March 26, 2021

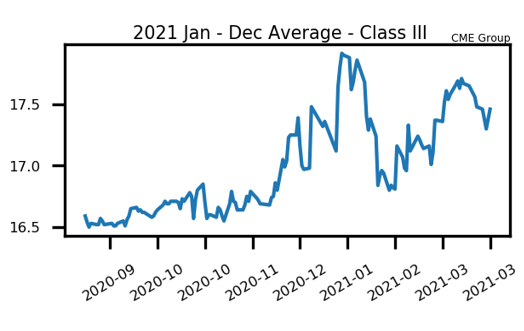

Dairy Prices Rebound to End the Week

Milk Highlights:

Cold Storage inventories for butter and cheese continue to rise as butter increased 17% YoY and cheese increased 5% YoY

The spot whey market once again finished at all-time highs for the electronic spot trade

The spot butter market finished the week at a multi-month high of $1.775/lb showing decent demand in a time of year we typically don’t see it.

The market continues to wait for updates from the new Ag Secretary Tom Vilsack to see if there will be additional government product purchasing

The second half of 2021 remains near the all-time highs for their respective contracts

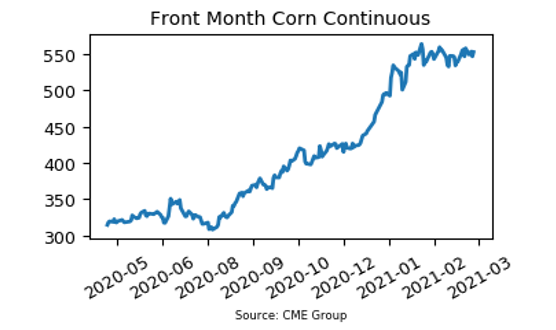

Corn Prices Consolidate Before Stocks Report

Front-month corn futures saw choppy trade throughout the week before the market finished 5.75 cents lower at $5.525. From a technical perspective, the 50-day moving average on the continuous chart has been a level of support the market has repeatedly tested and traded higher off of. We tested this level 2 times this week and 3 times last week and the market has held above it every time. Next Wednesday the quarterly grain stocks report will be released from the USDA. This is typically one of the more volatile reports of the year and the results could lead to a big move in either direction given the recent consolidation of the market. Analysts are expecting the planting intentions for corn to come in near 93.1 million acres vs. 90.8 million acres last year. Recent updates in the long-term forecasts are showing a warm and dry April. This is a bearish influence for the market as it should aid in a strong planting season.

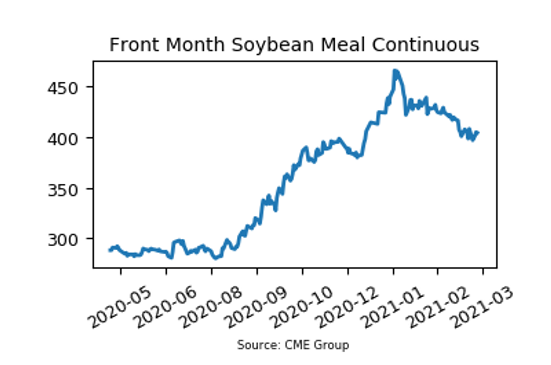

Soybean Meal Firm at $400/ton

The meal market has finished its third week in a row of testing prices below $400/ton before trading back above this psychological level of support. The market is likely looking forward to the quarterly grain stocks report on Wednesday before taking its next leg in either direction. The market traded as low as $395.4/ton before trading higher to finish the week at $404/ton. Going into the report on Wednesday, analysts are expecting soybean acres to come in at 90.1 million acres vs. 83.1 million acres last year. Dry weather in Argentina has continuously hurt the projections for their soybean production on the year. This week the Buenos Aires Exchange predicted that Argentinian production would come in at 44 mmt vs. the USDA’s current estimate of 47.5 mmt.

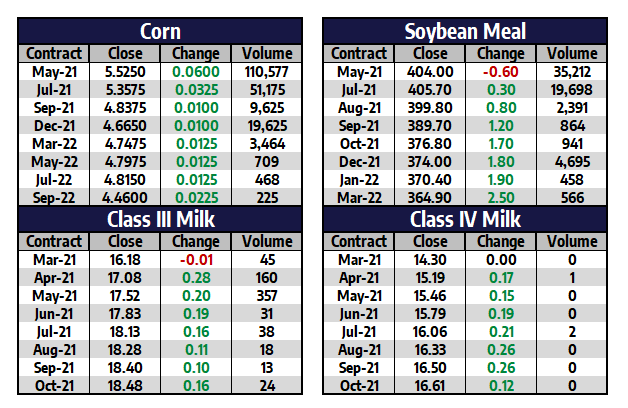

Market Quotes