May 28, 2021

Milk

The key component to the recent price action in the dairy markets continues to be the spot cheese market. The block/barrel average finished this week 3.875 cents lower at $1.55/lb. With the recent break in the market, the next level of support for the market lies at the 2021 lows near $1.48/lb. In the midwestern cheese report released by the USDA, cheese processors reported the there has been an influx of spot milk lately and there have been loads being sold at heavily discounted levels vs. class prices. The report also noted that processors worry that with barrel prices currently over the block price that barrels could continue lower to get to their normal position below blocks in price.

The Class IV market has also been disappointing here this week with what looks to be a rejection near multi-year highs to put in a short-term top in the market. Prices were hovering closer to $17.00 before they lost momentum and now the second-month contract sits at $16.54. While it isn’t surprising that the market struggled at such a pivotal price point, but with global prices continuing to be higher than domestic prices for non-fat powder and butter there was a chance that Class IV could have experienced a larger breakout. This could still happen if global prices continue to stay at elevated levels and our exports continue to grow at a rapid pace.

Milk Highlights:

June Class III milk fell 89 cents this week and June Class IV fell 30 cents.

The Class III / Class IV spread narrowed significantly this week and is back in line with the historical average.

US total cheese stocks fell 2% year-over-year in April

Corn

Not much upside follow-through after yesterday’s 40 cent limit up close on July. At today’s high July was up an additional 8 cents to 6.7275. July posted a 16 cent reversal off that high into today’s close. The reversal may have been fueled by increased precipitation potential for the Central/Eastern Cornbelt in this morning’s 6-10 day update. The 6-10 day temperature outlook is still calling for above-normal temps for the West and Northwest portions of the grain belt, and normal-to-below normal for the rest of the grain belt. For the week, Jul corn closed 3 cents lower and Dec corn closed 1 cent lower. Both contracts finished the week 54 cents and 45 cents off of their Wednesday lows, respectively. For the month, Jul corn closed down 17 cents and closed 78 cents off this month’s high of 7.35. This is the first down month for the corn market since July 2020. Next week Tuesday the USDA should release the first condition ratings for the corn crop. The condition of the crop is expected to be above 70 pct G/E. In 11 of 15 years, the rating was above 70, the final US yield was either at or above the USDA’s May estimate; this year’s May estimate was 179.5 bpa (last year’s final was 172 bpa).

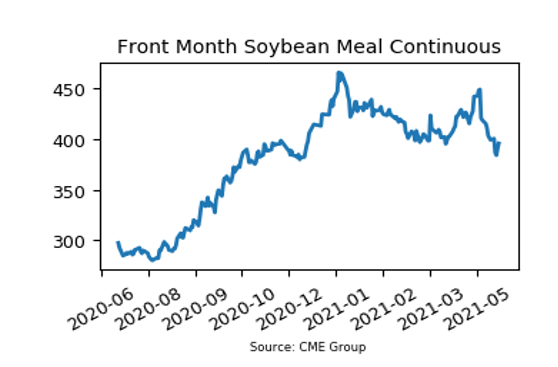

Soybean Meal

Soybean meal was the only market that was able to close higher today. For the week, Jul meal closed 3 dollars lower, but up 17 dollars from the low. This is the third down week in a row for meal, and from the May high to this week’s low the Jul contract fell 79 dollars. Jul closed down 30 dollars for the month, but above the Mar and Apr lows of 395.4 and 394.4 respectively. The Jul soybean contract closed the month down 4 cents, it’s first down month for the front month since May 2020. US soybean export pace continues to slow as 17 weeks ago US export commitments were ahead of last year’s pace by 966 mil bu, as of this latest week US export commitments are ahead of last year’s pace by 719 mil bu. The latest USDA estimate is calling for US exports of soybeans to be 598 mil bu more than last year. If the current pace of export declines vs last year continues, 15 weeks from now US export commitments could be around 475 mil bu. China and the US had first trade talks this week, and China is looking for a rollback of the Trump tariffs. To date, China has not yet bought any US new crop soybeans. Some estimates put out are calling for China to buy around 40-42 mmt this year.

Today’s Market Quotes