June 24, 2022

Milk Market Weaker on Bearish Cold Storage Report

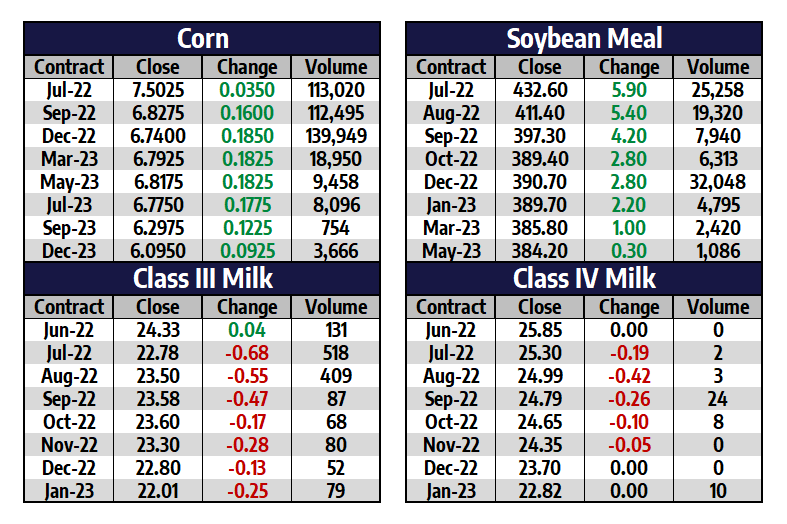

On Thursday the USDA reported that total natural cheese in refrigerated warehouses as of May 31st totaled 1.512 billion pounds – which is a new record. This was up 2% from April and was up 4% from the same month last year. This put a bearish tone back into the market because even though milk production across the country is down year-over-year, cheese inventories are still building. The rising inventory levels could be a detriment to current cheese prices that still hold up at an elevated price of $2.11875/lb. Additionally, if the recession talks pan out, cheese demand would likely begin to weaken. The US cheese trade saw sellers offer blocks 1c lower and offer barrels 2.25c lower in response to the USDA report. The drop in cheese along with the fact that the US butter price fell 4c to $2.9150/lb kept pressure on milk futures on Friday.

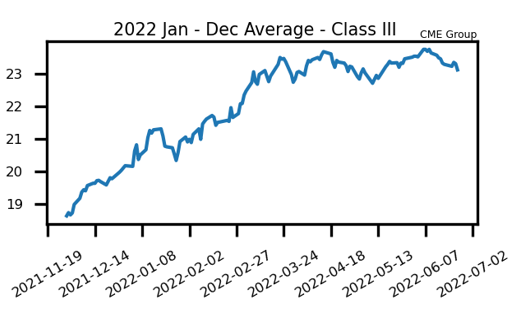

July class III milk fell 68c to $22.78 while the third month August contract fell 55c to $23.50. Class IV also ran into some selling pressure, dropping 19c in July and 42c in the August contract. The milk market still holds an uptrend as no longer term support levels have been taken out yet. This is the time of year where seasonality could kick in as the market tends to get a summer rally on the hotter conditions. With milk production output down each month so far this year along with cow numbers down over 100,000 head from a year ago, it should provide support to dairy. However, the cheese price will need to be watched closely in the coming days to see if buyers will still support these levels over $2.00/lb.

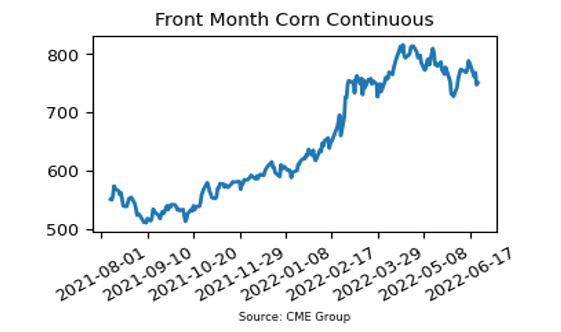

Corn Breaks Support

– December 2022 corn futures broke support this week and fell 57c lower to $6.74 per bushel

– The market saw some long liquidation from funds as the corn technically broke down and has now put in a series of lower highs and lower lows

– Some rain has fallen in key areas, but rain totals are light and there is not much expected for the next week. The Corn Belt will be under milder temperatures next week, though

– The market found buyers on Friday as contracts recovered about 16 to 18.50c from the earlier week selloff. Weather forecasts over the weekend will be watched closely

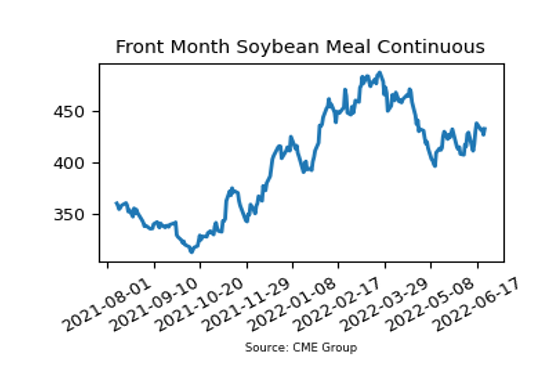

Soybean Meal Holds Over $400/Ton

– August soybean meal futures were down $11.10 per ton this week and posted a close at $411.40

– The soybean meal market continues to chop around above the $400/ton level as the market consolidates

– It was reported this week that China’s soybean meal supplies tripled in the last three months as weaker animal feed demand is building inventories

Friday’s Market Quotes