April 1, 2022

Milk Holds on After Early Week Selloff

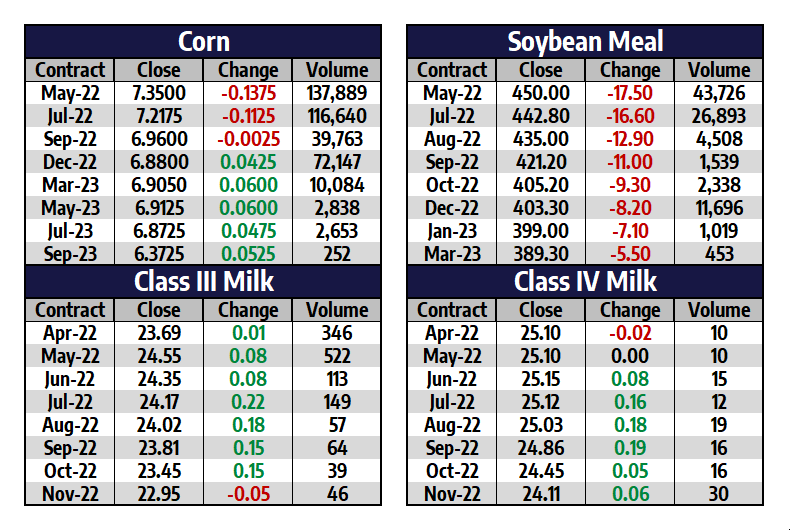

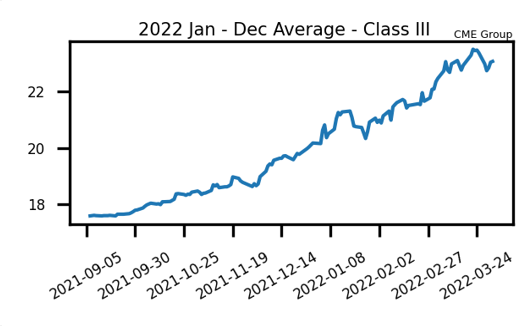

Milk futures ran into heavy selling pressure to start the week, but buyers supported the market higher on Thursday and Friday to limit losses. Spot cheese buyers bid up blocks 11.50c in total on Thursday and Friday while barrels rose 9.25c. This brought buying interest back into class III futures late in the week. The class IV trade got support from a three day stretch of higher prices for powder while butter added back a penny on Friday. The US whey price is really struggling, falling 8% on Friday alone. There will be a Global Dairy Trade auction next week Tuesday that will help give the market an idea of where global demand is. The last event was down 0.90%, so this one will be watched closely. Prior to that down auction, the GDT hadn’t posted a single down auction since December 21st.

The dairy market technically and fundamentally remains bullish for now, but a few things are starting to pop up that could be red flags moving forward. First, the US whey price is down about 25% from its high of the year and fell 8% alone on Friday. Further weakness could be a headwind for this class III market ahead. Second, spot cheese is right up near the 2019 high, which could act as resistance. A strong up day on Friday in cheese is noted, however. Finally, milk cows on farms in the US rose 3,000 head from January to February which was the first rise since May of 2021. Its early, but a strong increase in cow numbers could flip production growth back to a positive quickly in the coming months.

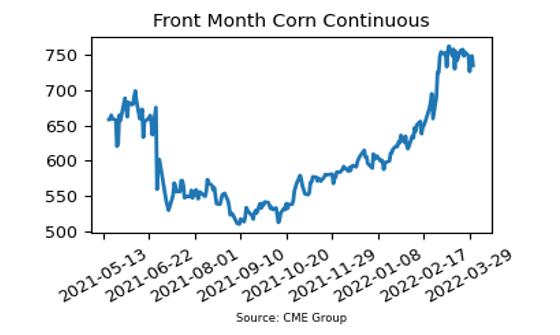

Corn Acres Projected To Fall Significantly

In Thursday’s USDA Prospective Plantings report, the USDA projected a large shift in acreage for 2022 from corn to beans. The USDA pegged 2022 corn acres to be planted at 89.50 million acres. This compares to 93.40 million acres last year and would be the lowest planted corn acreage total since 2018. The release of this date will keep support beneath the corn market for weeks to come. During this week’s trade, front month corn was down 19c but remains priced up at $7.35 per bushel. On the other hand, the fact that the USDA pegged March 1 corn stocks at 7.850 bb, may keep some pressure on prices. This is viewed as neutral and was right in line with market expectations. The 7 day forecast in the US calls for broad precipitation over the eastern part of the corn belt. The western areas should be drier. Brazil’s safrinha corn has a chance for rain this weekend.

Soybean Meal Begins to Move Lower

The soybean complex remained under heavy selling pressure on both Thursday and Friday as the USDA pegged 2022 soybean acres at a record high. The USDA said 91 million acres of soybeans are expected to be planted this year, which is well above last year’s 87.20 million acre number. Front month soybean meal fell $37.90 total this week and closed back down at $450 per ton. That contract lost $17.50 on Friday alone. The USDA also estimated March 1 soybean stocks at 1.931 bb. Crush demand remains strong. The big question for the market moving forward is demand. How strong China’s demand for US soybean supplies will be with Brazil having limited inventory is a big question in the market. Managed money is expected to be long about 99,000 soybean meal contracts.

Friday’s Market Quotes