May 13, 2022

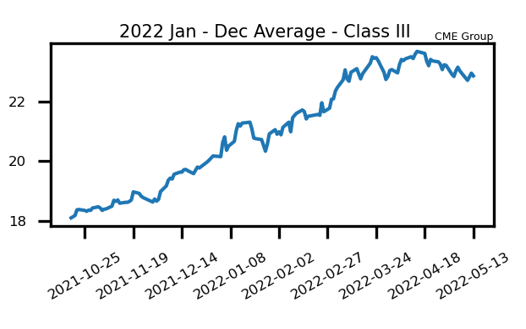

Class III Milk Down 4th Week in a Row

The second month class III milk futures contract finished the week at $23.83 per hundredweight. This is $1.96 off of its mid-April high. A higher US dollar, a falling soybean meal feed market, and a steady rise in cow numbers to start the year are all pressuring the market lower at this time. The U.S. whey price is also over 38% off of its high of year and is nearing 2021 lows. Per this week’s US central whey report, “end users say the only thing they are in need of is more space in their warehouse, as they are currently full in regards to whey supplies.” High inventory levels are weighing on that market. The US whey price fell 5.25c this week, cheese was down 1.375c this week, and powder fell a penny. Butter posted a nice week overall, adding 6.50c to $2.7050/lb.

Next week there will be another Global Dairy Trade auction, which should be watched closely by the market. The GDT is coming off of the May 3rd event in which global price levels fell 8.50%. That event also marked the fourth auction in a row that the GDT price index finished lower. Should there be more pressure on global levels again next week, it could keep class III and IV milk futures here in the US in a downtrend. However, if buyers step back in and show aggression at these lower levels, it could help the US market turn back higher. The USDA will also put out the April milk production report next week Wednesday. The market will look to see if the US cow herd grew once again.

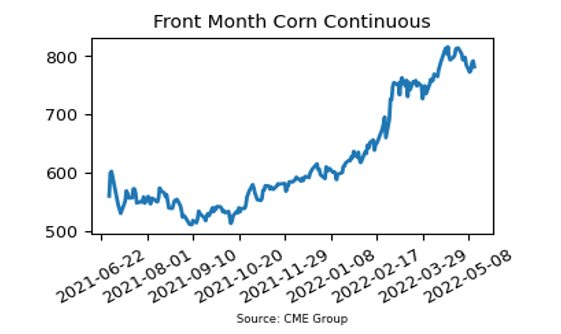

Corn Pulls Back As Planting Pace Expected to Pick Up

July corn futures fell 28.75c last week and fell another 3.50c this week. Pressure stems from a higher US dollar and the fact that planting progress is expected to pick up over the next week or two. The USDA put out a Supply and Demand report this week that showed higher than expected estimates of world ending stocks for 2021/2022. The USDA pegged expected corn yield for this year at 177 bushels per acre. This was well below market expectations of 179.60 bushels per acre. There were also unexpected production increases in Egypt, Nigeria, and Pakistan. The Buenos Aires Grain Exchange said 26% of corn has been harvested with 16% rated good to excellent. Managed funds are currently estimated to be net long about 346,000 contracts of corn.

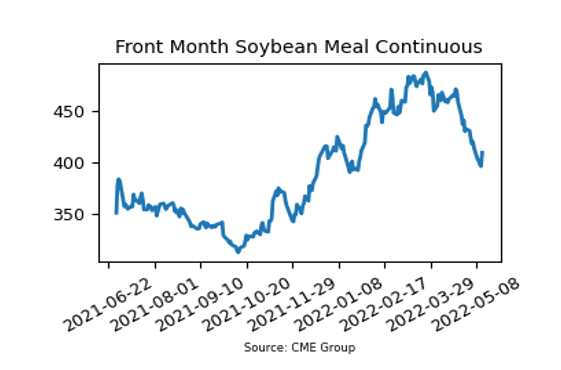

Soybean Meal Finds Support at $400/ton

July soybean meal futures were lower for the fifth week in a row as the market experiences a steady downtrend. Market conditions were very oversold by the end of the week, creating a strong move higher on Friday. Friday’s trade had July soybean meal up $13.30 per ton to $409.30. Buyers look to be defending the $400 level for now. The soybean market shot up on Friday as well, with support from this week’s Supply and Demand report. In the report, the USDA said old crop ending stocks will be 235 mb at the end of August, which is the lowest surplus in six years. Private exporters reported sales of 132,000 metric tons of soybeans for delivery to China during the 21/22 marketing year. China remains a steady buyer from the US.

Friday’s Market Quotes