April 22, 2022

Dairy Spot Markets Close Lower This Week

There has been a noticeable shift in supply and demand in the dairy spot trade over the past few sessions, with the class IV products leading the market lower. During this week’s trade, the US spot butter market fell 8.75c and closed down at $2.6675/lb. The spot powder market fell a total of 6.75c and closed down at $1.7550/lb. Both markets look to be headed towards a short term down trend as demand weakens. Over in the class III side, the whey trade was unchanged this week at $0.6350/lb while the block/barrel average cheese price was down 2.50c for the week. The US cheese price still remains elevated near multi-year highs up at $2.38125/lb. Strong international demand for US cheese has helped support the high price. The weakness in the spot products kept class III and IV milk futures lower. Second month class III fell 91c while second month class IV fell 40c.

This week was a busy one for news across the dairy trade with a Global Dairy Trade auction, a milk production report, and a cold storage report. To recap the events, the GDT auction was a bearish event, falling 3.60% overall. This was the third down event in a row for the GDT as global demand cools. Each product in the auction was offered lower. In the milk production report, production in March fell 0.50% from the same month last year. Cow numbers did increase 15,000 head from February, though. In this Friday’s cold storage report, the USDA said that total natural cheese in storage at the end of March 31, 2022 was down 1% from last month and down 1% from the same month last year.

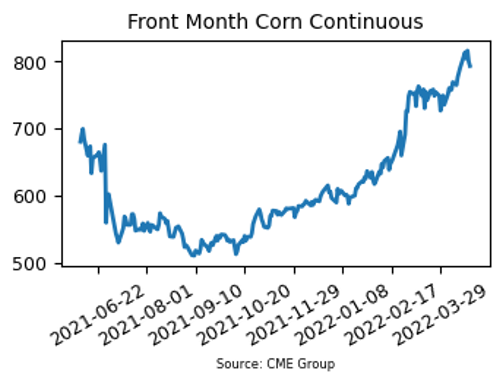

Corn Can’t Hang Onto $8 Handle

The front month corn contract was met with fairly strong resistance later this week after it tried a couple times earlier in the week to break and hold the $8 level. At the high of the week, May corn traded up at $8.1975 per bushel, before selling off on Thursday and Friday and closing at $7.93. The close for corn is still green for the week, and up 2.75c total from last Friday’s close. US corn demand remains steady across the globe. It was reported today that 1,347,000 mt of corn was purchased by China while 281,000 mt of corn was purchased for delivery to Mexico. South American corn prices are cheaper than the US which may limit exports moving forward. Dryness in central Brazil could be stressing their second corn crop. Buenos Aires Grain Exchange rated 18% of Argentina’s corn crop good to excellent (versus 20% a week ago). Cold and wet weather in much of the eastern Midwest may delay plantings there in the US. Planting progress in the US is already behind the 5-year average to start the season.

Soybean Meal Finishes Choppy Week Lower

Soybean meal futures ran into selling pressure late in the week – dropping $12.60 per ton lower combined on Thursday and Friday. This took the front month May contract down to $458.80 as the market continues to consolidate right around the $450 level. Lockdowns in Shanghai, China are restricting vessels from unloading at ports which could slow their buying of US soybeans. China needs to buy about 7 mmt of soybeans per month to satisfy the 92 mmt import demand. Private exporters reported 144,000 mt of soybeans for delivery to Mexico from the US. Global demand remains steady for US beans. Buenos Aires Grain Exchanged rated just 18% of Argentina’s soybean crop at good to excellent versus 23% last week.

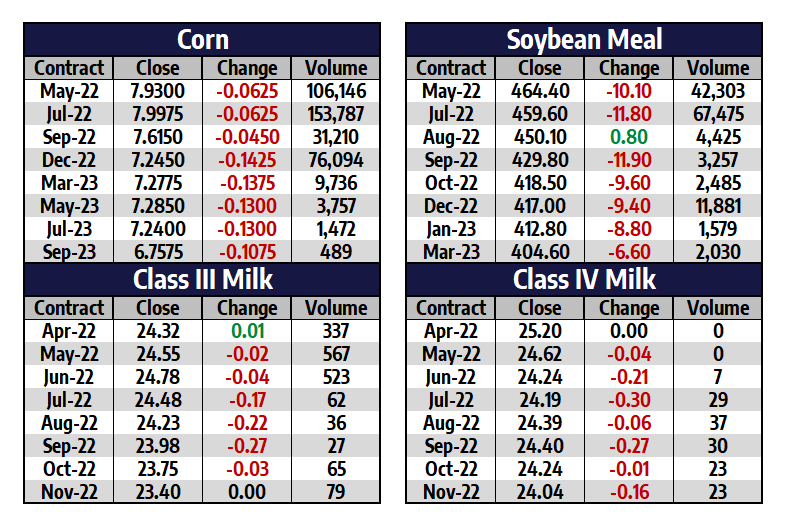

Friday’s Market Quotes