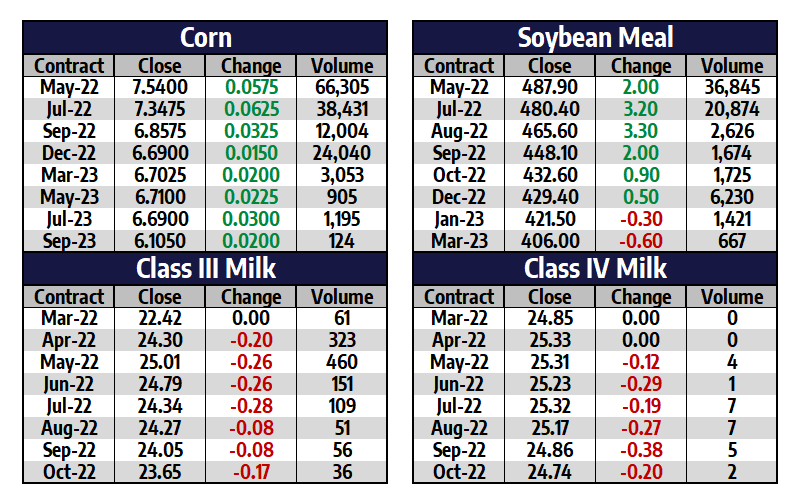

Friday’s Market Quotes