June 11, 2021

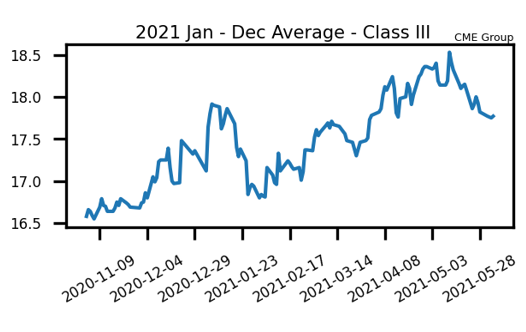

Milk Continues Lower

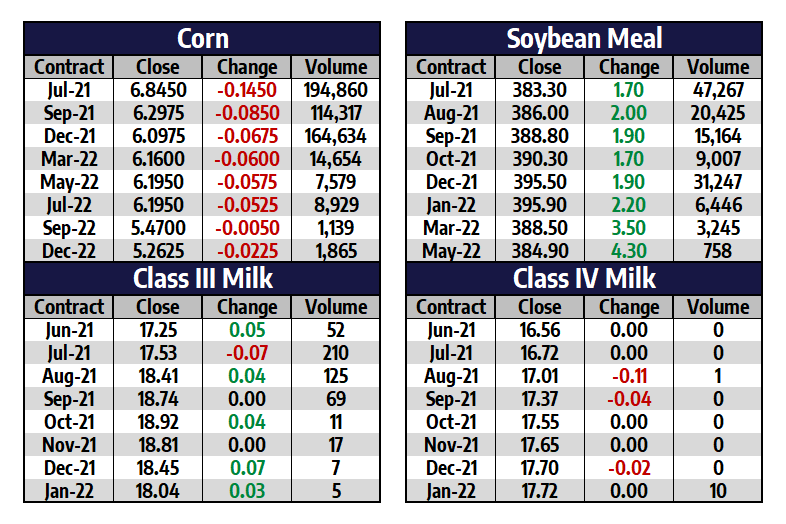

Milk Highlights:

The recent uptick in temperatures may finally start to curb some of the strong spring milk production rates we have been seeing recently

The curious spread between blocks and barrels leaves the market looking imbalanced as barrels are trading 17 cents over blocks as opposed to the typical 5 cent discount

Lower domestic cheese prices are driving exports higher as cheese exports for the month of April were up 51% YoY

The continuation of limited price action is dragging volatility lower and making downside protection more inexpensive.

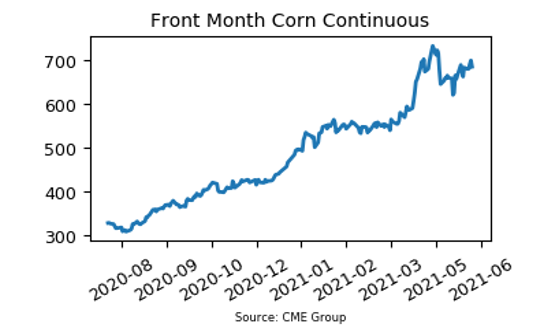

Corn Futures Finish Choppy Week

Corn futures had a range of over 47 cents this week but only ended up 2.25 cents higher than last week’s close at $6.85 on the July contract. The market appears to be disappointed by the results of the USDA’s WASDE report released yesterday as we finished the week trading lower. The USDA lowered 21/22 corn carryout to 1.357 billion bushels vs. the average analyst estimate of 1.423 billion bushels and 1.507 billion bushels in May. World ending stocks for 21/22 finished slightly above analyst expectations at 289.41 mmt. The USDA also increased ethanol usage and exports by 75 million bushels. Going forward weather will remain the focus of the market as many areas throughout the midwest are in need of additional rain. Longer-term forecasts are still showing above-average temperatures and below-average precipitation.

Soybean Meal Pokes Into New Lows for 2021

Soybean meal futures had the lowest weekly close for 2021 at $383.2/ton on the July contract. The market also traded to a new intra-day low for the year before recovering slightly. Downside support still lies at $375.8/ton but a break of this level of support would suggest the potential for trade down into $355/ton. This week’s lower trade also brought meal into contact with the 50-week moving average for the first time since August of 2020. The soybean complex dropped lower after the USDA decreased their U.S. crush estimates and didn’t adjust exports higher as the market expected. USDA put the 21/22 domestic carryout at 155 million bushels vs. expectations at 146 million bushels and 140 million bushels in May. The USDA increased their estimate of Brazilian bean production to 137 mmt vs. 136 mmt in May and left Argentinian production the same. The market was expecting the USDA to drop Argentina’s crop numbers.

Today’s Market Quotes