June 4, 2021

Milk Continues Lower

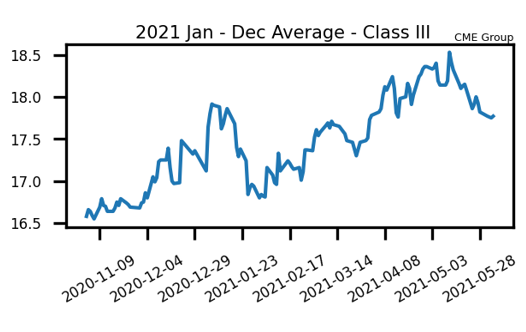

The milk market has struggled in recent weeks after putting in a high for the year in mid-May. The market had been trending counter seasonally higher throughout the start of the year and through peak production. However, the added cow numbers across the country and the 3.30% growth rate for April and likely a similar number in May have started weighing on prices. However, there still remains a good amount of support from export demand for US dairy products along with high feed costs. This week, both corn and soybean meal prices jumped higher again. Second month class III milk fell 10c lower this week to $17.94, dropping for the third week in a row. Second month class IV milk fell 36c to $16.67 this week. Demand for the US spot dairy market has also kept pressure on prices. Spot cheese finished the week back to $1.5575/lb this week, down from this year’s high of $1.82375/lb.

Milk Highlights:

Milk futures continued to work to the downside this week as heavy production across the country weighs on prices

Cheese demand is lacking and supply remains strong. Some Midwest cheese plants were open through the Memorial Day Holiday. Spot milk is readily available at discounts

This week’s Global Dairy Trade auction fell 0.90% with cheese up 0.50% and butter down 5.40%

Milk volatility has quieted down in recent weeks. Put option premium costs have been falling

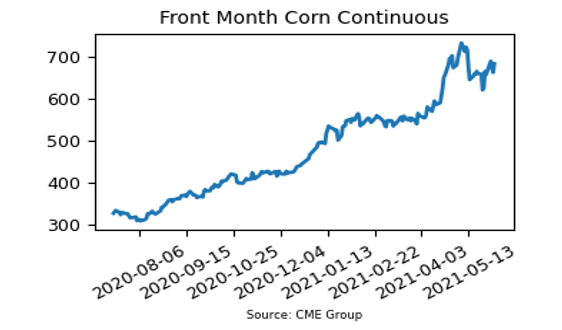

Corn Ends the Week Strong

Corn futures had a pretty volatile week of trade during this shortened Holiday week. The July contract jumped 32c on Tuesday, fell 13.75c Wednesday, again fell 13c on Thursday, and recovered 20.75c on Friday. Overall, the contract tacked on a total of 26c this week, closing at $6.8275 per bushel. December 2021 corn added 46c and closed at $5.9150 per bushel. The market rallied on the hot weather expected to move from the west to the east in the coming days. Record or near-record temperatures are expected to hit parts of the Corn Belt. Although, more rain has shifted into the 6-10 day forecast. Brazil’s drought continues to worsen, keeping the funds holding strong on their long positions. The funds are expected to be long 255,000 corn contracts.

Soybean Meal Stays Below $400/ton

Soybean meal futures snapped a streak of three down weeks in a row, but were only able to muster a $0.70 per ton gain overall. This brought the July contract to $396.20, closing below $400 per ton for the third week in a row. The market still technically looks weak here and there may be heavy resistance near that $400 per ton level moving forward. Extreme heat in the Dakotas and the northwestern grain belt may have kept buyers in the market on Friday. Brazil continues to capture almost all of the global soy export demand. Although, it is believed that Brazil could be out of soybeans by August – which would then lead the US to take over at that point. The funds are believed to be long 95,000 contracts of soybeans.

Today’s Market Quotes