May 6, 2022

Back-and-Forth Trade This Week

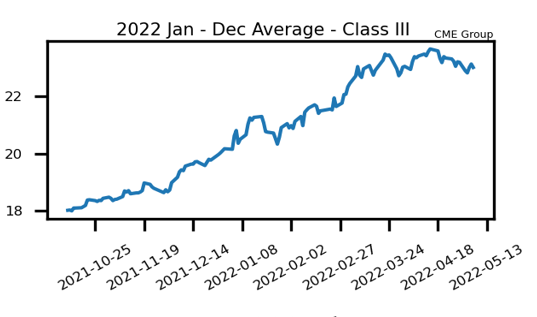

Class III futures started the week with two down days followed by a couple days of recovery, but prices turned red again during Friday’s action. The second month June contract finished today at $24.46, down a dime on the week and in the middle of about a $1.40 range. Spot cheese finished the week a penny higher, an impressive feat given the milk volatility and hefty drop in GDT prices. For Class IV, the price action this week was also up-and-down, but the June contract closed 30 cents lower, its fourth negative weekly close in a row. Spot butter was down 3.50 cents, with a close at $2.64/lb, still managing to avoid a selloff from multi-year highs so far.

The milk markets have set back off their mid-April highs and have entered a period of possible season pressure. Also weighing on the market was the sharp drop in the GDT Index, although US March exports were released on Wednesday and showed another impressive month. Going forward, it is safe to assume the uptick in both milk and dairy product production will continue given current price levels, which eventually will begin to weigh on this exceptional bull run. A higher dollar and recession talk are bearish factors as well, but for every person mentioning those factors, there is someone talking inflation and food shortages. Producers should continue to tune out the noise and focus on managing risk where possible.

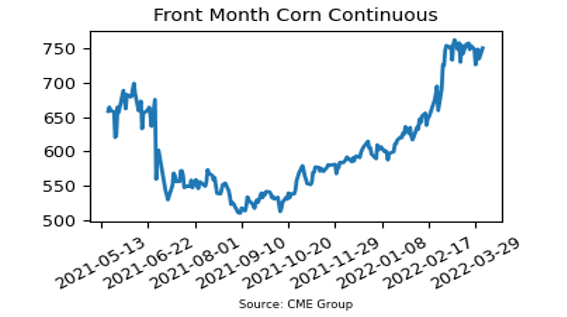

Corn Falters to Start May

July corn futures fell 28.75 cents this week, closing out at $7.8475. After coming into some selling pressure on an approach of $8.25 last week, price action has retraced lower and one could argue that most of the bullish news was priced in around the $8.00 mark and new buying slowed. The weather forecast for most of the US should influence some catching up in planting progress next week which could lead to some additional profit-taking. A higher US dollar is likely putting pressure on commodities as well, although weather in South American remains stressful as their production season progresses.

Soybean Meal Continues Slide

July soybean meal futures have traded lower for four weeks in a row now, giving up $18.70/ton this week with a close at $413.60. The weak technical action has seen a downward break of the trendline that was broken to the upside in late January, which brings the $390.00 area as the next downside objective. A reversal in soybean oil added to the overall weakness in the complex this week, and soybeans likely felt some pressure for the same reasons corn did: better planting weather and a higher dollar. Stats Canada released that March 31st stocks of canola came in at 3.940 million metric tons, down from the 4.580 mmt expected and 6.600 mmt last year. With lower expected acres and a continuation of dry weather in many production areas, supply could suffer for that crop for a second year in a row.

Friday’s Market Quotes