May 19, 2023

Milk Markets End Skid Lower

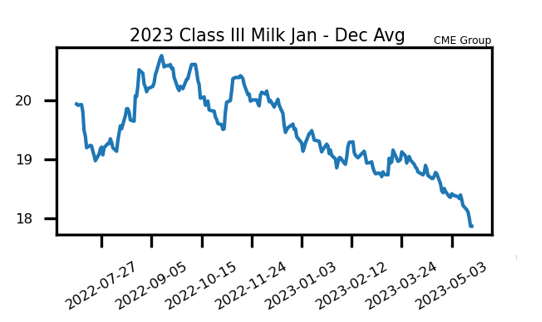

- Class III and Class IV futures were able to hold off the bears on Friday with gains in Class III and unchanged Class IV.

- The spot cheese trade gained over 3 cents today and likely was the catalyst for green on the board in Class III.

- Milk production for April was higher YoY by 0.33% while the dairy herd size and production per cow were in line with last years numbers.

- Cattle and calves on feed were 3% below numbers from May 1st of last year; placements in April totaled 1.75 million which is 4% below last years total.

Volume continues to be strong in the spot dairy trade but has produced a move higher in prices. Instead, the low prices seem to be the reason for the buying activity as only butter ended higher on the week. The positive cheese trade on Friday seems to have given support to Class III prices, at least temporarily, as most futures finished in the green today and ended a week long skid of lower prices. Class IV seems to be supported by decent butter prices but powder continues to try and bring futures lower as inventories are reportedly large and buying has been light. Milk production report stays on brand with recent reports as minimal gains in production and the dairy herd size neither contracting or growing substantially. Strong cattle prices remain as feedlots remain below year ago levels and the dairy herd is not growing at any impactful rate. Next week is light on fundamentals outside of a cold storage report on Wednesday.

Corn Price Erode Throughout Week

- After sideways trade last week in the corn market, this week provided a large drop in corn prices for current and new crop. Front month corn futures fell over 31 cents while December 23 futures fell 9 cents, below $5 per bushel for the first time since 2021.

- Ethanol production remains in line with previous weeks and last years production but below the production needed to hit USDA’s corn usage forecast.

- Planting progress jumped another 16 points to 65% complete, well above the 5 year average, but some states like North Dakota and Minnesota are still dealing with excess moisture creating delays in planting or replanting areas washed out by heavy rains.

- Old crop corn commitments for export remain below expectations, down 35% from year ago levels, and on pace for a 10 year low.

- Warmer and drier weather is anticipated for the corn belt over the coming week allowing for planting progression and promoting crop growth for those fields already planted.

Soybean Complex Plunges Lower

- The entirety of the soybean complex was under heavy selling pressure this week as Brazil’s record crop and competitive pricing pressure domestic supplies.

- The front month July meal contract lost $23.80 per ton during trade this week, with weekly settlements lower 4 of the last 5 weeks.

- Export commitments for last week were above expectations but the pace has fallen in recent weeks and is now 14% behind on old crop commitments from year ago levels; both meal and oil exports are below year ago levels as well.

- Soybean plantings are nearly half complete at 49%, 22 points ahead of last year and 13 points ahead of the 5 year pace.

- Emergence is at 20% for the bean crop, 12 points ahead of last years numbers.

Friday’s Market Quotes